The British branch of ThinkMarkets has published a report summarizing the financial results for 2022, which shows that it managed to slightly improve its revenue, which stood at £2.8 million. However, the final net profit turned out to be worse than reported in 2021, reaching £287,584.

ThinkMarkets UK Higher Revenue but Lower Net Profit

The company's net revenue increased 3.14% from £2.74 million. However, due to higher administrative costs, which stood at £2.59 million compared to £2.49 million seen in previous year, the operating profit shrank 7% to £232,025.

Ultimately, this led to a drop of nearly 6% in net profit from £304,988 reported in 2021 to £287,584 in the current year. However, the value of the net assets owned by the broker increased: in 2021 it was £3.17 million, while in 2022 it rose to £3.46 million.

TF Global Markets (UK) Limited, which is authorized by the British Financial Conduct Authority (FCA) under license number 629628, is responsible for ThinkMarkets' operations in the United Kingdom.

"The Company's business developed in line with the board's expectations and the results for the year and the financial position at the end were considered satisfactory given industry conditions and general economic uncertainties," commented Amin Adat, the Director of Finance at ThinkMarkets UK.

Copy Trading App and Acuity Trading Partnership

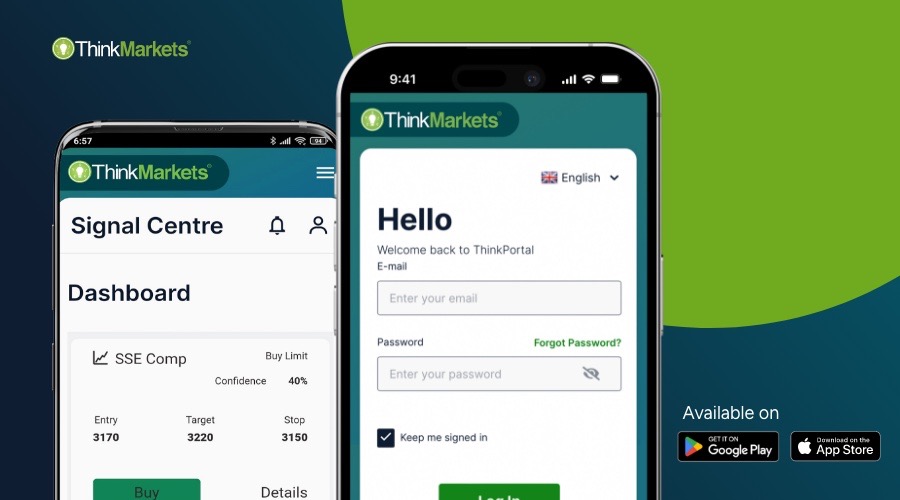

Several months back, ThinkMarkets expanded its offerings through a strategic collaboration with Acuity Trading, a firm specializing in AI-driven market analytics . As part of the agreement, ThinkMarkets seamlessly incorporated Acuity Trading's Signal Centre functionalities into its own trading platform. Acuity Trading had previously acquired Signal Center in 2021 to diversify its product suite.

In related news, the provider of retail foreign exchange and CFD trading services with headquarters in London and Melbourne, recently unveiled a new copy trading platform that users can access via a mobile application.

Additionally, the brokerage firm has rolled out its ThinkPortal app this month, a versatile mobile application designed to offer traders the flexibility to manage their accounts on the go.