In 2025, traditional finance players – from retail brokers to major exchange operators – moved decisively into prediction markets. What was once a niche product has turned into a fast-growing part of mainstream market infrastructure.

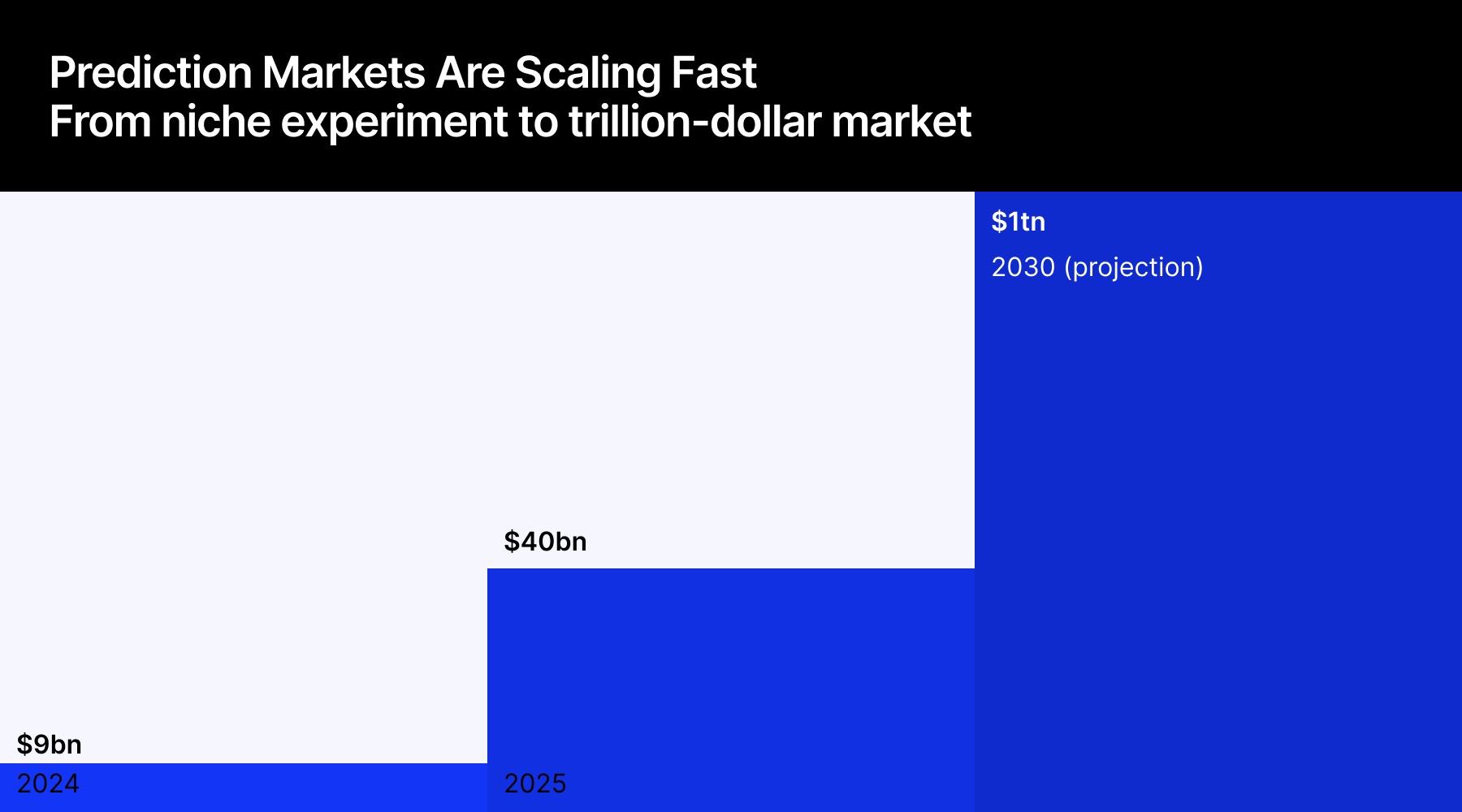

Trading volumes jumped from about $9 billion in 2024 to roughly $40 billion in 2025, according to industry research. Projections now point to annual volumes approaching $1 trillion by the end of the decade, pushing prediction markets from an experimental corner of finance into a meaningful revenue line.

What Brokers Are Actually Offering

Distribution-first positioning

Retail platforms have focused on access and integration rather than product novelty. Robinhood set the template. Its Prediction Markets Hub, launched in March 2025, placed event contracts directly inside its core trading app. By late 2025, the product was generating roughly $100 million in annualized revenue, across 9 billion contracts, making it one of Robinhood’s fastest-growing lines.

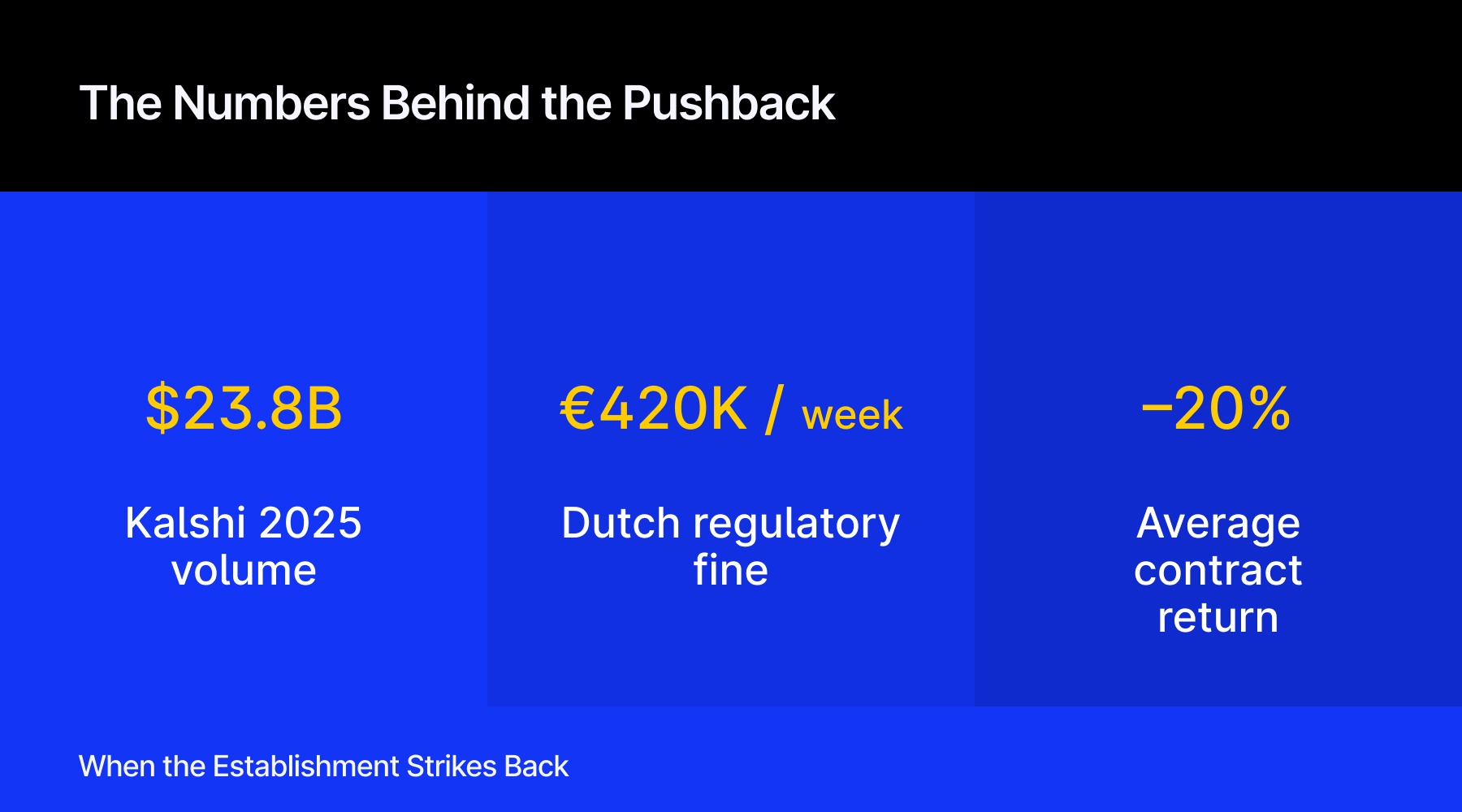

By late 2025, the product was generating hundreds of millions of dollars in annualized revenue, making it one of the company’s fastest-growing business lines. The initial model relied on Kalshi, a CFTC-regulated exchange. Robinhood’s distribution power proved decisive: Kalshi’s national market share jumped from just over 3% to roughly two-thirds within months.

By November 2025, Robinhood moved to capture more of the value chain by acquiring LedgerX, shifting from partner to vertically integrated operator. Products now cover outcomes ranging from central bank decisions and economic data to election results and major sports events.

“Robinhood is seeing strong customer demand for prediction markets, and we’re excited to build on that momentum,” JB Mackenzie, vice president and general manager of futures and international at Robinhood, said at the time.

Other retail and futures brokers, including Webull, NinjaTrader and Optimus Futures, have folded similar contracts into existing derivative terminals, treating them as another short-duration asset class.

Most recently, Plus500 launched its own prediction markets offering for U.S. customers as part of Plus500 Futures, providing access to event contracts, including products from Kalshi.

Compliance-first positioning

Larger players have taken a more cautious approach, focusing on regulatory structure. Interactive Brokers launched event contracts focused on economics and politics through its CFTC-regulated unit ForecastEx, deliberately avoiding sports in its public positioning.

The strategy has been to build neutral infrastructure while waiting for courts and regulators to clarify jurisdictional boundaries.

Why Exchanges Are Getting Involved

The move is not limited to brokers. Intercontinental Exchange, owner of the NYSE, invested $2 billion in Polymarket in late 2025. CME Group partnered with FanDuel to launch FanDuel Predicts using CME’s exchange and clearing infrastructure.

Meanwhile, Cboe Global Markets has announced plans for its own prediction markets platform, excluding sports to preserve institutional credibility. ICE plans to distribute Polymarket’s probability data to institutional clients, positioning prediction prices as another market signal alongside rates and equities.

For exchanges, prediction markets are increasingly viewed as complementary to traditional derivatives rather than a parallel ecosystem.

Why TradFi Is Entering Now

Four factors explain the shift.

First, revenue. Prediction markets generate frequent transactions and short holding periods. Fee yields are higher than in retail equities, where commissions have been compressed for years.

Second, institutional demand. Proprietary trading firms and asset managers are testing prediction markets as forecasting tools rather than speculative products.

“It’s easy to understand why exchanges, brokers and investors are intrigued,” says Jesse Forster, Head of Equity Market Structure Research at Coalition Greenwich and author of Prediction Markets: It’s All About the Data. “By tapping into the ‘wisdom of the crowd,’ prediction markets promise unique signals about the future.”

Third, distribution effects. Once embedded in a broker app, prediction markets benefit from cross-pollination between asset classes. Scale comes from distribution, not standalone platforms.

Fourth, regulation. In 2025–2026, the CFTC signaled a more permissive stance toward event contracts, including sports outcomes, encouraging brokers and exchanges to commit infrastructure rather than treat the space as provisional.

How Brokers Defy the “Gambling” Label

Brokers frame event contracts as commodities traded on federally regulated exchanges rather than bets placed with sportsbooks. Routing transactions through CFTC-licensed venues is meant to pre-empt state gambling laws.

They also emphasize information value. Prediction markets are presented as tools for aggregating expectations about economic and political outcomes, not as entertainment products.

At the operational level, platforms apply anti-fraud and anti-manipulation rules, monitor suspicious trading patterns and suspend accounts when insider information is suspected.

- The Wallet Is the New Battleground for Prediction Markets, Bitget Wallet Report Argues

- Prediction Markets Scale Up as Volumes Surge, But Regulation and Liquidity Remain Key Constraints

- Kalshi CEO: Prediction Markets Could Spawn New Job Category Like Instagram Creators and Uber Drivers

Where the Argument Is Vulnerable

A central weakness in the “not gambling” framing is consumer protection. Prediction markets generally lack safeguards that are mandatory for licensed sportsbooks, such as age verification, responsible gaming tools and exclusion lists.

State regulators argue that products with similar behavioral risks should be subject to comparable protections, regardless of how they are classified at the federal level. That gap is most visible in insider trading risk. Event outcomes are binary and time-sensitive, making non-public information especially valuable.

Enforcement tends to be reactive, with platforms intervening only after suspicious trading patterns emerge. Regulators have pointed to several high-profile cases involving large, well-timed bets on political outcomes as evidence of these vulnerabilities.

The regulatory argument also weakens outside the United States. In the UK, authorities have made clear that prediction markets would almost certainly fall under gambling law rather than financial regulation.

British regulators view such products as functionally similar to betting exchanges – a model that has existed since the early 2000s and requires a dedicated gambling licence. That contrast underscores how dependent the current U.S. expansion is on jurisdictional interpretation.

What qualifies as a federally regulated derivatives product in the United States would likely be treated as gambling in most other mature markets.

What Happens Next

Much depends on upcoming legal and regulatory decisions. If federal pre-emption is upheld, prediction markets could scale rapidly, with sports contracts becoming a standard broker product.

If states prevail, platforms may face fragmented licensing regimes that slow growth and cut margins. The most likely outcome is a hybrid system: federal oversight paired with baseline consumer protections negotiated with states.

Either way, traditional finance’s expansion into prediction markets is a calculated bet on regulation – and on the idea that probabilities, not just prices, will become a permanent feature of modern markets.