Bridgewise launches AI tool for CFD brokers

This week, a new version of an AI market analysis chat tool for CFD brokers hit the market. Bridgewise launched an updated version of Bridget, an AI-based market analysis chat solution tailored for global CFD brokers. The solution is currently in pilot with 300,000 traders.

The company has emphasized the competitive and data-heavy nature of capital markets. It also noted rising customer acquisition costs and limited lifetime value in the brokerage industry.

Join IG, CMC, and Robinhood in London’s leading trading industry event!

However, Bridgewise is not alone in offering AI-based solutions for brokers; its local competitor TipRanks, along with numerous other technology providers, also offers AI-powered stock analysis tools.

Global FX trading soars

Meanwhile, the global foreign exchange (FX) trading is rising. BIS’s report showed that it surged 28% to $9.6 trillion daily in April 2025. Over-the-counter interest rate derivatives also saw a sharp rise, jumping 59% to $7.9 trillion per day.

The US dollar remained the dominant currency, participating in 89% of all FX trades. It was followed by the euro at 28.9% and the Japanese yen at 16.8%.

CMC Markets expands via Westpac deal

More brokers are looking for collaborations beyond their niche. This week, CMC Markets secured an extended technology partnership with Westpac Banking Corporation to provide white-label trading platforms for Westpac Share Trading and St.George Directshares.

This deal gives CMC access to Westpac’s customer base of approximately 13 million clients, with integration expected to take about 12 months. CMC anticipates this partnership will grow its Australian customer base by around 40% and increase domestic trading volumes by approximately 45%.

Capital.com UK profit soars 215%

The UK unit of Capital.com reported a net trading revenue of approximately £40.9 million for 2024, marking a 37.7% increase from £29.7 million the previous year.

According to the Companies House filing, the revenue primarily comes from rebates paid by its parent company, earned through its role as a matched principal broker in the CFD and spread betting markets.

OANDA Europe profit skyrockets 738%

Bigger gains also came from OANDA Europe, the UK subsidiary of the global OANDA group, which reported a significant profit increase of 738% in 2024. Pre-tax profit reached £1.51 million, up from £227,336 in 2023.

Despite lower market volatility throughout the year, the broker's total revenue grew 13% to £18.5 million, compared to £16.3 million the previous year.

The UK-regulated broker attributed its strong financial performance to successful client acquisition and retention efforts that offset the typical market lull seen in reduced volatility conditions.

Trading212 Cyprus doubles revenue

Trading212’s Cyprus entity more than doubled its revenue in 2024, reaching £42.2 million. The company’s overall group revenue hit over £194 million for the year, marking a 67.2% increase compared to 2023.

Additionally, the recently acquired German brokerage FXFlat contributed over £1 million in revenue. Marketing expenses for the group surged past £65 million in the same period.

Darwinex Operator's profit drops

Not all brokers are posting strong numbers. Tradeslide Trading Tech Limited, the UK-based CFDs provider operating under the Darwinex brand, published its 2024 annual results showing a profit after tax of €477,000, down from €581,000 in 2023.

Gross profit decreased to €5.06 million from €5.33 million as cost of sales increased to €2.32 million. Higher administrative expenses led to a trading loss of €472,000 in 2024, reversing the previous year's operating profit of €252,000.

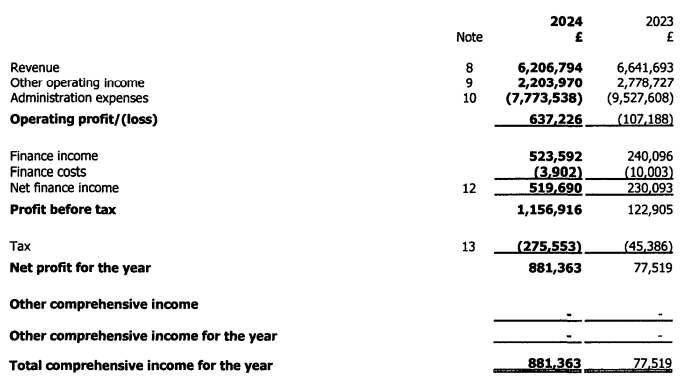

Tickmill UK’s revenue drops

Tickmill UK also experienced a decline in trading volume in 2024, which fell to $136 billion from $189 billion the previous year. This volume drop led to a 6% decrease in revenue, bringing it down to £6.2 million.

Despite lower revenue, Tickmill UK’s profits rose due to a reduction in administrative expenses and external swap and commission charges. The company also reported a decrease in intercompany recharge income, which fell to £2.2 million from £2.7 million in 2023.

Afterprime launches first pay-to-trade brokerage

Away from the numbers and onto new offerings. This week, Australian brokerage Afterprime introduced the world’s first “pay-to-trade” model, allowing active forex traders to earn additional income through a program called “Flow Rewards.” This model offers up to $3 per lot traded on top of zero-commission trading, targeting traders with high monthly volumes.

Founded by Global Prime’s former executives Jeremy Kinstlinger and Elan Bension, Afterprime claims that traders handling 1,000 lots per month could earn up to $36,000 annually through this post-trade optimization system. The rewards come from value redistributed from market spreads rather than client funds, providing an incentive beyond traditional commission savings.

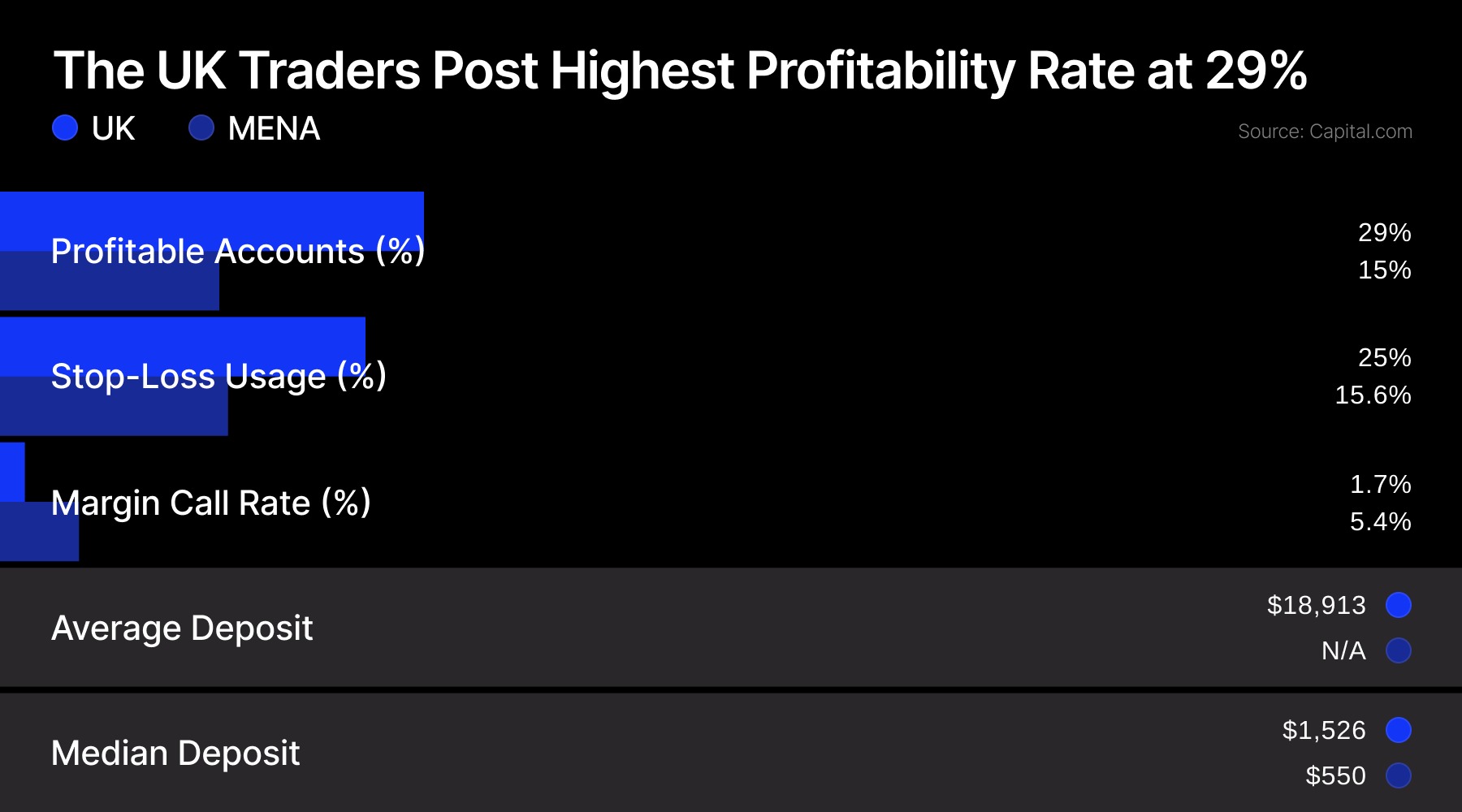

UK traders use stop losses 60% more

And to some interesting findings: British retail traders use stop-loss orders 60% more often than traders in other regions, contributing to a higher account profitability rate of 29%, according to Capital.com data from May 2023 to May 2025.

This profitability rate is nearly double that of the MENA region, which stands at 15%, and slightly higher than Europe’s 27%. The average UK deposit is $18,913, with a median of $1,526, almost three times higher than deposits in Europe and MENA.

IG secures FCA crypto licence in the UK

In matters licensing, IG became the first UK-listed company to receive a crypto asset license from the Financial Conduct Authority (FCA). This license enables IG to expand its cryptocurrency offerings and provide more accurate pricing.

Previously, IG launched crypto trading in June through a partnership with FCA-registered firm Uphold, but the new license now allows customers to transfer crypto assets directly in and out of the IG platform and access additional features.

Binance targets banks and brokers

Binance has launched Crypto-as-a-Service (CaaS), a white-label solution targeting financial institutions and brokerages. This platform enables these firms to offer crypto trading under their own brand while leveraging Binance’s infrastructure.

Introducing #Binance Crypto-as-a-Service (CaaS)

— Binance VIP & Institutional (@BinanceVIP) September 29, 2025

A white-label solution for corporates and financial institutions to integrate crypto services with full front-end control, powered by Binance’s unmatched infrastructure and liquidity.

Learn more 👉https://t.co/efBybAglQY pic.twitter.com/Gvsj9iAJCy

CaaS provides access to Spot and Futures trading, liquidity, custody, compliance, and settlement services. Institutions maintain control over their user interface and client relationships, reducing the cost and time required to develop crypto services independently.

Integral launches stablecoin prime broker

Still with crypto, the rising popularity of stablecoins seems to be attracting more firms in the industry. Integral, a technology provider in the forex trading industry, launched PrimeOne, a stablecoin-based crypto prime broker platform.

The platform operates entirely on-chain, with all traders funded and collateralized using stablecoins instead of cash, enabling trading and settlement to be conducted via blockchain technology.

Stablecoins, Football Sponsorships, and Prediction Markets

In Paul Golden’s weekly column, Tether launched a US-compliant stablecoin and appointed Bo Hines, formerly of the Presidential Council of Advisers for Digital Assets, to a key role. Despite Hines’ recent arrival, Tether’s stablecoin, USDt, remains the market leader.

Data from RWA.xyz indicates USDt saw inflows of $19.6 billion last quarter, the highest among stablecoins, contributing to the total $46 billion inflow into stablecoins during that period.

Tether benefits significantly from the yield on US Treasuries backing its tokens and is reportedly targeting a $500 billion valuation through an upcoming private placement.

Kudotrade launches prop trading Arm

Lastly, more brokers are launching prop trading divisions. Kudotrade, regulated in Mauritius, launched its proprietary retail trading platform called “Kudo Funded.” The platform offers traders access to capital of up to $200,000 and represents Kudotrade’s entry into the growing proprietary trading sector, joining other traditional financial firms expanding in this area.

Kudo Funded operates on a typical prop trading model. Traders must complete evaluation challenges and demonstrate consistent performance while adhering to risk management rules. Upon qualification, traders receive access to funding programs. The company highlights that qualified traders benefit from “generous profit shares” and guaranteed payouts as part of the program.

Kraken-Owned NinjaTrader enters prop trading

Also eying prop trading, NinjaTrader Group, now owned by Kraken, launched two new proprietary trading platforms—NinjaTrader Prop and Tradovate Prop—under its affiliate NT Technologies.

Among the first to adopt these new platforms are Take Profit Trader, Apex Trader Funding, and MyFunded Futures. The launch marks NinjaTrader Group’s entry into the prop trading business, providing traders with a comprehensive toolkit tailored to every stage of prop trading.

- Weekly Roundup: IG's First Spot Crypto Revenue; Can Trump’s Push to End Quarterly Reports Benefit Companies?

- Weekly Report: CFD Accounts Near 6M, XM Gains Dubai License, IG Prime’s White-Label Launch

- Weekly Summary: Prop Firms Sneak Into India Through “Education”; CySEC’s New CFD Limits Downplayed by Brokers