CMC teases entry into tokenisation

The tokenization wave shows no signs of slowing, and the retail brokerage industry appears to be catching the fever. This week, CMC Markets has hinted at the upcoming launch of tokenised assets under its capital markets arm, CMC CapX.

The teaser follows recent announcements from Robinhood and several crypto exchanges launching stock tokenisation services. The London-headquartered firm mentioned that it plans to use its “partnership with StrikeX Technologies” to support its asset tokenisation plans.

Alpari no longer with Exinity?

Meanwhile, Alpari no longer appears to be part of Andrey Dashin’s Exinity Group. According to exclusive details confirmed by Finance Magnates RU, the company was transferred from its former holding structure to a separate legal entity named Parlance Trading Ltd.

As of last month, the Alpari trademark and its domain are registered under this new company, replacing Alpari (Comoros) Ltd. as the listed trademark owner.

Markets.com CEO changes and other exec moves

And in another of our exclusive stories, Markets.com CEO Stavros Ch. Anastasiou left the company and was replaced by Andreas Kyriacou. Anastasiou is an experienced industry professional who previously worked at FXPro Group as Chief Compliance Officer, Head of Internal Audit, and in Business Development. He also served as Group Chief Compliance Officer at Finalto for over five years.

According to his LinkedIn profile, Kyriacou joined the Cypriot operator of Markets.com last December. Prior to that, he held positions at FXGlobe and IronFX. He is a Chartered Accountant, qualified through the Institute of Chartered Accountants in England and Wales (ICAEW), UK.

He told FinanceMagnates.com that his expertise includes financial reporting and analysis, regulatory compliance, tax planning and structuring, auditing, and risk management.

Elsewhere, Niki Saki has stepped down as Chief Executive Officer of MEX Orient, an entity launched by MultiBank Group to expand into underdeveloped markets, focusing on Central Asia, the Middle East, and North Africa. Rostro Group also appointed Oliver Ryan as the new Head of Trading Operations, Systematic Market.

Axi launches institutional liquidity service

Back to the FX and CFD space, Axi launched a new institutional liquidity service called AxiPrime this week and announced collaboration with technology provider Your Bourse to support the platform's expansion.

The Sydney-based firm said that the new offering will serve professional trading firms by providing access to multiple asset classes, including Forex, metals, equities, cryptocurrencies, and commodities through a single platform.

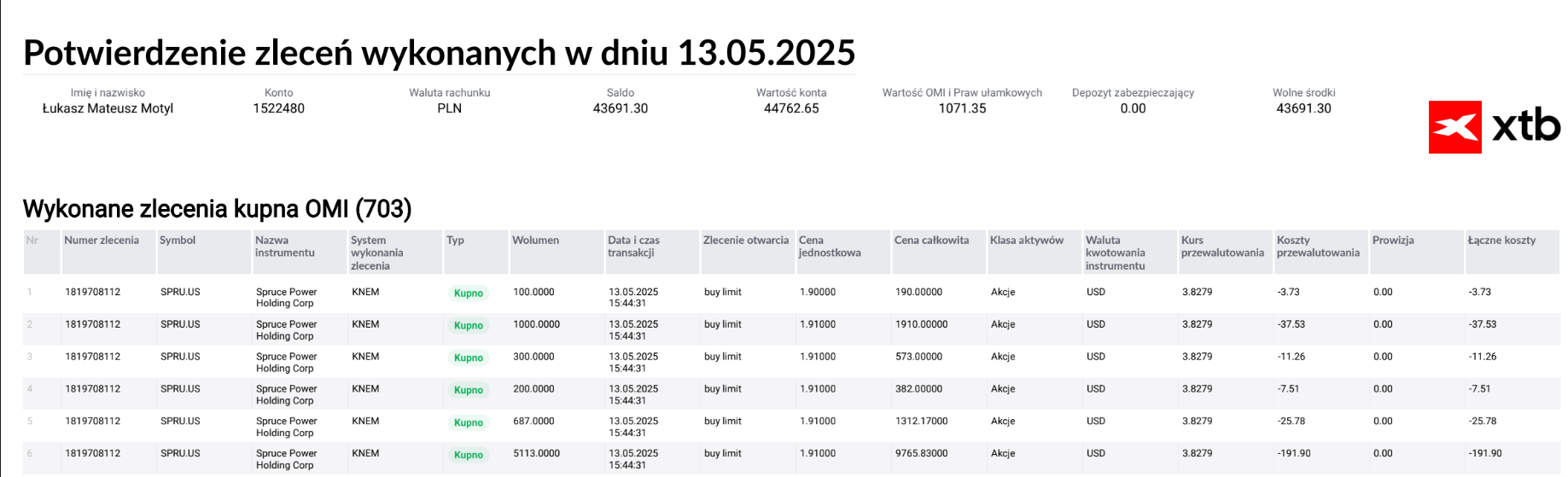

XTB tightens security following alleged client hack

Polish online broker XTB is implementing stronger security protocols after a client publicly claimed losing approximately 150,000 Polish zloty ($38,000) in what appears to be a sophisticated hacking scheme that might have affected at least a few investors across Central Europe.

The controversy erupted over the weekend when a five-year XTB client shared a detailed post on social media describing how hackers allegedly drained his account through thousands of rapid-fire trades on obscure financial instruments.

Strong client deposits boost Plus500's Q2 revenue

Plus500 (LON: PLUS) generated $209.3 million in revenue in the second quarter of 2025, ending on 30 June, as customer deposits on the platform remained strong at $1.5 billion during the three-month period.

Additionally, the Israeli broker added 29,268 new customers in Q2 2025, compared to 24,810 in the same quarter of the previous year. The number of active customers at the end of the quarter reached 132,602, up from 123,803 in Q2 2024.

Early this year, Plus500 agreed to buy an Indian broker to enter the world’s largest futures and options market. However, nearly 91% of individual Indian futures and options traders reportedly lost money in the financial year 2025. The volume of the Indian options market likely triggered Plus500’s interest, leading to its agreement to acquire Mehta Equities.

Memecoins: from hype to reality

Keeping tabs on the crypto space, the memecoin market, once the playground of viral trends and overnight riches, is entering a new phase.

In 2024, it ballooned into a $60 billion ecosystem, according to BDC Consulting, a 169% surge driven by coins like Dogecoin, valued at $35.91 billion, Shiba Inu at $8.97 billion, and PEPE at $6.12 billion.

But this explosion has brought saturation. Thousands of tokens now flood platforms like Ethereum and Solana, fragmenting liquidity and thinning investor focus.

ESMA reviews Malta’s CASP licensing

Despite the rapid growth in digital assets, regulation is now catching up fast. The European Securities and Markets Authority conducted a peer review to evaluate Malta’s oversight of crypto asset service providers amid changing EU regulations. The review examined Malta’s authorisation process, governance frameworks, anti-money laundering measures, and supervision after authorisation.

🔎 A peer review analysing @MFSAComm approach to authorising #CryptoAsset Service Providers under #MiCA:

— ESMA - EU Securities Markets Regulator 🇪🇺 (@ESMAComms) July 10, 2025

✅ Good supervisory engagement and resources

💡 Areas for improvement related to the assessment of authorisations were identifiedhttps://t.co/dBy1J12NnQ pic.twitter.com/O4OuYz78WE

While Malta’s financial authority demonstrated sufficient resources and expertise, the report raised concerns about at least one case where a provider was authorised despite unresolved issues.

Trump announces copper tariffs

Outside the industry, Donald Trump is back in the spotlight with a potential 50% tariff on copper imports. Interestingly, the announcement wasn’t made via policy brief or international forum, but through the media.

Copper isn’t glamorous, but it’s absolutely essential to the global economy. From electric vehicle batteries and 5G infrastructure to plumbing and electronics, the reddish-brown metal is the unsung hero of industrial progress.

The hottest trend in AI

Lastly, the hottest trend in AI isn’t prompt hacking—it’s building smarter systems, from chatbots to analytical AIs, by curating what surrounds the prompt. Welcome to the age of context engineering.

BREAKING: Copper prices surge as much as +20% after President Trump imposes a 50% tariff on copper imports. pic.twitter.com/E46r4zeYBt

— The Kobeissi Letter (@KobeissiLetter) July 8, 2025

Context engineering is fast becoming the backbone of serious AI deployments, especially those involving large language models (LLMs). If prompt engineering was the scrappy little startup idea—getting clever with wording to coax better answers—then context engineering is the mature, boardroom-bound enterprise strategy.