The London Stock Exchange Group, has today released its interim management statement for the period to January 22, 2014, reported as unaudited financial performance for its 3rd Quarter ending December 31, 2014.

Results of strong financial performance were noted with Q3 total income up 48 percent at £308.9 million and 9 months year-to-date up 38 percent to £876.0 million, as per the announcement, which included Full Year (FY) 2013 totals among other metrics for the period.

A bullish move in the EUR/GBP compared with the same period last year, affected the groups exposure to movements in this exchange rate to the tune of £7 million of total income for every €0.05 change in the average euro/sterling rate, highlighting the level of its currency exposure from its business lines outside of the U.K.

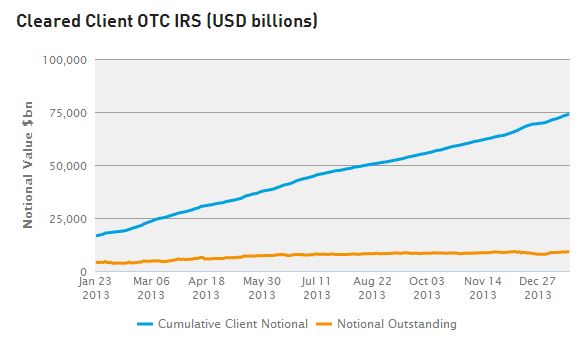

$74 trillion Notional Cleared by SwapClear with $424 Trillion Outstanding

Despite the shift to listed, the OTC market for Interest Rate Swaps remains a breadwinner for LCH.Clearnet, in addition to its listed non-OTC business which had total income in Q3 up 1% to £36.5m, driven mostly by a nearly 200% rise in its commodities segment and with much less growth across Cash Equity, Fixed Income and Listed Derivatives.

[source: SwapClear]

LCH.Clearnet's SwapClear Q3 Income soared 89% YoY to £24.5m in 2013 from £13.0m in prior year period. According to information on its website, SwapClear clears more than 50% of all OTC interest rate swaps and more than 95% of the overall cleared OTC interest rate swap market.

SwapClear and ForexClear Q3 Combined Income £28.5 million up 70% YoY

[Source: SwapClear]

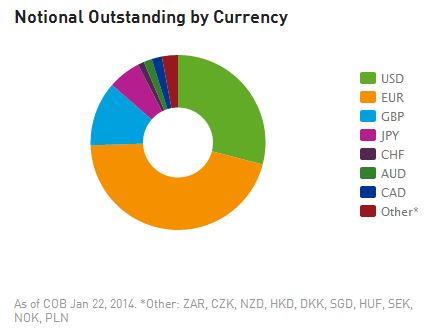

For SwapClear, this includes regularly clearing in excess of $1 trillion notional per day and with more than 2 million cleared trades outstanding, just $76 trillion shy of a half-quadrillion at $424 trillion in outstanding notional amounts mostly consisting of Interest Rate (IR) swaps ($269 trillion) as of the close of business January 22nd, 2014.

The London Stock Exchange Group appears bullish on this business line as it focuses its efforts on it even more post-acquisition, in the opinion of Forex Magnates' research team.

Since the acquisition the group has added Forex and CFD related links to its main website, and describing capabilities of LCH.Clearnet in comparison to clearers in the U.S for example, for certain electronic financial transactions.

Centralized Counter Party Clearing for Foreign Exchange Coming?

The London Stock Exchange (LSE), one of several exchanges owned by the group, has a section dedicated to CFDs, as well as a page for Forex, where it notes how aside from the Clearing House Interbank Payment System (CHIPS) clearing method used in the U.S. for non-domestic FX transactions outside the U.S. the largest clearing house is LCH.Clearnet.

While the ForexClear segment only accounted for £4m in Q3 income up 6% YoY from £3.8m, this line could become expanded upon if centralized clearing mandates for FX come into play in the future. During the firm's Q3 period for the three months ending December 31,2013, just over $200 billion in Forex notional volumes had been cleared by ForexClear.

Forex Magnates had previously reported when ForexClear surpassed the $1trillion mark, as well as when CFD's became centrally cleared when Cantor Fitzgerald announced it would use LCH.Clearnet to mitigate the counter-party risk of CFDs traded over-the-counter.

According to the press release today dated January 23, 2013, excluding the additional business lines, the group reported growth Q3 and year-to-date revenues driven by organic increases in all segments, as well as inclusion on LCH.Clearnet revenues – on an organic constant currency basis (assuming a fixed exchange rate), Q3 revenues up 13%. An excerpt of the LCH.Clearnet reported figures can be seen below:

![Interim Management Statement on Income for Q3 [Source: London Stock Exchange Group]](https://www.financemagnates.com/wp-content/uploads/fxmag/2014/01/LSEG-LCH.jpg)

Interim Management Statement on Income for Q3 [Source: London Stock Exchange Group]

Restructuring for Cost Control and Optimizing Operations of LCH.Clearnet

The Group said it remained focused on delivering the synergy benefits from the transaction with LCH.Clearnet, with detailed work programmes underway to control costs, restructure and deliver operational efficiencies, and noted good progress on the integration.

Suneel Bakhshi, as previously announced by the group, starts as LCH.Clearnet’s Group CEO, on 3 February, 2014. LCH.Clearnet’s Q3 total income of 3 per cent on pro forma basis – included further YoY growth in OTC clearing.

Commenting in the official press release regarding the Q3 performance, Xavier Rolet, Chief Executive of London Stock Exchange Group said,“The Group continued to make good progress, delivering further revenue growth in the past quarter. All of our main business segments have recorded good performances, both through organic development and as a result of successful additions to the Group’s portfolio of businesses.”

Xavier Rolet, Chief Executive, London Stock Exchange Group

Mr. Rolet concluded in the release regarding the attention on LCH.Clearnet,“Significant focus remains on the integration of LCH.Clearnet, with a number of detailed programmes underway to achieve the widespread benefits of the transaction. We are also focused on developing further growth opportunities across the Group, building on our increasingly diverse world class assets and working in partnership with our customers to deliver service and product innovation.”

Q3 Revenue Summary

Revenues for three months and nine months ended 31 December, 2013, with comparatives against performance for the same period last year, provided above, and LCH.Clearnet volumes reported below in euros and US dollars for certain products (also note, certain line items are reported in trillions, whereas others in billions of respective currency, as well as millions of contacts traded) excerpted from the additional segments reported by the group which noted that all figures are unaudited. A full copy of the press release can be found on the LSE Group website.

![Interim Management Statement on Income for Q3 [Source: London Stock Exchange Group]](https://www.financemagnates.com/wp-content/uploads/fxmag/2014/01/LCH-LSEG.jpg)

Interim Management Statement on Income for Q3 [Source: London Stock Exchange Group]