Trustpilot’s Reputation Casino

Top on our weekly news recap is an interesting development involving prop trading firms and Trustpilot. Recently, the online review platform abruptly wiped out over 1,300 reviews from the profile of prop firm Hola Prime, leaving just 49 behind. The reason? The firm had allegedly flooded the platform with fake reviews to boost its rating.

While Hola Prime is just the latest to be exposed, the case highlights a much bigger issue: the booming black market for fake reviews in the trading industry.

3️⃣ How Some Firms Manipulate Reviews

— Prop Firm Journal (@PropFirmJournal) March 11, 2025

Some prop firms may flood platforms with fake positive reviews while flagging or removing negative feedback to protect their image.

If a firm has thousands of 5-star reviews but little community engagement, it’s worth asking: Is this real?

Airwallex Eyes the Creator Economy

And in the sporting arena, Airwallex, the fintech heavyweight, is banking on creatives, splashing cash in F1, and making global plays with strategic acquisitions. While Airwallex is busy building out its fintech ecosystem for creatives, it’s also flexing its own creative muscles.

Enter: Formula 1. Because nothing says “cutting-edge fintech” quite like slapping your brand on the world’s fastest (and most expensive) billboard. Airwallex isn’t just making waves in fintech—it’s merging speed, culture, and creativity in spectacular fashion. Ahead of the Australian Grand Prix, the company gifted Oscar Piastri a custom-wrapped McLaren supercar featuring an electrifying design by First Nations artist Reko Rennie.

NAGA Founder Announced New Crypto Startup

Benjamin Bilski, the former CEO and founder of NAGA is preparing to launch a new cryptocurrency trading platform. Following his departure from NAGA after its acquisition by CAPEX.com, Bilski is now eying the opportunities in the crypto landscape.

Now, he believes he has identified a major inefficiency in the industry—one he claims could “change everything.” His LinkedIn post suggested that the new platform would address structural issues in market-making and liquidity provision. He emphasized democratized liquidity pools, an independent blockchain optimized for scale, social investing elements, and an AI-driven ecosystem tailored for traders.

Ripple Secures License in Dubai

Elsewhere, blockchain payments company Ripple secured a regulatory license from the Dubai Financial Services Authority (DFSA), becoming the first digital assets-enabled payments provider authorized to operate in the Dubai International Finance Centre.

The approval represents Ripple's first license in the Middle East and allows the company to offer regulated crypto payment services to businesses throughout the UAE, strengthening its position in a region where it already maintains about 20% of its global customer base. This is reportedly a continuation of the regulatory moves initiated by the company in the Middle East late last year when, in October, it obtained an in-principle license to launch cross-border payment services.

Ripple has secured regulatory approval from the Dubai Financial Services Authority (DFSA), making us the first blockchain payments provider licensed in the DIFC. https://t.co/6oHWtnjODr

— Ripple (@Ripple) March 13, 2025

This milestone unlocks fully regulated cross-border crypto payments in the UAE, bringing…

Still in the Middle East, Abu Dhabi’s investment company MGX invested $2 billion in crypto exchange Binance in one of the latest major institutional investment deals in the crypto space.

Financial Reports

Several companies posted their financial results this week. Doo Group reported a total trading volume of $134.11 billion in February 2025, a 25.33% increase from January. The company faced lower trading activity in January due to seasonal factors and market adjustments. Despite initial challenges, trading volume rebounded in February as market conditions stabilized.

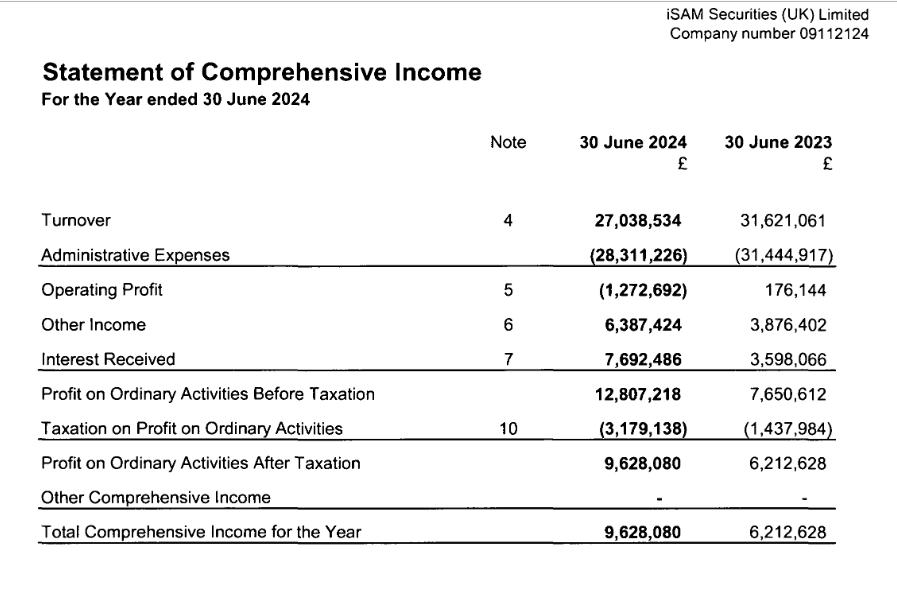

iSAM Securities (UK) Limited also registered its results, reporting a total turnover of £27.04 million for the financial year ending 30 June 2024, reflecting a decline from £31.62 million in the previous year. Despite lower revenue, administrative expenses saw a slight reduction, standing at £28.31 million compared to £31.44 million in 2023.

Meanwhile, Futu Holdings Limited (Nasdaq: FUTU) saw its fourth-quarter net income more than double as trading volume surged to an all-time high amid increased investor activity in AI and cryptocurrency stocks. Also reporting strong results, IG Group (LSE: IGG) reported a 12% increase in total revenue for the third quarter of fiscal year 2025 (Q3 FY25), reaching £268.0 million as stronger market conditions and an uptick in active clients drove performance.

Yuh, the mobile-focused finance app developed by Swissquote and PostFinance, reported a profit of CHF 1.7 million in 2024—its first profitable year since launching in May 2021. “We originally planned to break even by 2025—proof that a well-thought-out strategy, decisive action, and an unwavering focus on our customers can achieve great things,” said Markus Schwab, CEO of Yuh.

In the prop trading space, Maven Securities Holding Limited, a UK-based proprietary trading firm, recorded a 30% decline in revenue to £84 million for the fiscal year that ended June 30, 2024, while increasing profit before tax to £15.6 million, according to the company's annual financial statements.

The Flock of Hedge Funds to GCC

Meanwhile, the most recent Global Financial Centres Index illustrates the growing influence of the GCC’s (Gulf Cooperation Council) two main financial centers. Dubai moved up four places to 16th, and Abu Dhabi advanced from 37th to 35th. Riyadh, Doha, and Kuwait City also made big moves, albeit from a much lower base.

The region's increasing appeal to hedge funds is a significant factor in this growth. A report published by Dubai International Financial Centre (DIFC) in September 2024 notes that the number of hedge funds establishing operations in the center rose by 125% in 2023.

The Fintech-Bank Marriage is Broken

The latest findings show a strained relationship between banks and the fintech sector. Regulatory scrutiny intensified last spring after middleware provider Synapse collapsed, leaving thousands of online customers’ deposits in the lurch.

Last summer, federal banking agencies released an interagency statement providing guidance for banks working with third parties on deposit products, as well as a request for information related to the bank-fintech relationship. In September, the Federal Deposit Insurance Corporation (FDIC) proposed new recordkeeping rules for banks that take deposits from fintech customers.

Israeli Court Orders Panda CFD Technology Provider Sale

A FX/CFD tech partnership that generated millions in wealth reached its breaking point this week, according to the Israeli media outlet TheMarker.com. An Israeli economic court ordered the sale of fintech company Panda Trading Systems to a third party after years of escalating conflict between its equal shareholders.

Samuel Gutman and Maor Lahav, who founded Panda in 2007 and each owns 50% of the company, reportedly failed to establish any mechanism for resolving disputes or separating their interests. The court noted this oversight created significant potential for expensive and lengthy legal proceedings when disagreements emerged.

Revolut vs. The UK Regulator

Additionally, Revolut and Visa took on the UK Payment Systems Regulator over proposed caps on interchange fees, arguing that innovation and competition are at stake.

Revolut and Visa filed legal challenges against the UK payments regulator, PSR, arguing that it has overstepped its powers with a proposed cap on international transaction fees. They asked the court to review and ultimately overturn the PSR’s decision.https://t.co/1WaTpKWxTj

— Max Karpis (@maxkarpis) March 8, 2025

The legal challenge, filed separately by both companies, contends that the PSR’s move is unnecessary and could have unintended consequences for consumers and businesses alike. Given Revolut’s rapid rise and Visa’s global dominance, this isn’t just another regulatory spat—it’s a battle for the future of fintech.

Safra Sarasin to Buy 70% Stake in Saxo Bank

Lastly, Swiss private bank J. Safra Sarasin agreed to acquire a 70 percent stake in Saxo Bank, which has been looking for a new buyer for months. The deal is valued at around 1.1 billion euros ($1.19 billion), putting the Danish online trading and investment services provider at a valuation tag of about 1.6 billion euros.

The new owner will purchase Finnish Mandatum's stake of 19.8 percent in Saxo as well as the 49.9 percent stake in Chinese group Geely. Saxo Bank’s founder and CEO, Kim Fournais, will continue to hold his 28 percent stake in the company. He will also remain the CEO of the company.