BGC Group has reported a significant surge in revenue, driven by strong performance across all asset classes for the third quarter of 2023. The brokerage and financial technology provider reported an upturn in most major indicators on a quarterly basis, but for the first nine months of the year, it recorded a substantial contraction in net profit compared to 2022.

BGC Group Reports Robust Q3 2023 Financial Performance

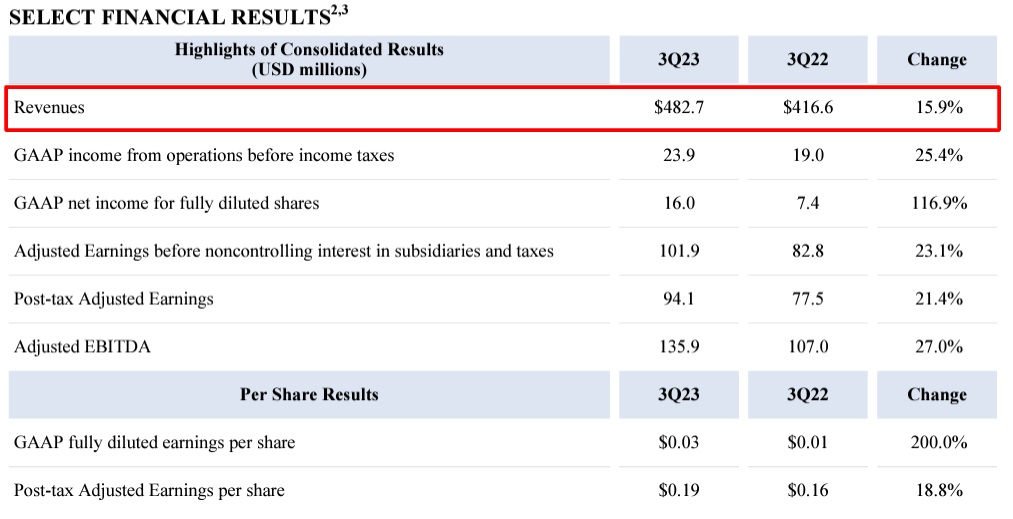

BGC's revenue for the third quarter rose 15.9% to $482.7 million. This growth was not confined to a single region; the Americas and EMEA saw revenue escalations of 19.0% and 16.9%, respectively, while Asia Pacific revenues rose 5.9%. Rates and Credit revenues improved 12.1% and 9.6%, respectively, while FX revenues were 8.6% higher. Energy and Commodities revenues grew 35.0%.

The company's pre-tax adjusted earnings grew 23.1% to $101.9 million, with margins improving 125 basis points to 21.1%. This marks the twelfth consecutive quarter of year-over-year (YoY) margin expansion. Post-tax adjusted earnings rose 21.4% to $94.1 million, or $0.19 per share, an improvement of 18.8%. Adjusted EBITDA also saw a significant rise, improving 27.0% YoY to $135.9 million.

“We had another outstanding quarter, generating revenue growth of 16 percent, reflecting increased volumes across all of our asset classes,” Howard W. Lutnick, the Chairman and CEO of BGC Group, commented. “BGC is extraordinarily well positioned to benefit from the return of interest rates, which we expect to drive our trading volumes, revenue and profitability higher for the foreseeable future.”

Fenics, BGC's electronic trading platform , also experienced robust growth. It saw an uptick of 19% in revenue, led by a record quarter for Fenics Growth Platforms, which grew by over 45%. Fenics UST, the company's electronic US Treasury platform, reached a record 25% market share of the volume traded on US Treasury exchange marketplaces during the year.

HigherYear-to-DateCostsImpactedNetProfit

Upon examining BGC's report, we notice that revenues grew for the first nine months of 2023, and along with them, total expenses significantly increased as well. As a result, the company's net profit from January to the end of September stood at $17.5 million, compared to $55.26 million reported in the same period the previous year. The reason could be, among other things, the second quarter, in which despite the boost in revenue, the company did not achieve profitability.

For the fourth quarter of 2023, BGC anticipates revenues to be between $450 and $500 million and pre-tax adjusted earnings to range from $88 to $108 million. Additionally, a quarterly cash dividend of $0.01 per share has been declared, payable on 1 December 2023.

In July, the company revealed that it has successfully transitioned to a full C-Corporation. Following this change, the company has rebranded itself as BGC Group, Inc. and has modified its Nasdaq ticker symbol from BGCP'to BGC.