CFD accounts near 6 million

The retail CFD industry continued to grow in the second quarter of 2025, with total global active accounts reaching 5.68 million, according to Finance Magnates’ latest Quarterly Intelligence Report.

The milestone, which excludes Japan, reflects steady momentum from the previous quarter, when the market first crossed the 5 million account threshold.

Eleven brokers now manage more than 100,000 monthly active accounts, underscoring the sector’s strong expansion. XTB retained its lead with 750,000 accounts.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

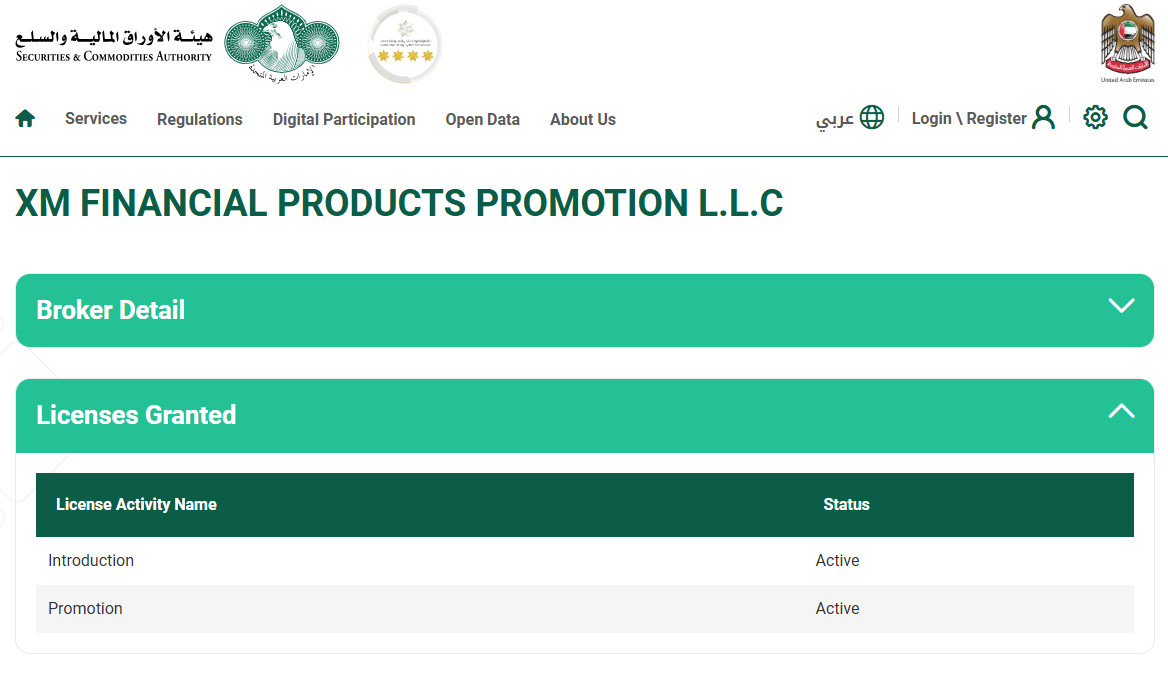

XM is now regulated in Dubai

The rising account numbers can partly be attributed to an increase in regulatory approvals in the brokerage space. XM secured a Category 5 license from Dubai’s Securities and Commodities Authority. The approval was granted to its locally incorporated entity, XM Financial Products Promotion, which was established in January 2025.

The company has also established a regional base in Dubai’s Opus Building at Business Bay and intends to activate the new license before the end of the year.

Capital.com plans Turkey entry

Capital.com also confirmed it is seeking a financial services licence in Türkiye and hiring a Chief Executive to lead its local operations. Salim Sebbata, Head of Corporate Development at Capital.com, said the move is part of the broker’s broader strategy to explore licenses in multiple markets.

Salim Sebbata, Head of Corporate Development at Capital.com, said the move is part of the broker’s broader strategy to explore licenses in multiple markets. Capital.com is also pursuing a license in Japan.

Neex secures UAE approval

In the Middle East, CFD broker Neex entered the UAE market after receiving regulatory approval from the Securities and Commodities Authority. The move positions Neex to expand its operations across the region.

Neex Securities LLC was granted a Category 5 license by the SCA, enabling the broker to carry out promotion and introduction activities. The license also allows clients to access regulated markets in forex , indices, commodities, and stocks, broadening Neex’s Middle East presence.

Offshore CFD broker Monaxa gains South Africa's license

Monaxa, a newer contract for differences (CFDs) broker, also obtained a South African license as part of a shift from offshore to onshore operations. The firm is now planning to seek MiFID II authorization to expand its reach into Europe.

CEO Chris Trikomitis confirmed the South African approval on LinkedIn, noting the company’s intention to progress with its European entity. It remains unclear whether Monaxa will pursue MiFID II authorization through Cyprus or via another European jurisdiction.

Traders could benefit from AI models

Swiss National Bank research found that large language models (LLMs) outperformed traditional AI in predicting FX market movements, prompting many traders to consider how they could use the technology to improve their forecasts.

The study showed that fine-tuned LLMs captured the nuances of news articles more effectively, especially when trained on a mix of human-labelled and distant-labelled datasets. Researchers also noted that domain-adapted LLMs had an edge over pre-trained financial models.

IG Prime launches white-label platform

Meanwhile, IG Prime unveiled a white label trading platform that enables partner institutions to offer multi-asset trading services under their own brand. An unnamed international banking group has become the platform’s first client, marking the start of IG Prime’s expansion into technology partnerships beyond its traditional brokerage services.

The new platform gives the bank’s hedge fund clients access to IG’s global trading infrastructure while keeping the bank’s branding consistent across the user experience. The launch reflects IG Prime’s strategy to broaden its offerings and deepen relationships with financial institutions through tailored technology solutions.

- Weekly Summary: Prop Firms Sneak Into India Through “Education”; CySEC’s New CFD Limits Downplayed by Brokers

- Weekly Highlights: Cyprus Limits Retail CFDs as Institutional Demand Grows

- Weekly Snapshot: FTMO Revives MT5 Access for Prop Trading in the US, Capital.com Pursues Japan License

IG Group also announced the acquisition of Australian cryptoexchange Independent Reserve for an initial enterprise value of A$178 million (£86.8 million), marking its entry into the Asia-Pacific cryptocurrency market.

Axi launches crypto derivatives

More CFD brokers are exploring opportunities in the crypto space. Axi launched fiat-settled crypto perpetual contracts, allowing traders to access crypto derivatives without converting their funds into stablecoins

The contracts are settled directly in fiat, which Axi says eliminates the need for stablecoin conversions, lowers counterparty risks, and provides clearer visibility of account balances and trading performance.

eToro EU approved for crypto in Germany

Elsewhere, eToro Europe Ltd. received approval to offer cryptoasset services in Germany under the Markets in Crypto-Assets Regulation. The company announced that all cryptoasset trading for German clients would be conducted directly through eToro EU, ending the use of DLT Finance for trading services on the platform.

eToro recently expanded its cryptoasset offering by adding five new tokens: LayerZero, ZKsync, Pyth, EigenLayer, and Swell.

Google adds stablecoin payments to AI apps

In the crypto space, Google is moving into digital payments for artificial intelligence, unveiling a new protocol that enables AI applications to send and receive money, including stablecoins pegged to traditional currencies.

The initiative is being developed in partnership with Coinbase, the Ethereum Foundation, and more than 60 other firms across the finance and technology sectors.

FCA wants to apply traditional financial rules to crypto

Even as crypto adoption grows, regulations are tightening. The UK’s financial watchdog is seeking public feedback on how its existing rulebook should apply to the fast-evolving crypto sector.

The Financial Conduct Authority published a consultation paper examining how current provisions in its handbook could apply to firms engaged in regulated crypto asset activities. The initiative comes as HM Treasury prepares legislation to establish a new regulatory framework for the sector.

The CFTC’s move to simplify access for global crypto platforms to US customers could increase liquidity for American traders, though the change largely formalizes access that already existed. In late August, the acting CFTC chair highlighted the foreign board of trade registration framework.

Elon Musk buys $1B in Tesla stock

Outside the industry, Elon Musk purchased roughly $1 billion of Tesla shares, marking his first open-market buy since early 2020. The acquisition included 2.57 million shares at prices ranging from $372.37 to $396.54.

The move has reinvigorated the Tesla narrative and captured the attention of retail investors, coinciding with Musk’s push for greater control of the company and a substantial executive pay plan.

Nvidia invests $5B in Intel

Lastly, Nvidia is investing in Intel and collaborating on product development, focusing on CPU and interconnect synergy rather than solving Intel’s manufacturing challenges. The announcement sent shares higher, reflecting investor optimism about the partnership.

NEWS: @NVIDIA and @Intel to develop AI infrastructure and personal computing products.

— NVIDIA Newsroom (@nvidianewsroom) September 18, 2025

Read the announcement: https://t.co/Gl28iWwSZc pic.twitter.com/srOhEnr0Ja

The $5 billion investment in Intel’s common stock, priced at $23.28 per share and subject to regulatory approval, is part of a broader roadmap.