Prop firms dodge restrictions in India with “education” branding

Prop firms seem to have found a way into India’s market: Using “education” campaigns to attract clients while avoiding banned terms like forex and CFDs. Ads in Hinglish – a blend of Hindi and English – are also proving especially effective.

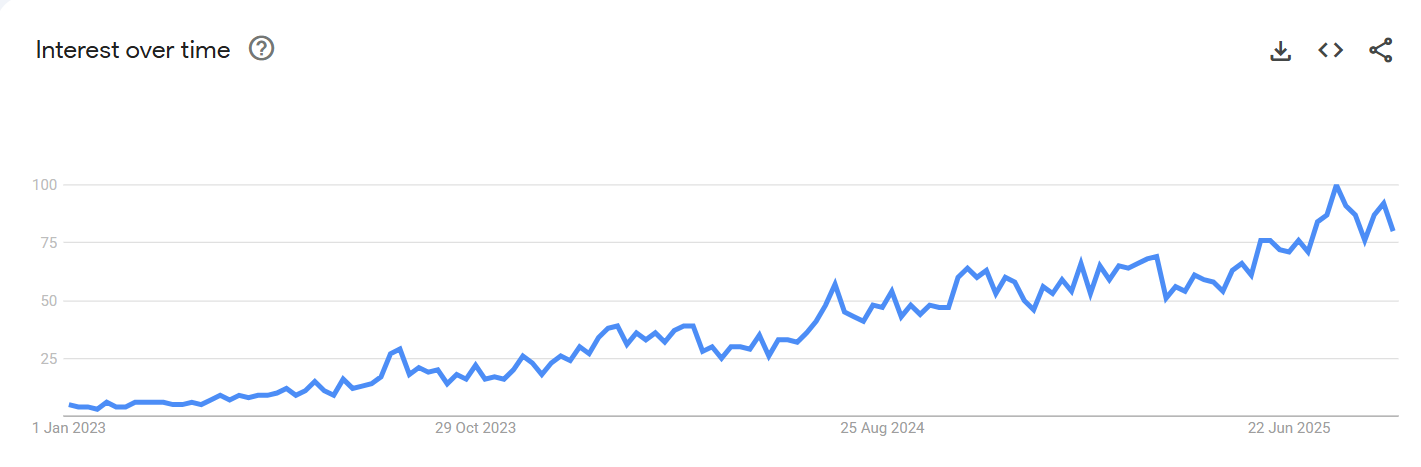

A sector-wide analysis of the top 50 prop firms found that around 40% of their organic website traffic comes from India. Google Trends also highlights growing local interest, showing sharp increases in searches for “prop firm” and “prop trading” since 2023.

To get past platform restrictions, firms are reshaping their messaging. Instead of promising profits or highlighting forex and CFDs, they market trading as “education” and offer “free demo accounts.”

Brokers brush off CySEC’s new CFD limits

In matters of regulations, CFD brokers in Europe are adjusting to new rules from the Cyprus Securities and Exchange Commission (CySEC), which imposed tighter limits on leverage for certain contracts.

The regulator capped leverage at 10:1 for non-major commodity and index CFDs, aligning Cyprus more closely with stricter EU standards. With the directive now in force, CySEC-regulated brokers are reshaping their offerings and compliance setups.

MENA accounts for 52% of Capital.com’s H1 trading

As regulations tighten in Cyprus, brokers are reaping big elsewhere. Capital.com reported that the Middle East and North Africa (MENA) accounted for 52% of its trading volume in the first half of 2025, cementing the region as its biggest market.

UAE traders dominated activity, contributing nearly three-quarters of MENA’s total. Overall, the broker processed $804.1 billion in volume across the region, up 53.3% from the previous six months.

ATC Brokers doubles profit in the UK

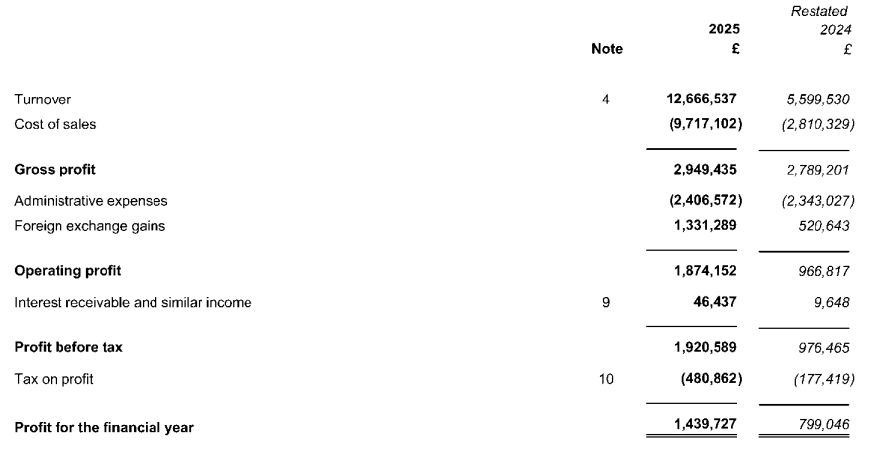

ATC Brokers reported a sharp rise in its UK business performance for the year ended 30 April 2025, with revenue climbing 125% to £12.7 million. Operating profit doubled to £1.87 million, while net profit came in at more than £1.4 million.

Commissions contributed £7.84 million and brokerage income £4.8 million, up 151% and 100% respectively from the previous year. The broker attributed the higher turnover to increased trading volumes but did not disclose specific figures.

Revolut tops 34 Polish brokers, XTB still leads

In the fintech space, Revolut surpassed 34 traditional Polish brokerage firms to secure the second-largest position in the country’s retail trading market. Despite the rapid rise, the fintech still trails behind XTB, which remains the dominant player.

According to data from Poland's Central Securities Depository (KDPW), XTB held almost 615,000 Polish market accounts at the end of August, while Revolut reported 590,000 investment accounts.

Capital Index UK posts a loss

Meanwhile, Capital Index (UK) Limited narrowed its annual losses for 2024, posting a net loss of £18,000 compared to a much larger deficit a year earlier.

For the year ended 31 December 2024, the company reported a pre-tax profit of £23,678, a significant turnaround from the £207,006 pre-tax loss recorded in 2023.

Crypto derivatives drive record trading volumes

Derivatives trading has emerged as the leading driver in crypto markets. Shift Markets will host a webinar on September 25, 2025, focusing on the rapid rise of crypto derivatives and their role in reshaping digital asset trading.

With derivatives trading volumes now surpassing spot markets, the session will explore how these instruments are driving higher revenues, attracting more sophisticated traders.

Kraken's Breakout bet

Still with crypto, Kraken has strengthened its presence in active trading by acquiring Breakout, a crypto-native proprietary trading firm. The move marks the first time a major exchange has integrated a prop trading arm into its platform..

Breakout offers a model familiar to forex and futures traders: participants pay a fee to enter a challenge or evaluation phase. Traders who meet profit targets without exceeding drawdown limits gain access to funded accounts, with up to $200,000 in notional capital, and retain most of the profits—sometimes as much as 90%.

Retail confidence rebounds

Retail investors are showing renewed optimism in the US market after two straight quarters of waning sentiment, according to eToro’s latest Retail Investor Beat survey.

The quarterly survey, which polled 10,000 retail investors across 13 countries, revealed that 38 percent now see the US as offering the strongest long-term return potential.

CFTC to weigh MiCA platforms entering U.S. markets

In the US, the Commodity Futures Trading Commission (CFTC) is considering allowing trading platforms licensed under Europe’s MiCA framework to operate in American markets, Acting Chairman Caroline D. Pham told UK lawmakers.

Remarks by @CFTCpham before the UK All-Party Parliamentary Group on Blockchain Technologies, Parliamentary International Roundtable Digital Assets Policy & Regulation: https://t.co/wpRhrRlphF

— CFTC (@CFTC) September 8, 2025

Pham said the agency is exploring whether MiCA-authorized platforms could meet the criteria under the CFTC’s existing cross-border recognition rules.y

FCA charges 3 finfluencers over CFDs – could rules tighten?

The Financial Conduct Authority (FCA) has criminally charged three UK-based finfluencers for allegedly promoting high-risk contracts for difference (CFDs) to their social media followers. The regulator says the trio encouraged retail investors to trade in foreign exchange through CFDs without proper authorisation.

The accused—Charles Hunter, Kayan Kalipha, and Luke Desmaris—appeared individually at Westminster Magistrates’ Court on Wednesday. All three pleaded not guilty and are scheduled for a hearing on 8 October 2025.

Robinhood launches social trading

Also this week, Robinhood unveiled plans for a new social trading platform that allows users to share live positions and trading performance. The move is seen as a direct challenge to Reddit’s influential WallStreetBets community, as the broker seeks to expand its footprint in active trading services.

The announcement came at Robinhood’s annual HOOD Summit in Las Vegas, where the company also revealed AI-powered trading tools and an expanded range of futures offerings. Robinhood Social will initially launch by invitation to select U.S. customers early next year, with a broader rollout planned thereafter.

Nasdaq seeks SEC approval for tokenized securities

Nasdaq filed a proposal with the U.S. Securities and Exchange Commission (SEC) to introduce tokenized securities on its exchange. The initiative aims to combine the benefits of digital assets with the established infrastructure of U.S. equity markets.

The exchange emphasized that tokenized securities would operate like conventional stocks, maintaining investor protections and market stability.

Oracle stock jumps on AI forecast, Ellison nears Elon Musk

Outside the industry, Wall Street reacted with surprise as Oracle unveiled an ambitious cloud revenue forecast, sending its stock sharply higher and propelling founder Larry Ellison’s net worth closer to Elon Musk’s territory.

Analysts and investors were taken aback by the scale of the projection, with many likening it to a high-energy startup pitch rather than a long-established tech giant’s guidance.

Elon Musk’s $1 trillion Tesla pay plan

Lastly, Tesla has unveiled a massive pay package for Elon Musk that could be worth nearly $1 trillion over the next decade, potentially making him the first trillionaire.

If approved by shareholders and all targets are met, the award could exceed $1 trillion, though more conservative estimates put it around $900 billion.