The shares of Scotland-based cloud computing provider for financial markets Beeks Financial Cloud Group PLC (LSE: BKS), surged 40% on Tuesday after the company made several key announcements regarding new customer wins and upgraded financial forecasts.

Beeks Financial Cloud Announces Major Contract

The company has signed a multi-million dollar, multi-year expansion agreement to provide additional infrastructure through its Proximity Cloud offering to an existing Tier 1 investment manager customer. This new contract more than doubles the value of Beeks' initial engagement with the customer to $3.6 million over four years. Beeks noted significant additional growth potential with this customer, as currently only 30% of their trading infrastructure has migrated to Proximity Cloud .

Beeks also announced a conditional contract with one of the world's largest exchange groups to deliver its Exchange Cloud solution, pending regulatory approval. Exchange Cloud provides a cloud-based trading environment optimized for global exchanges. This marks Beeks' third major international exchange customer for Exchange Cloud.

The CEO of Beeks, Gordon McArthur, highlighted the company's "land and expand" strategy with customers and the considerable further growth potential as the financial markets continue adopting cloud solutions.

Higher Financial Forecasts

On the back of robust H1 FY2024 results and new contract momentum, Beeks now expects FY2025 performance to exceed previous forecasts significantly. The company delivered over 25% year-over-year revenue growth in H1 FY2024 along with improved margins. Beeks also generated positive free cash flow in the half, ending December 2023, with £5.5 million in net cash.

“The delivery of free cash flow was a key objective for the current year and we are pleased to have achieved that to plan, as we capitalise on the investments we have made into the expansion of our product offering," added the CEO of Beeks. “Our growing contract momentum demonstrates the considerable appetite we see across the financial markets.”

With contract momentum accelerating, McArthur said that Beeks now anticipates FY2025 will substantially surpass expectations.

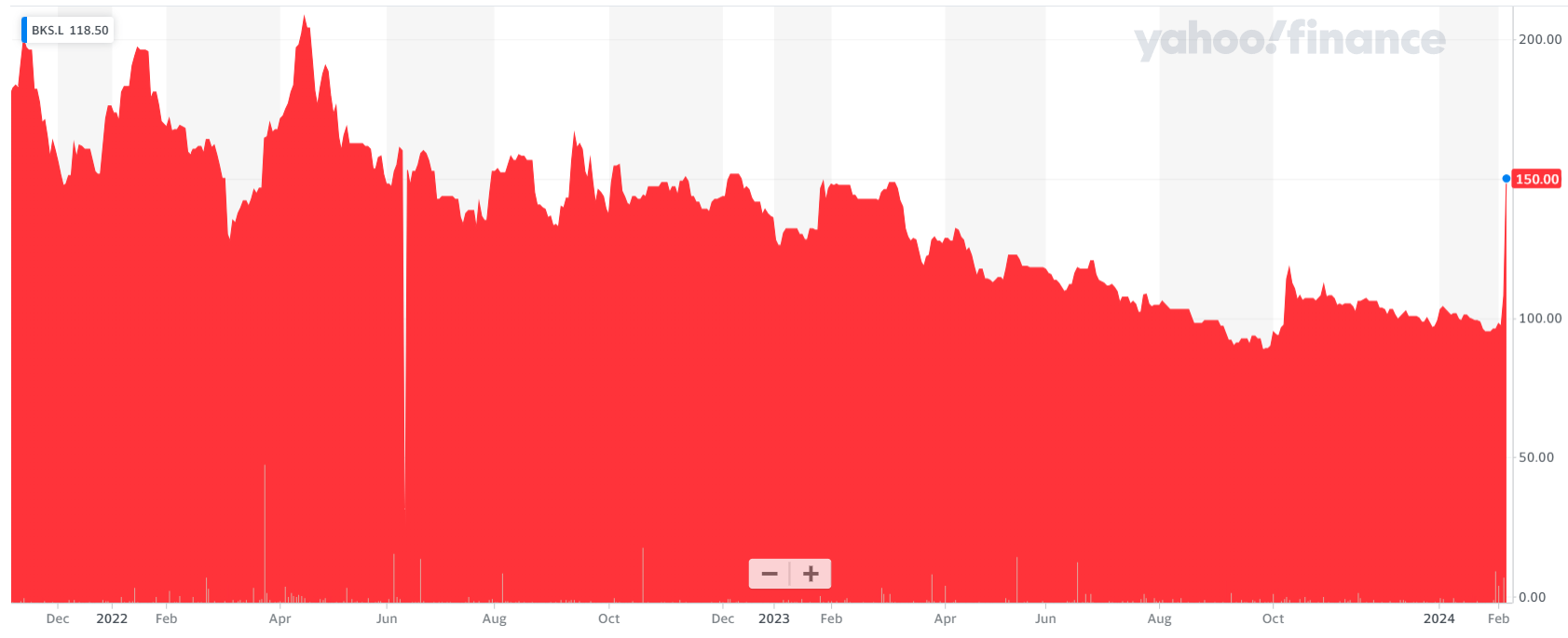

Beeks Shares Surge Higher

Investors very positively received the information provided by the company, and its shares opened much higher on Tuesday, rising 40% to 155 pence. This is the highest value for BKS shares since the end of 2022. The move retraces a significant portion of the downtrend observed over the past two years.

The reaction from shareholders should not come as a surprise, as the report shows that after the annual financial results for the year ending on 30 June 2023, Beeks expects a clearer rebound. Although the last reported period has shown a jump of 22% in revenue, there was no room for profits. The operating loss amounted to £331,000.