Germany to require CFD-style warnings for turbos

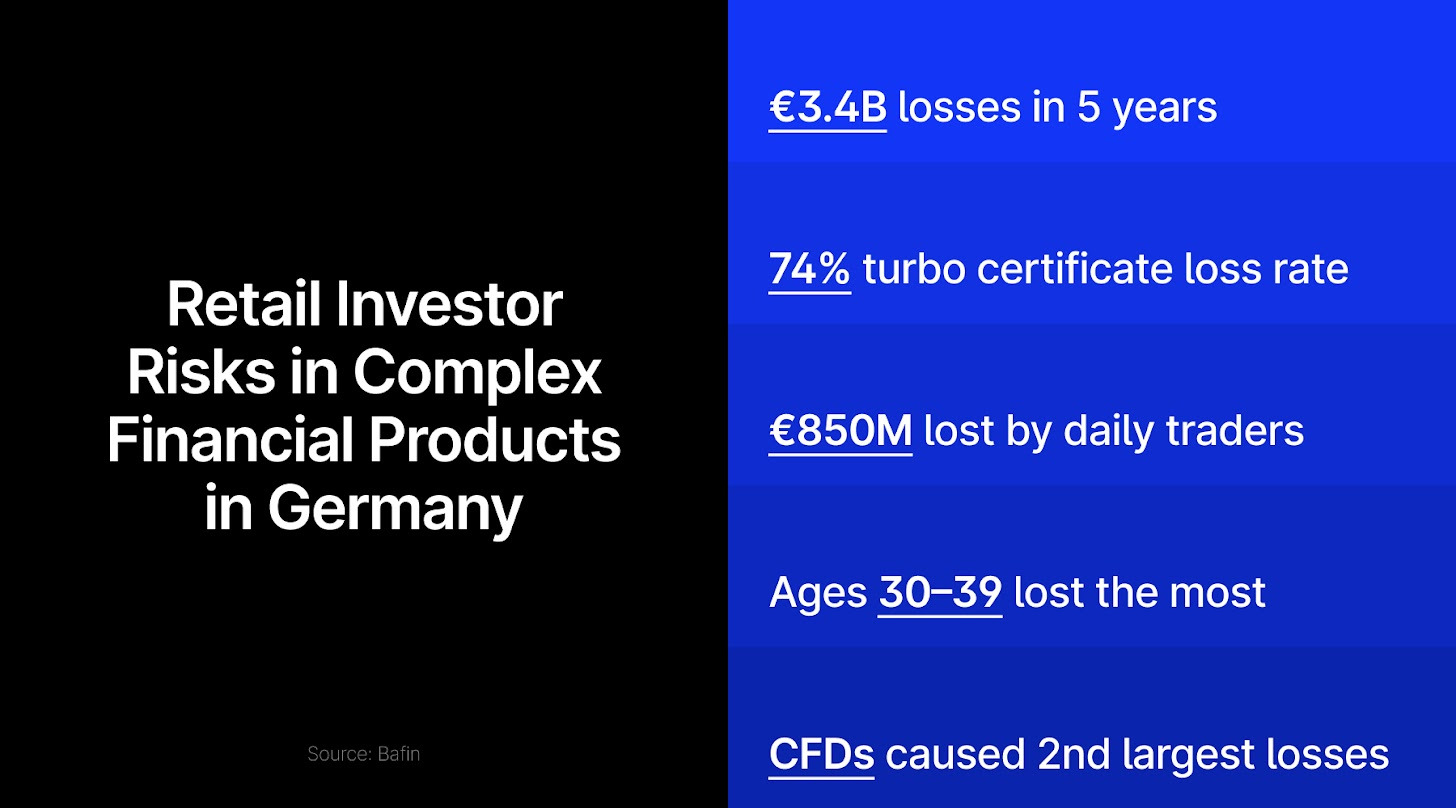

Among a set of headlines shaping the market this week, Germany’s financial regulator, BaFin, will introduce new restrictions on turbo certificates starting next year. The rules come after data showed that 543,000 retail investors traded turbos between January 2019 and December 2023, with 74.2% of them incurring losses.

Join IG, CMC, and Robinhood at London’s leading trading industry event!

Under the new framework, all platforms offering turbo certificates to German retail investors, including third-party sites advertising these products, must prominently display a standard risk warning.

Providers will no longer be allowed to offer bonuses or other incentives to traders, and intermediaries must conduct surveys assessing clients’ understanding of turbo certificates at least every six months.

- Weekly Highlights: Daily FX Volumes Hit $9.6 Trillion, UK Traders Use Stop Losses 60% More Than Peers

- Weekly Roundup: IG's First Spot Crypto Revenue; Can Trump’s Push to End Quarterly Reports Benefit Companies?

- Weekly Report: CFD Accounts Near 6M, XM Gains Dubai License, IG Prime’s White-Label Launch

ActivTrades posts 80% growth in funded accounts

ActivTrades reported an 80% increase in funded trading accounts, driven by strong demand in Asia and Latin America. The London-based broker said these regions are becoming increasingly important as forex and CFD trading gain popularity among retail investors.

Industry figures highlight the scale of opportunity for brokers expanding into emerging markets. In 2023, the Asia-Pacific region will account for 30% of global CFD revenue, and Latin America will contribute 8%.

Forex.com operator secures Dubai license

At the same time, Gain Capital, the operator of Forex.com and City Index, secured a Category 5 license from the Securities and Commodities Authority in Dubai this week. The license permits the company to offer financial consultations and promote financial services.

This means the firm can market its CFD services and refer clients to its non-UAE entities, but it is not permitted to hold client funds or execute trades locally. It remains unclear whether the company will promote the Forex.com or City Index brand in Dubai.

Dubai speeds up CFD license approvals by 33%

In the regulatory front, the Dubai Financial Services Authority launched a new digital platform to accelerate the licensing process for financial firms seeking to operate in the emirate’s International Financial Center.

DFSA Connect automates parts of the authorization workflow, cutting processing times by about one-third, according to the regulator. The DFSA reported an 18% increase in applications during the first nine months of 2025 compared with the same period in 2024.

This development coincides with broader growth in Dubai’s financial sector. The Dubai International Financial Centre (DIFC) registered 1,081 new companies in the first half of 2025, bringing the total number of active entities to 7,700.

Tokenized stocks win approval in France’s €6 billion pilot

In a matter that continues to draw attention, France’s financial regulator, the Autorité des Marchés Financiers, approved the operating rules of LISE, a blockchain-based trading platform that will enable the issuance and trading of tokenized company shares.

The approval moves France closer to launching its first stock exchange built entirely on distributed ledger technology, with retail investors expected to trade tokenized securities directly through digital wallets starting in early 2026.

Not far away, the UK Financial Conduct Authority has outlined plans to advance the use of tokenization within the asset management industry. The regulator said the initiative is intended to encourage innovation and improve operational efficiency by enabling firms to adopt distributed ledger technology within existing regulatory frameworks.

Kraken buys Small Exchange from IG for $100M

At the intersection of crypto and retail brokerage, IG Group completed the sale of Small Exchange to a U.S.-based crypto firm, Kraken, in a deal valued at $100 million, marking its exit from the U.S. derivatives market. The transaction delivers a post-tax profit of £73.3 million and aligns with IG’s strategic shift toward growth in the UK and Australia.

Under the terms of the deal, IG received $32.5 million in cash and $67.5 million in stock from Payward Inc., Kraken’s parent company. The transaction boosts IG’s regulatory capital by £22.7 million, excluding the equity portion.

CEO Breon Corcoran described the exit as “a significant return on the Group's acquisition of Small Exchange” while noting it “enables us to collaborate with Kraken on the distribution of new crypto products.”

Ripple acquired GTreasury in $1B deal

Big crypto firms are also making major acquisitions. Ripple has agreed to acquire corporate treasury platform GTreasury in a deal valued at $1 billion, expanding its footprint in enterprise-level finance and liquidity management.

The move signals Ripple’s strategy to grow beyond cross-border payments and compete in corporate finance technology traditionally dominated by established financial software providers. The acquisition follows Ripple’s recent $200 million purchase of a stablecoin-focused payments platform, reinforcing its push into broader financial infrastructure services.

Coinbase Invests in India’s CoinDCX

Another big name in the digital asset space, Coinbase, has made a new investment in CoinDCX, a cryptocurrency exchange with operations in India and the Middle East. The deal builds on earlier backing from Coinbase Ventures and is still subject to regulatory approvals and other closing conditions.

📰 Today in money

— Mannie🧊 (@Metamannie) October 15, 2025

➡️ Coinbase Invests in CoinDCX; Strategic Move Signals Deeper India Ambitions

Coinbase has officially backed CoinDCX, one of India’s leading crypto exchanges, reinforcing its presence in the fast-growing Indian market.

The investment is a continuation of… pic.twitter.com/f9kCFOf83W

CoinDCX has continued expanding beyond India, establishing a presence across key Middle East markets. The exchange reported annualized transaction volumes of about $165 billion, annualized group revenue of roughly $141 million, and assets under custody exceeding $1.2 billion as of July 2025.

Robinhood U-turns on copy trading

Robinhood has launched a new feature called Robinhood Social, marking its entry into copy trading just nine months after publicly criticizing similar services over regulatory concerns. The platform will allow users to follow and replicate the trading activity of other investors, positioning Robinhood alongside competitors that already offer social and copy trading tools.

Introducing Robinhood Social. Coming next year.

— Robinhood (@RobinhoodApp) September 10, 2025

Show off your recent gains, discuss strategies, follow your favorite traders, and make market moves in real-time.#RobinhoodPresents https://t.co/cLhiCw7bpH pic.twitter.com/LYaLgkcuuM

The company had previously argued that copy trading posed potential compliance issues, particularly regarding financial promotions and investor protection. Its shift in strategy signals a change in market approach as it seeks to expand engagement among retail traders.

Binance blames "display issue" for altcoin price crash

Binance has attributed the sudden drop of several altcoins to $0 on its platform to a display error. The incident occurred the previous week and affected trading pairs involving cryptocurrencies such as IoTeX, Cosmos, and Enjin, whose prices briefly appeared as zero on Binance despite trading at normal levels elsewhere.

Binance said the problem did not reflect actual market prices or executions and was limited to the way values were shown on the platform. Prices for the affected assets remained significantly higher on other centralized exchanges during the incident, raising concerns among traders until Binance issued its explanation two days later.

Kenya's parliament passes crypto bill

Crypto legislation is taking shape in Africa. Kenya, the continent's sixth-largest economy, approved the Virtual Asset Service Providers Bill, introducing a regulatory framework for digital currencies and virtual assets.

The legislation designates the Central Bank of Kenya as the licensing authority for stablecoins and sets out clear rules for the registration and supervision of crypto exchanges and issuers. The bill, passed last week, now awaits President William Ruto’s signature before becoming law.

The legal clarity is expected to attract global crypto firms such as Binance and Coinbase, which have shown interest in expanding across Africa.

DOJ seizes $15B in the largest fraudulent crypto forfeiture

Even as crypto adoption grows, challenges remain. The U.S. Department of Justice seized about $15 billion in Bitcoin linked to an alleged “pig butchering” crypto fraud scheme operating out of Cambodia, marking the largest forfeiture in the DOJ’s history.

🚨 Explosive News! 🇺🇸 The DOJ just pulled off its biggest seizure ever, confiscating $15B in #Bitcoin from a massive 'pig butchering' scam operating out of 🇰🇭 Cambodia.

— TheCryptoRadar⭐ (@thecryptoradar1) October 14, 2025

Is now the moment for a 🇺🇸 Strategic #Bitcoin Reserve? 👀 #crypto #btc #CryptoCommunity pic.twitter.com/KQ67rOpRU3

According to U.S. prosecutors, the group allegedly used bribery and operated forced-labor compounds where trafficked workers were coerced into running crypto scams. Victims were reportedly targeted online and deceived into transferring funds through fake investment schemes, with the money later laundered.

OpenAI and Broadcom sign 10-gigawatt AI chip deal

Away from forex and crypto, OpenAI has signed a multibillion-dollar deal for custom silicon, strengthening its partnership with AMD while reducing reliance on Nvidia. The agreement marks a significant shift toward specialized chip design tailored for large-scale AI workloads, signaling OpenAI’s long-term commitment to controlling more of its core infrastructure.

The company acknowledged that artificial intelligence demands massive computing power, with inference and real-time interactions requiring immense energy and processing capacity. As part of its strategy to scale efficiently, OpenAI announced a 10-gigawatt chip deployment deal with Broadcom.

Walmart and OpenAI launch ChatGPT shopping tool

Walmart introduced a new feature that allows customers to shop through ChatGPT. This feature enables users to search for and purchase products using natural language prompts.

The system, called Instant Checkout, is part of a partnership with OpenAI and aims to streamline online shopping by removing the need to browse product pages or use traditional search filters.

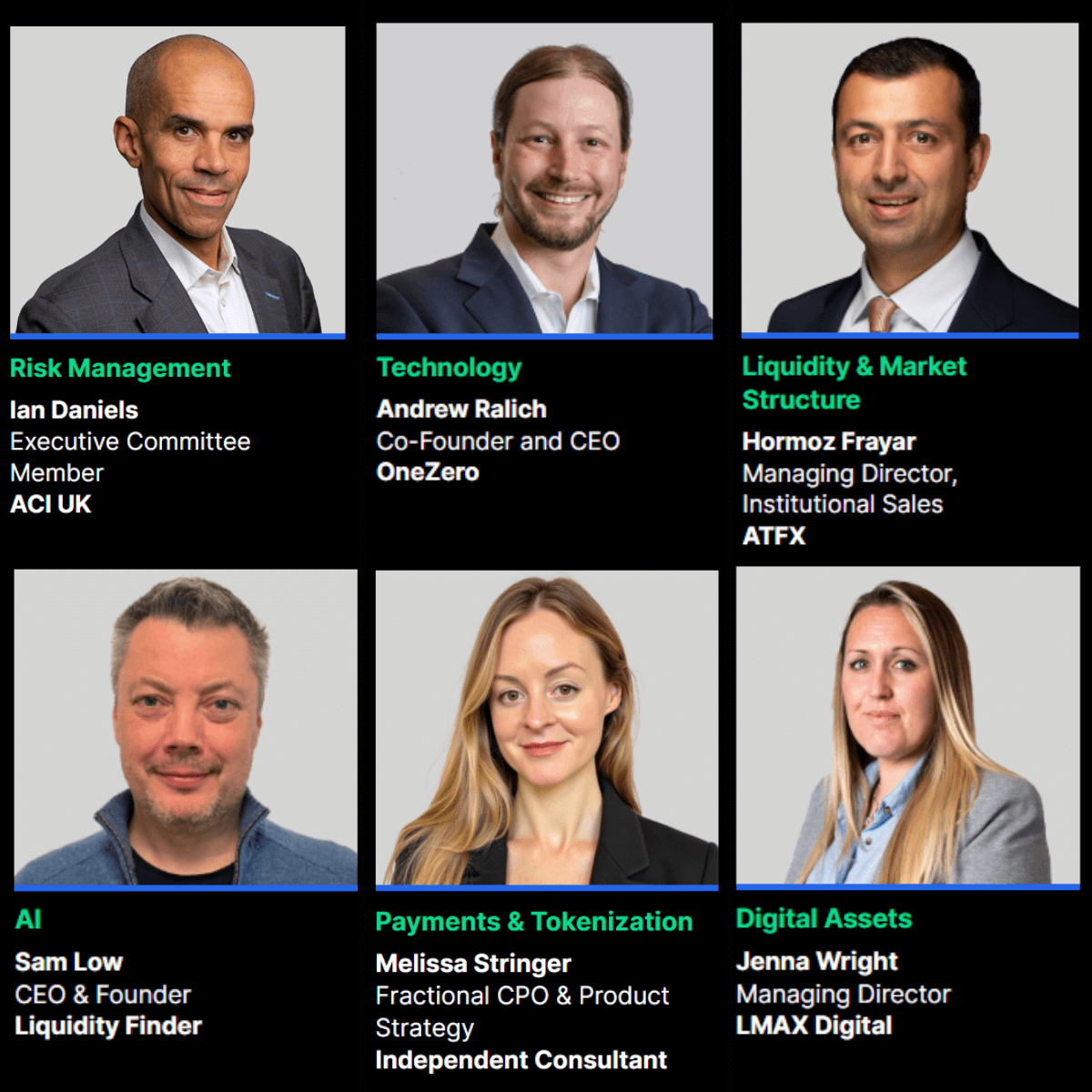

London Summit Introduces The FX Roundtables

Lastly, the London Summit will host its FX Roundtables on 26 November 2025 as part of FMLS:25. The event is a private, invitation-only gathering for professionals from the FX and FICC sectors, aimed at facilitating focused industry discussions.

The session will feature six dedicated tables bringing together institutional representatives for off-the-record conversations. The format is designed to encourage the exchange of insights on market developments, strategies, and emerging trends while supporting professional networking.