High web traffic, low CFD volumes

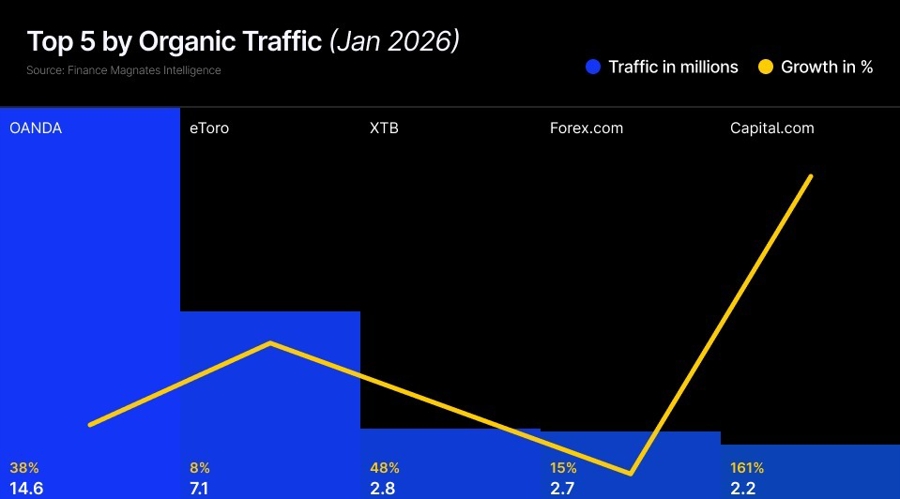

A new dataset from the fmintelligence portal challenges the long-held belief that more website traffic translates into higher trading activity for brokers. Analysis of 47 retail forex and CFD firms shows that the correlation between organic web traffic and actual trading volumes is just 0.09, essentially insignificant.

The figures, which compare January 2026 traffic data with recent monthly CFD volume averages, suggest that online visibility and trading activity measure very different aspects of a broker’s performance.

- Weekly Update: CFD Accounts Top 6M; Tradu Migrates Accounts to FXCM

- Weekly Roundup: Octa Entity to Launch New Broker; XTB’s CFD Era Fades

- Weekly Recap – MFF Founder Breaks Silence: “We Were Blindsided”; Is the Retail-Institutional Gap Narrowing?

The sector as a whole is seeing strong traffic growth, though unevenly distributed. Total organic traffic rose 36.5% year-over-year to 40.2 million visits in January 2026, up from 29.4 million. However, only 57% of brokers gained visitors, while 36% lost ground.

iForex readies £43.3M London IPO after delay

Meanwhile, iFOREX set the price of its London Stock Exchange IPO at 195 pence per share, implying a market capitalization of about £43.3 million. Trading in the shares, which will list under the ticker IFRX, is expected to start on February 25.

The listing comes after the company postponed an earlier plan to go public in late June 2025 due to additional time needed to complete a routine compliance inspection in the British Virgin Islands, before recently confirming that the process had restarted. The IPO comprises 4,487,179 new ordinary shares, with no existing shareholders selling any stock.

Plus500 plunges on £67M exec share sale

Significant insider share sales, even in profitable brokers, can still grab market attention. Plus500 executives sold £67.1 million worth of shares on Tuesday, sparking a sharp selloff that briefly wiped out up to 10% of the broker’s market value before the stock narrowed losses to trade 6% lower at 4,430 pence.

Executive | Initial Bonus Value | Value Increase (20%) | Value Before Sale |

David Zruia | £8,500,000 | £1,700,000 | £10,200,000 |

Elad Even-Chen | £8,500,000 | £1,700,000 | £10,200,000 |

Nir Zats | £120,000 | £24,000 | £144,00 |

CEO David Zruia, CFO Elad Even-Chen and CMO Nir Zats offloaded a combined 1.5 million shares at £44.78 each to Goldman Sachs International, in a block trade arranged by Panmure Liberum that accounted for 2.14% of Plus500’s issued share capital. The broker earlier posted strong metrics with average client deposit jumping 124%.

Last year, non-over-the-counter revenue at the broker surpassed $100 million and grew to about 14% of total revenue, up from virtually zero just a few years ago. The rapid growth of this segment highlighted how the contracts for difference (CFD) specialist is steadily building business lines beyond its core CFD offering.

eToro soars despite crypto setback

More interesting numbers came from the Nasdaq-listed eToro. The group posted record full-year results, alongside an expanded share buyback program and upbeat guidance. It shares soared more than 20% higher to close at $33.07, the highest level in over a month.

Net contribution for the year rose 10% to $868 million, GAAP net income increased 12% to $216 million, and the company ended 2025 with $1.3 billion in cash on its balance sheet.

Metric | Q1 2025 | Q2 2025 | Q3 2025 | Q4 2025 | FY 2025 |

Net Contribution ($M) | $217 | $210 | $215 | $227 | $868 |

Net Income GAAP ($M) | $60 | $30 | $57 | $69 | $216 |

Adj. EBITDA ($M) | $80 | $72 | $78 | $87 | $317 |

AUA ($B) | $14.8 | $17.5 | $20.8 | $18.5 | $18.5 |

Funded Accounts (M) | 3.58 | 3.63 | 3.73 | 3.81 | 3.81 |

Source: eToro Group Ltd. SEC filings (Form 6-K), Q1-Q4 2025

CEO Yoni Assia described 2025 as a “defining” or “milestone” year for eToro, highlighting its May Nasdaq IPO, faster product rollouts, and a broader international footprint as supporting factors behind the company’s growth momentum.

IG’s latest “Check Your Fees” campaign stirs debate

Are “fat cats” quietly snacking on UK investors’ funds with hefty fees? Well, IG’s recently launched campaign, “Check Your Fees,” aims to highlight how much UK investors are overpaying in platform charges.

The broker’s latest Fat Cat Index found that more than half (52%) of investors use one of the 12 most expensive investment platforms, paying up to £515 more per year than those on lower-cost alternatives.

For active investors using one of the top four costly providers, the extra annual cost rises to £711, or even £922 on the priciest platform. The findings show that active investors pay an average of £54 in annual fees on the cheapest platforms, compared to much higher totals on premium ones.

Kraken goes on hiring frenzy in Cyprus

Away from cats, something interesting is unfolding in Cyprus’ crypto space. Over the past two weeks, crypto exchange Kraken has posted about 50 new roles. The hiring spree follows its 2025 acquisition of CFD broker Greenfield Wealth, a move that gave the exchange a Cyprus Investment Firm (CIF) license and access to the EU’s MiFID framework.

Most of the new vacancies are senior or managerial, indicating a focus on building leadership and technical depth rather than entry-level capacity. Roughly 70% of the openings target senior talent, including positions such as Regulatory MiFID Officer, Global Head of Middle Office, and Senior AI/ML Engineer.

The Trading Pit launches Seychelles CFD broker

In the prop space, The Trading Pit has launched a new brokerage, TTP Markets, which is regulated in Seychelles. With this move, the company joins other proprietary trading firms expanding into the CFD brokerage sector.

The launch is being carried out gradually, with TTP Markets initially onboarding a small group of selected retail and corporate prop traders from The Trading Pit’s community. The company emphasized that this is not a full-scale retail push but rather a pilot phase to test its regulatory systems and prepare for future global expansion.

The5ers enters futures prop market

At the same time, prop firm The5ers entered the futures proprietary trading space with the introduction of its new futures prop offering, joining a growing list of CFD-focused prop firms expanding into this segment. Other major names, including FundedNext, have recently launched similar initiatives as the market continues to attract established trading brands.

The Trading Pit has introduced TTP Markets, our Seychelles-regulated brokerage arm.

— The Trading Pit (@TheTradingPit_) February 17, 2026

The rollout will begin with a select group of successful retail and corporate prop traders, followed by a expansion across jurisdictions.

Read the full article - https://t.co/e0IUfhUyLY pic.twitter.com/T26BbsywbM

Many CFD prop firms are turning to futures as a way to access the US market, which remains largely closed to CFD-based operations. Following MetaQuotes’ reported restrictions on CFD prop firms onboarding American traders, demand in the US has shifted toward futures-focused models.

Overnight trading stays niche as access grows

Meanwhile, for years, 4 p.m. in New York signaled the end of the trading day, when markets quieted and traders reviewed the day’s activity. That routine is changing. According to data shared exclusively with Finance Magnates, between 25% and 40% of Capital.com’s retail clients traded during pre- and post-market hours in the past three months, although only 4% to 5% traded overnight.

Robinhood has surpassed $20B in overnight trading volume since launching Robinhood 24 Hour Market last year. 🔥 pic.twitter.com/qK8gNF797c

— Vlad Tenev (@vladtenev) June 5, 2024

On eToro, which recently introduced 24/5 trading for S&P 500 and Nasdaq 100 stocks, about one-third of stock trades in December 2025 happened after normal trading hours.

A similar trend is visible at Robinhood. In June 2024, CEO Vlad Tenev said that one year after launching its “24 Hour Market,” the platform had recorded more than US$20 billion in overnight trading volume.

CFTC defends prediction markets

Global regulators are increasingly at odds over how to treat prediction markets. CFTC Chair Michael Selig stepped up tensions between federal and state regulators over control of prediction markets. He directed the agency to get involved in ongoing court cases and made it clear that the CFTC, not individual states, should have authority over these markets and their event-based contracts.

I have some big news to announce… pic.twitter.com/3OBNTaOnIL

— Mike Selig (@ChairmanSelig) February 17, 2026

In a video posted Tuesday on X, Selig said the agency had filed an amicus brief to support its claim of “exclusive jurisdiction” over prediction markets, saying they are part of the broader derivatives market regulated by the CFTC.

Netherlands shuts Polymarket

In Amsterdam, things are quiet different. The Dutch Gaming Authority has ordered Adventure One, the operator of prediction platform Polymarket, to stop offering games of chance in the Netherlands because it does not hold a local gambling license.

The move comes after similar action in the United States, where Tennessee’s Sports Wagering Council told Kalshi, Polymarket, and Crypto.com to halt sports-related contracts, cancel existing ones, and refund customers.