Institutional foreign exchange volumes showed signs of stabilization in July 2025, with most major trading platforms recording modest improvements compared to June's subdued activity, despite the US dollar touching its lowest levels since 2022 during the month.

The recovery came as the greenback marked its first upward month after six consecutive months of declines, providing some relief to currency markets that had been grappling with persistent weakness throughout the first half of the year.

Institutional FX Volumes Stabilize in July Despite Dollar's Historic Decline

Cboe FX volumes climbed to $1.05 trillion in July from June's $1.01 trillion, though the increase was primarily driven by additional trading days. With 23 trading days compared to 21 in June, average daily volumes actually declined to $45.6 billion from $48.3 billion the previous month.

The year-over-year comparison tells a different story. July 2024 saw Cboe handle $1 trillion in total volumes with an ADV of $44.5 billion, suggesting current activity levels remain roughly in line with historical patterns despite the dollar's broader struggles.

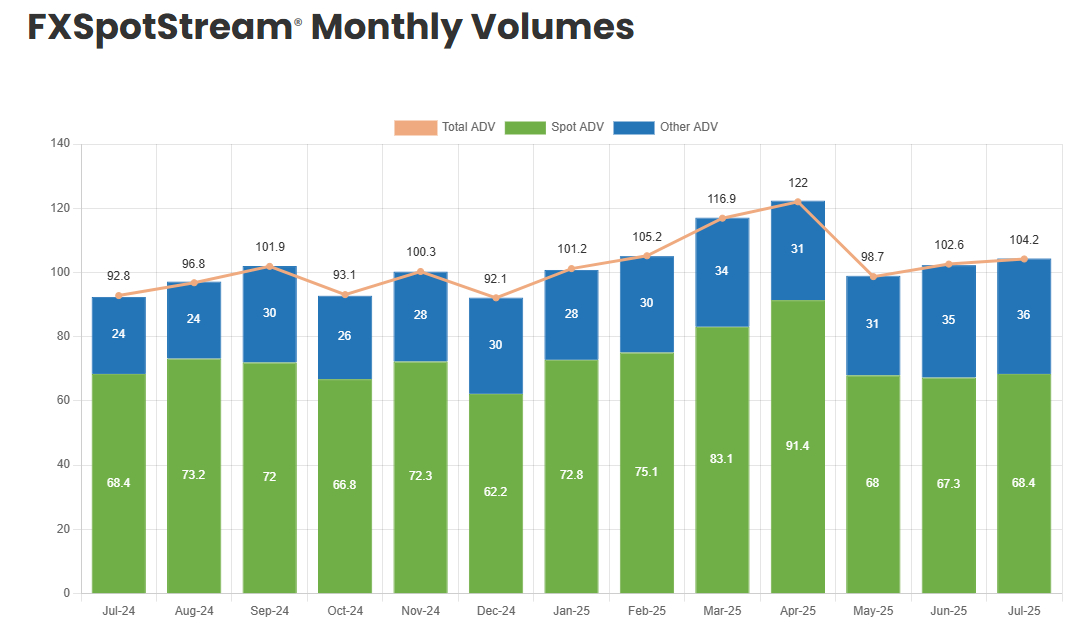

FXSpotStream posted more encouraging numbers, with total ADV reaching $104.2 billion compared to June's $99.8 billion. The platform's spot ADV hit $68.4 billion, while other products contributed $36 billion to the daily average.

European Exchanges Maintain Momentum

European platforms showed more consistent strength. Euronext FX volumes dipped slightly to $584.7 billion from June's $609.5 billion, but the decline was modest given the volatile currency environment. ADV fell to $25.8 billion from $27.7 billion, reflecting the impact of additional trading days.

360T, operated by Deutsche Börse Group, posted stronger results with total volumes reaching $768.6 billion, up from June's $711.7 billion. The platform's ADV climbed to $33.4 billion from $33.9 billion, representing one of the more robust performances among major institutional venues.

Japanese Market Shows Sharp Contrast

The Japanese market painted a starkly different picture. Click 365 volumes plummeted to 1.41 million contracts in July, representing a dramatic decline from both monthly and yearly comparisons. ADV dropped to 61,391 contracts, down 19.6% from June and a steep 48.6% below July 2024 levels.

This marked a significant reversal from July 2024, when Click 365 had posted strong growth with 2.75 million contracts and an ADV of 119,474 contracts. The current weakness suggests Japanese institutional appetite for FX trading has cooled considerably amid ongoing market uncertainty.

Market Context and Outlook

July's performance reflects the complex dynamics facing currency markets. While the dollar's decline to 2022 lows initially seemed poised to drive volatility and trading activity higher, institutional volumes have remained relatively contained compared to the explosive growth seen during April's Trump-induced market turbulence.

"We are expecting a weaker U.S. dollar in the coming months. The recent budget implications, the inflationary effects of tariffs, and President Trump's critical remarks towards Fed Chair Jerome Powell all suggest a negative outlook for the U.S. economy for the remainder of the year,” said Jennifer Lee, Senior Economist at BMO Capital Markets

The dollar's first monthly gain in six months during July may signal a potential turning point, though traders remain cautious about declaring an end to the greenback's broader weakness. With ongoing geopolitical tensions and trade uncertainties continuing to influence currency flows, institutional platforms are preparing for potentially higher volatility in the coming months.