The EMEA branch of multibank FX aggregation services provider for spot foreign exchange trading, FXSpotstream Europe Ltd, increased its revenue and operating profit in 2023. The company's latest report showed that net profit grew by over 60%.

FXSpotstream Europe Increases Its Net Profit to $183,000

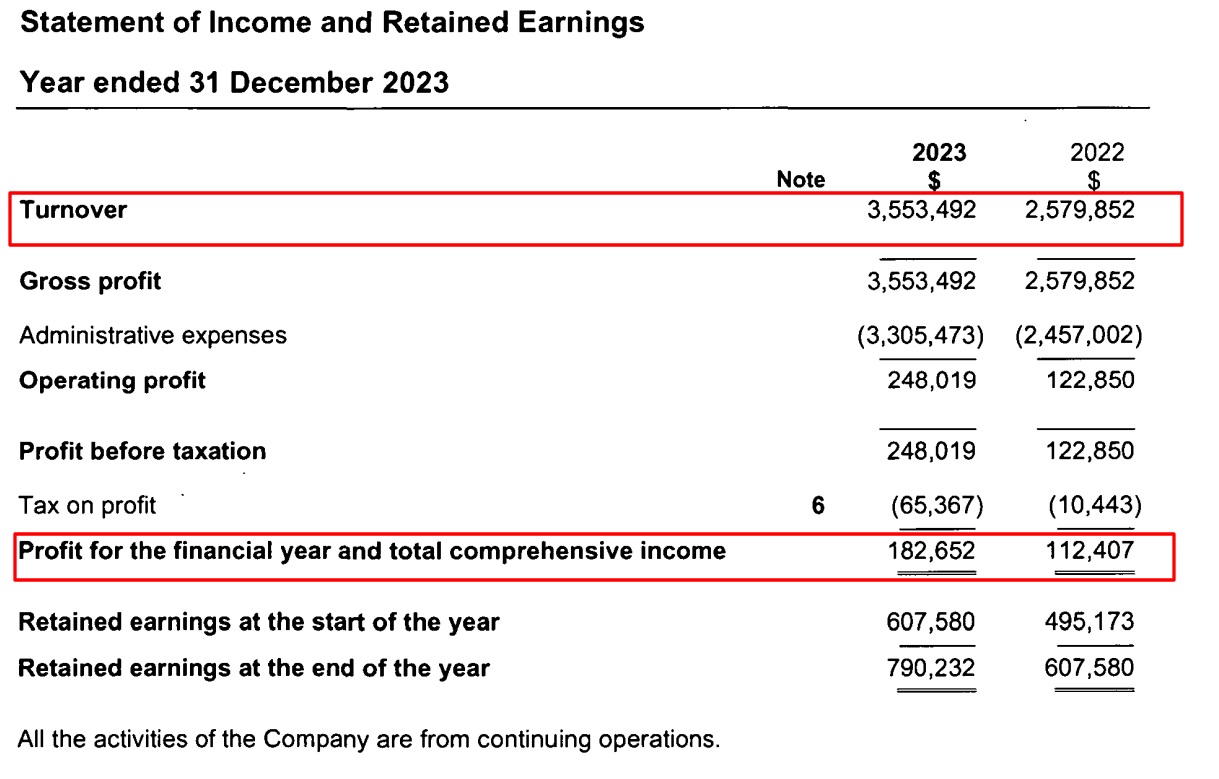

According to the latest report published in the UK's Companies House, FXSpotstream Europe achieved a turnover of $3.5 million, increasing its revenue by 40% from the $2.5 million reported in the previous year. It's worth noting that this marks another consecutive year in which the company's main financial indicators have shown positive change.

Although the company also increased its administrative expenses (from $2.5 million to $3.3 million), operating profit was still more than twice as high as the previous year, reaching $248,000 compared to $123,000 in 2022.

As a result, net profit after tax grew by over 60% to $183,000 from $112,000. The company's assets also increased, amounting to over $790,000 at the end of 2023.

FXSpotStream's Spot Average Trading Volumes Also High

Additionally, FXSpotStream noted a significant increase in its Average Daily Volumes (ADV) for July. The spot forex ADV jumped by 39% compared to the previous year, and other ADV categories surged by 85% YoY, rising from $14 billion.

Furthermore, FXSpotStream has named John Ashworth as the Independent Chair of its Board of Directors. Ashworth, who is currently serving as the CEO of Caplin Systems—a provider of trading technology—brings more than three decades of expertise in the tech sector to the role. His prior positions include senior roles at key FX-centered organizations such as FENICS, GFI, Apama, and FXAll.

Commenting about the appointment, FXSpotStream's CEO Jeff Ward said: “As we continue to mature and expand as a business, there is a need to add senior leadership with a strong background in independent governance and technology, and John brings both of these to the table.”