If the Cap Fits, Why Not Reap the Dividend?

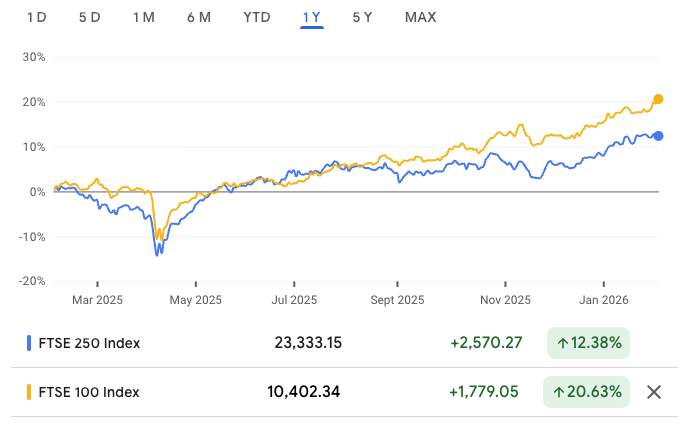

UK mid-caps have had a hard time over recent years, weighed down by negative sentiment around the domestic economy and investor preference for large-cap stocks and international equities.

Historically, mid-cap stocks tended to offer higher growth potential but at the expense of dividends. Now this situation has reversed and, for the first time since the early years of the 21st century, there are a large number of mid-cap companies trading on lower valuations and offering significantly higher dividend yields than large caps.

Are you attending iFX Expo Dubai? Do not miss the first-ever Trading Festival.

With the UK economy showing tentative signs of growth and the government seemingly getting a handle on inflation, this segment of the market is starting to look more attractive, especially when valuations are taken into account.

The FTSE 250 is trading at not much more than two-thirds of its long-term average price-to-earnings ratio.

According to AJ Bell, the highest-yielding stock among mid-cap companies in the UK market is Ithaca Energy at 11.4%. However, the firm’s head of markets cautions that any yield above 9% would need extra investigation by potential investors to make sure it is not a one-off payout, as companies are not normally that generous with dividends.

The second-highest dividend payer in the FTSE 250 is Lancashire, a speciality insurer focusing on risks in areas including property, energy, marine and aviation, which has a strong history of paying high dividends due to the nature of its business.

Other generous dividend payers in the FTSE 250 include various investment trusts in the renewable energy and property sectors.

- Are Retail Investors ‘Smarter Than the Average Bear’?

- 'InstiTail' Trading Gains Momentum, but Bridging the Gap Is Another Matter

- Louder in America, Quieter in Europe: Shareholder Activism Splits Investors

Gains in Spain Lead to Market Overvaluation

The suggestion that Europe offers equity investors better value than the US is not a new one, as discussed previously, with European stock markets starting last year significantly undervalued.

However, when looking at individual countries, a more uneven pattern emerges. While the Morningstar Europe Index gained more than 19.4% in 2025, compared with 8.7% in 2024 and 15.5% in 2023, there was a large gap between Spain, which returned more than 57%, and France, where the stock market gained a more modest 13%. Italy was the other strong performer, gaining more than 37%.

Unsurprisingly, the extent to which European markets are undervalued has decreased over the past 12 months. Only seven markets had a price-to-fair-value ratio below 1 at the end of 2025, and overall values were at their highest level for three years.

Spain was the most overvalued market, followed by Italy and Belgium, where values increased even faster than in Spain last year.

Another factor in the narrowing gap between European and US equities was the rise in fair values for some large companies in the US index, including NVIDIA, Apple, Amazon and Alphabet, which reduced the valuation of the market as a whole.

Fernando Luque, a senior financial analyst at Morningstar, noted that the financial services sector was the most expensive in valuation terms, followed by utilities, where the three largest companies in the sector ended the year with very different valuations. Spain’s Iberdrola was overvalued by 20% and Italy’s Enel by 10%, while the UK’s National Grid was undervalued by 6%.

Apart from real estate, one of the cheapest sectors was consumer cyclical. Although most European sectors saw their price-to-fair-value estimates increase during 2025, this was not the case for the technology, industrials and communication services sectors, with technology failing to see an increase despite the rise in ASML Holding.

Why Emerging Markets Could Build on Earnings Expectations

Analysis conducted by investment firm Redwheel indicates that 2025 marked the first year emerging markets outperformed the US since 2017. Long-term supporters of non-US markets hope this marks a new period of stronger performance, similar to the first decade of the millennium, when emerging markets outperformed every year except 2008.

In the 2000s, emerging market performance was driven by higher commodity prices and a weaker US dollar. By 2025, similar conditions were in place, supported by falling rates, attractive valuations, reform momentum and shifting capital flows.

While US equities rely on earnings growth and maintaining higher valuations, international equities have stronger return potential from a re-rating of valuations to narrow the gap with the US, as well as currency gains against the US dollar. Markets outside the US began to close the valuation gap in 2025, and earnings outside the US, although more volatile, are improving and are expected to match the US growth rate through 2026.

Interest rates are expected to be the most important economic driver of global equity performance this year, with the Federal Reserve setting the pace. The easing cycle that began in late 2024 resumed later last year and is likely to continue in 2026, with futures pricing indicating that the US will cut its policy rate twice more in 2026, reaching a level of 3–3.25% by the end of the year.

Looser US monetary policy allows emerging market central banks to lower interest rates, which are currently very tight given how quickly inflation has fallen.

Meanwhile, the dollar is expected to face many of the same pressures this year as in 2025, including larger US fiscal deficits and rising government debt without a clear plan for fiscal control. Markets have also shown concern about erratic US economic and trade policy, as well as the potential weakening of the independence of key institutions such as the Federal Reserve.