While intermediaries continue to be the primary fund distribution channel in Singapore, digital platforms are democratising access.

According to Crisil Coalition Greenwich research based on interviews with some of the largest fund distributors in Singapore, fund distribution platforms have reported positive net asset growth across equities, fixed income and multi-asset funds for the first time since 2022.

- iFX EXPO Dubai Recap: Regulation, Gold, AI, and Retail Traders Shape Market Stability

- “Top Traders Watch Money Flow, Not Strategies”: iFX EXPO Dubai 2026 Enters Final Day

- After Rebranding, Alchemy Markets Integrates TFB Technology into Trading Infrastructure

Fund distributors are optimistic that these favourable conditions will continue – platforms expect to see positive net inflows across the vast majority of fund types and strategies, and distributors are projecting the strongest demand for investment grade bonds and multi-asset funds. They also expect to see a surge in demand for private assets.

Gatekeepers and the Platform-Ready Ecosystem

According to Killian Lonergan, head of distribution intelligence at BBH, private banks dominate flows in Singapore, particularly for offshore funds.

“Retail banks and platforms matter for scale but margins are thinner and access is more selective,” he says. “Direct-to-consumer distribution is minimal for foreign fund managers unless they have a strong brand, local onshore presence or ETF-style simplicity.”

Lonergan adds that such a gatekeeper-driven ecosystem – where commercial success is less about regulatory approval and more about being ‘platform-ready’ – is often underestimated by managers.

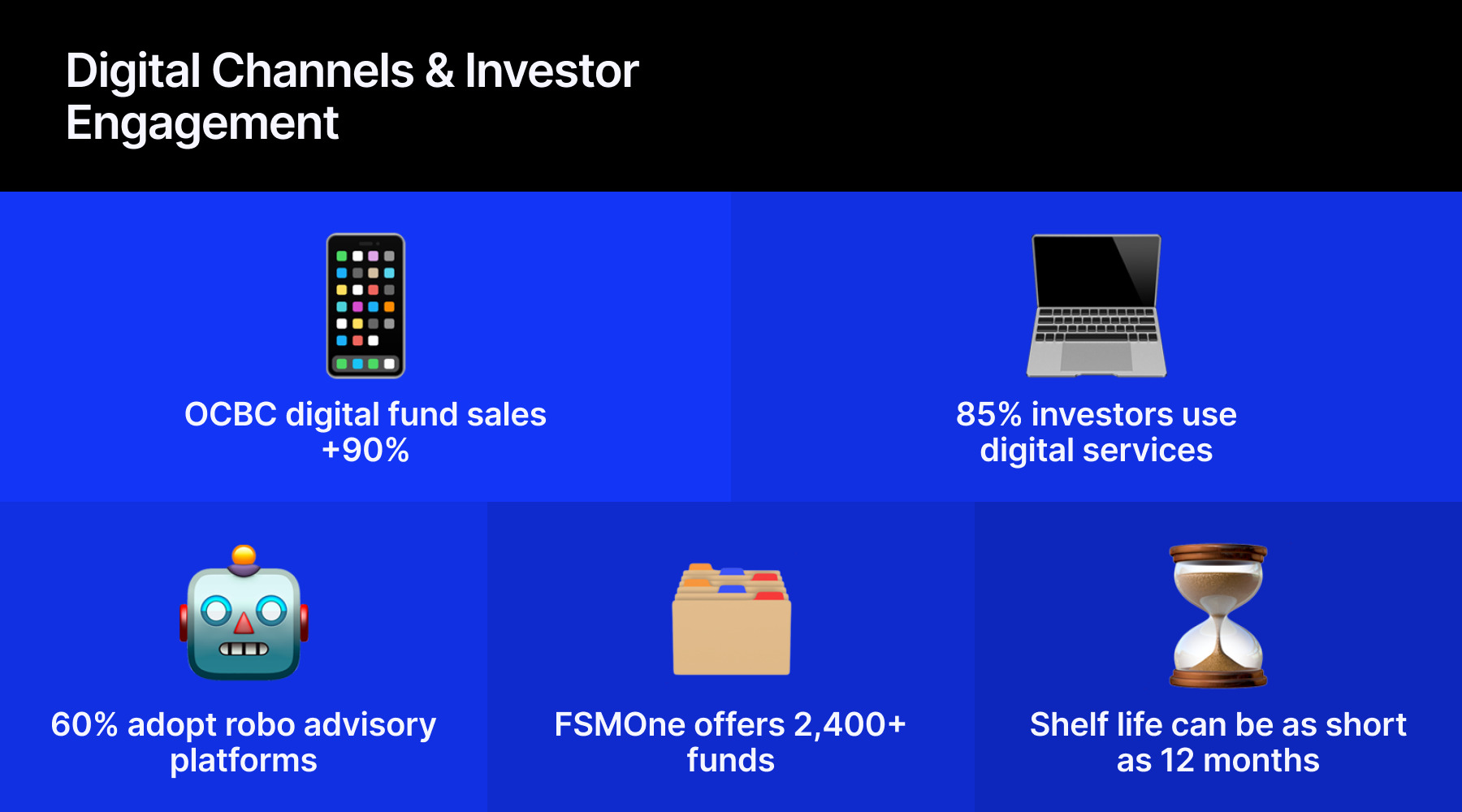

“Singapore distributors increasingly behave like asset allocators, not just sales platforms,” he says. “They actively curate product shelves and remove funds that lack momentum, underperform peers or create operational complexity. As a result, shelf life can be as short as 12 months.”

An additional nuance to the market is that Singapore acts as a regional booking centre, not just a domestic market. Investors may be Southeast Asian, North Asian or Middle Eastern, but assets are often booked in Singapore.

Banks Remain Core, Digital Channels Expand

Timothy Liew, head of investments at OCBC, agrees that banks and independent financial advisory firms remain the primary avenue through which retail investors access funds, mainly due to established client relationships and advisory support.

“Online self-service channels have increased accessibility for retail investors by lowering entry barriers, both in terms of minimum investment amounts and convenience, which has attracted a new cohort of younger, more self-directed investors and expanded our investor base,” he says.

In 2025, OCBC saw a 90% year-on-year increase in sales volume from funds invested through digital channels.

“That said, many customers still prefer advisory-led channels when building more comprehensive or holistic portfolios,” adds Liew.

Online distributors encompass a broad spectrum of intermediaries, including fund supermarkets, robo advisors, digital brokerages and other technology-enabled platforms.

Mobile Access and Regulatory Support

Direct mobile access to funds provides tangible benefits to investors, including lower minimum investment amounts and transaction fees, 24-hour access and reduced time for execution , observes Elaine Tan, head of asset owners & asset managers client lines for Asia Pacific, Securities Services, BNP Paribas.

“These benefits have been amplified by a wave of financial industry innovation and a supportive regulatory evolution focusing on investor protection and transparency,” she says.

“If this trend continues, the fund industry will need to roll out inclusive solutions that bridge the digital divide, ensuring less digitally proficient investors enjoy the same access as their tech-savvy counterparts.”

As online platforms, mobile apps and robo-advisors from both new digital-first entrants and established intermediaries enhance their own digital and mobile capabilities and continue to mature, Justin Christopher, head of Asia at Calastone, also expects direct and digital channels to account for a growing share of fund flows.

“We are seeing both the emergence of new mobile-first platforms and a strong focus across the industry on delivering better investor experiences and broader investment capabilities,” he adds. “As access to products such as private market funds continues to expand, digital and mobile-based models will be well positioned to respond quickly and provide investors with greater choice and access.”

Direct-to-Consumer Models Gain Traction

One of the most interesting players in the business-to-consumer space is FSMOne (formerly Fundsupermart.com), which enables retail investors to directly select and purchase from more than 2,400 funds across various asset classes.

“Traditional channels such as banks and advisers often provide personalised investment advice, but they may come with higher fees including sales charges and wrap fees,” says Joshua Chim, general manager FSMOne Singapore.

“There is a growing retail demand for cost-effective, self-directed investing as a result of rising financial literacy among investors.”

The Case for a Hybrid Advisory Model

Human-led channels provide tailored advice, long-term relationships and curated portfolios, which are particularly valued by affluent and mass affluent investors seeking confidence in their financial decisions.

That is the view of Luke Lim, managing director Phillip Securities, who acknowledges that digital platforms have helped shift expectations around access, cost and usability.

“However, we have also seen the continued need for trusted advice when navigating life stage planning, risk management and broader financial goals,” he says. “As investor needs evolve, a hybrid ‘high tech, high touch’ approach is emerging as the most sustainable path forward.

This means combining strong digital infrastructure with the trusted guidance of technology-enabled financial advisers who understand an individual’s priorities, life goals and emotional comfort with risk.”

Digital Pressure on Private Banking Models

Lonergan recognises that digital distribution options have shifted Singapore’s retail investing landscape and that their influence on shaping price transparency expectations, promoting clean share classes and accelerating demand for lower-cost institutional-style products is increasing.

This has indirect implications for private banking distribution, where there is a growing disconnect between traditional distributor retrocession models and investor expectations. As a result, managers are feeling the pressure to maintain parallel share class structures, differentiated fee models and more sophisticated operational setups.

However, Lonergan argues that their impact has been somewhat overstated.

“While digital investment platforms and robo advisors have rapidly gained traction among individual investors, they have not disintermediated traditional advisory channels so much as expanded the front door for retail engagement,” he says, referring to industry analysis suggesting that around 85% of Singapore investors have used digital wealth services and nearly 60% use robo advisory platforms as part of their investment journey.

“They have not displaced private banks for meaningful AUM accumulation,” he adds. “Many investors begin on apps but still turn to human advisers for broader planning, risk profiling and long-term allocation decisions.”