Bobby Lee, CEO of BTC China, one of the largest bitcoin exchanges by volume, sported a “Make Bitcoin Great Again” hat as he took the stage this past January at the Hong Kong iFX Expo. Since then, Bitcoin and other Cryptocurrencies have been nothing short of great, with prices rising to all-time highs.

This isn’t the first time this has occurred. Back in 2013, prices also spiked, with the value of Bitcoin rising from the teens to over a thousand dollars per coin. Different this time around has also been the emergence of a Bitcoin alternative, Ethereum. With Ethereum and its underlying currency ether, it has ushered in a new wave of Initial Coin Offerings (ICO), and the ability to invest in tokens of real companies.

[gptAdvertisement]

Crypto up, binary down

The rising prices and wide selection of crypto-related products hasn’t been lost on retail brokers. Seeing an opportunity, forex and CFD brokers and technology providers have been rapidly launching solutions to allow retail clients to trade and invest in cryptocurrencies.

Boosting interest has been a collapse in the binary options industry. Global financial regulators and payment networks have taken a negative attitude towards binary options which has made it a more difficult environment for brokers to operate in.

With their existing customer bases and marketing funnels, cryptocurrencies provide an attractive alternative for binary options firms to get involved with. Helping firms enter the crypto market quickly are an array of trading technology providers with turnkey and white label solutions that combine bitcoin trading with existing retail forex trading solutions.

B2Broker

Among the list of technology providers offering crypto solutions is B2Broker. With services from B2Broker, brokers can launch cryptocurrency trading within the popular Metatrader 4 and 5 platforms. This is important as it provides a platform that is familiar to the vast majority of retail forex traders as well broker operators.

On the surface, this is an appealing option for brokers. But, before diving ahead and offering Bitcoin, Litecoin, Ethereum and others, it is important to evaluate the end product that traders will be using to see if it's worth their time.

Trade cryptos on Metatrader

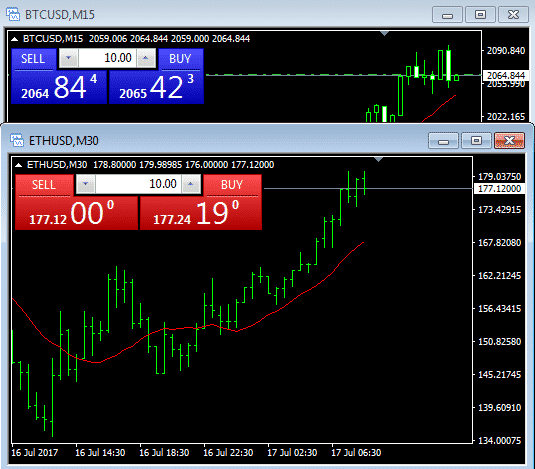

Trading cryptocurrency on Metatrader has its appeal, and B2Broker does this well.

On the same Metatrader 4/5 platforms that house forex and CFD trading can be found Bitcoin, Litecoin, Ethereum, Dashcoin, Namecoin and Peercoin. The cryptocurrencies can also be traded in multiple denominations including dollar, euro, pound and ruble.

The products can be traded with leverage (albeit limited to 3X) as well as shorted. This is unlike the vast majority of crypto exchanges which are cash-based and only allow long positions.

Like any other symbol on Metatrader, the cryptos can be dragged and dropped into the chart screens and standard technical analysis can be applied to them. In addition, they can be traded automatically with Expert Advisors (EA) that are created for Metatrader.

Pricing - not ready for prime time

When it works, this setup definitely makes bitcoins and other cryptos “great”. But, where B2B Broker’s solution has its problems is with market data quality.

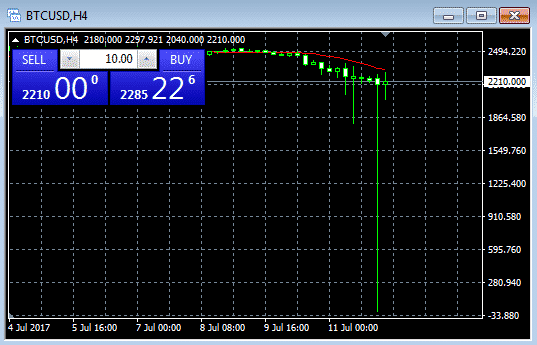

In the time reviewing the platform, price spikes were prevalent in both Bitcoin and Ethereum; two very liquid currencies. Regarding to Ethereum, the price spikes occurred over a multi-hour timeframe and disrupted trading and technical indicators. According to B2Broker, the pricing is based on data from exchanges. It commented: “Every exchange has own depth of the market (the number of orders for bit/sale). The order price is formed depending on demand and supply on this exchange”.

Market data issues causing spikes isn’t a new phenomenon for the forex industry. However, it's a problem that no longer exists for major currencies and CFDs (more or less), and the spikes are reminiscent of what traders had to endure five plus years ago.

Like forex, there is no reason why the trading of liquid cryptocurrencies can’t become spike free. (For what it’s worth, over the two week review period, the spikes weren’t frequent with only one day being problematic and B2Broker handling other volatile periods with quality data.) However, for any broker looking to launch cryptocurrencies with B2Broker, market data quality is an area that they have to investigate as problems there will lead to many client trading issues and complaints.

Spreads

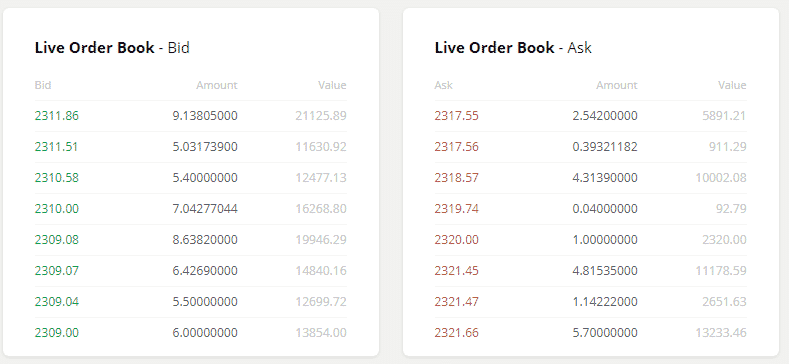

Along the lines of pricing, spreads were also an issue. As seen in the screenshot below, spreads for Bitcoin provided by B2Broker were $75. This compares to $1-2 available from Bitstamp, a popular Europe-based bitcoin exchange.

Vs Bitstamp

Like the price spikes, the wide spreads weren’t always an issue with the screenshot below showing tight pricing during this past Monday’s volatile trading day. Similar to its explanation of the price spikes, B2Broker attributed the wide spreads on the underlying exchanges it uses: “The cryptocurrency pricing is dynamic and depends on demand and supply, which in turn depends on external news and the situation on the market/world. For example, the fake news of Vitalik Buterin death lowered the price of Ethereum by 15% for four hours.”

For traders, the spreads may be the cost of business for having leverage and the ability to short. However, the wide spreads do make it harder to implement short term trading strategies and trade with EAs.

Brokers thinking about launching cryptos should have an understanding of how spreads will affect trading volumes.

Business model

One of the important operational features of B2Broker is how it offers its cryptocurrency solution. The product can be provided as a full MT4/5 white label, with brokers using its Metatrader environment and technology. In addition, brokers can elect to use their own system and pull Liquidity of cryptocurrencies to their own Metatrader systems that they currently run.

In terms of which platform to use, B2Broker recommends Metatrader 5 as it is more conducive to how cryptocurrencies are priced. This is due to the fact that Metatrader 5 supports eight decimals, versus four with Metatrader 4.

The overall offering is priced to brokers using a fee per volume traded model. This is similar to the fee structure that is prevalent among liquidity providers for forex and CFD products.

Summary

There is little doubt that cryptocurrencies, either in their current form or another, are here to stay. ICOs are showing that an alternative to IPOs on stock markets can exist and anyone can invest in these startups of the future. Similarly, P2P trading that matches traders around the globe selling both real and synthetic securities could become a low cost alternative to centralized exchanges.

For retail brokers, launching cryptocurrencies is a way of aligning with the future of trading. B2Broker also makes it easy with both its full Metatrader white label and liquidity only setups. But, as with any opportunity, spreads and market data quality are two important items to analyze when considering cryptocurrency solutions from B2Broker.