Exential Group, a managed Forex fund located in Dubai Media City, was ordered by UAE’s financial regulators to cease operations pending an investigation of the Department of Economic Development (DED), according to a Thenational.ae report.

The alleged fraudulent company promised annual returns of up to 120 percent on an investment of as little as $25,000, less than AED 92,000. But when investors tried to close their accounts they lost connections to Exential Group and were still unable to withdraw their money.

From the tales of the defrauded investors, the forex fund doesn’t exist, and Exential Group is clearly a Ponzi scheme, in which new investors’ funds are used to pay returns to existing investors, and which could collapse at any moment. The top end of the pyramid was reached and this moment has already come.

For impunity, the company tried to connect itself with S&S Brokerage House, a financial intermediary regulated by the Central Bank of UAE. Also, it is presided over by a member of the Royal Family of Abu Dhabi, Sheikh Adbulla Zayed Saqr Al Nahyan. However, there is no clear evidence of this partnership, if any, and anyway this can’t overshadow the clear signs of fraud.

Reviewing the company’s website confirms that Exential Group is nothing more than a fraudulent scheme. Firstly, it tells us what they are doing, and that’s it. The website doesn’t provide any information about its owners, regulation, licences, traders or any other official credentials. Legitimate websites will clearly state the name of the regulator that oversees their work, and details of their commercial registration and trade license. Secondly, offering 110 per cent a year is phenomenal. Simply put, it is too good to be true

Furthermore, to operate legally, fund managers must be licensed by the Emirates Security and Commodities Authority (SCA) and the Central Bank of the UAE.

myfxbook clarifies the scam

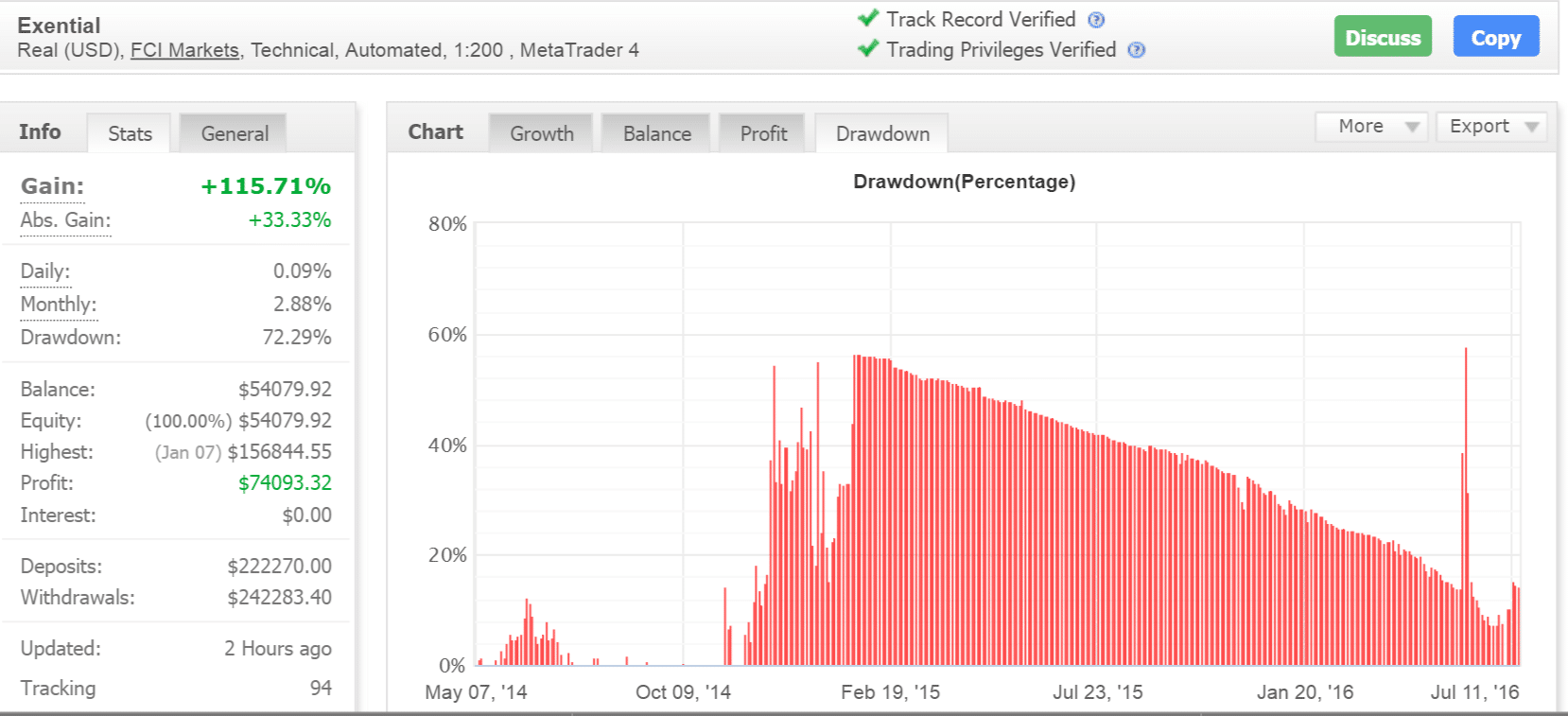

Finance Magnates took a look at the company profile on myfxbook and the following notes should be mentioned:

- Exential Group claims this account is the “master” and that it is “mirrored” to other accounts. But where are these other accounts and why can't clients access their individual accounts as long they are separated from the master? Most probably, it is just one account and the investors’ monies were not used in forex trading, or only a symbolic amount to be precise. Instead it was used to pay returns to old investors and the rest was taken by the owner. Look at the figure below to see that less than $250,000 was transacted on this account.

Exential Group profile on myfxbook

- On January 2015, the drawdown was more than 55%, of course due to the SNB Black Swan , which means that the company lost more than half of its invested capital. However, the picture stayed rosy and profits were reported at the usual levels this month.

- Exential Group is using an offshore registered broker, FCI Markets, which is licensed by the Financial Services Commission (FSC) in the British Virgin Islands. This watchdog is often criticised as a weak regulator because it does not require the information on the register to be verified.

Exential Group, which also uses the names Exential Mideast Commercial Brokers LLC, Tadawul ME, and Exential Mideast Investment LLC, matches perfectly the profile of MMA Forex, a Ponzi-like investment scheme in Dubai which collapsed in the summer of 2013. Investors lost millions at this time and the company’s chief executive, the Pakistani businessman, Malik Awan, was jailed for two years for fraud.

Victims' Stories

One of the Dubai-based scam’s victims, Maubeen Gulzar, told Thenational.ae that he deposited $40,000 into the scheme through two accounts – one opened in 2014 and another in February 2015. Initially, the company paid profits of $1,800 a month which encouraged him not to withdraw it and grow his investment into the fund. He withdrew $12,000 in 2015 but has not been paid any more, even though he was owed $60,000 at this point.

“I waited a month and hadn’t received any money, updates or emails. It’s got to the point where I’ve almost given up on seeing the money again. I think these schemes attract people in by greed," said Mr Gulzar.

Another victim was an administrator in the construction industry, Afzal Shaik, who borrowed AED 74,000 ($20,000) on a credit card to open an account.

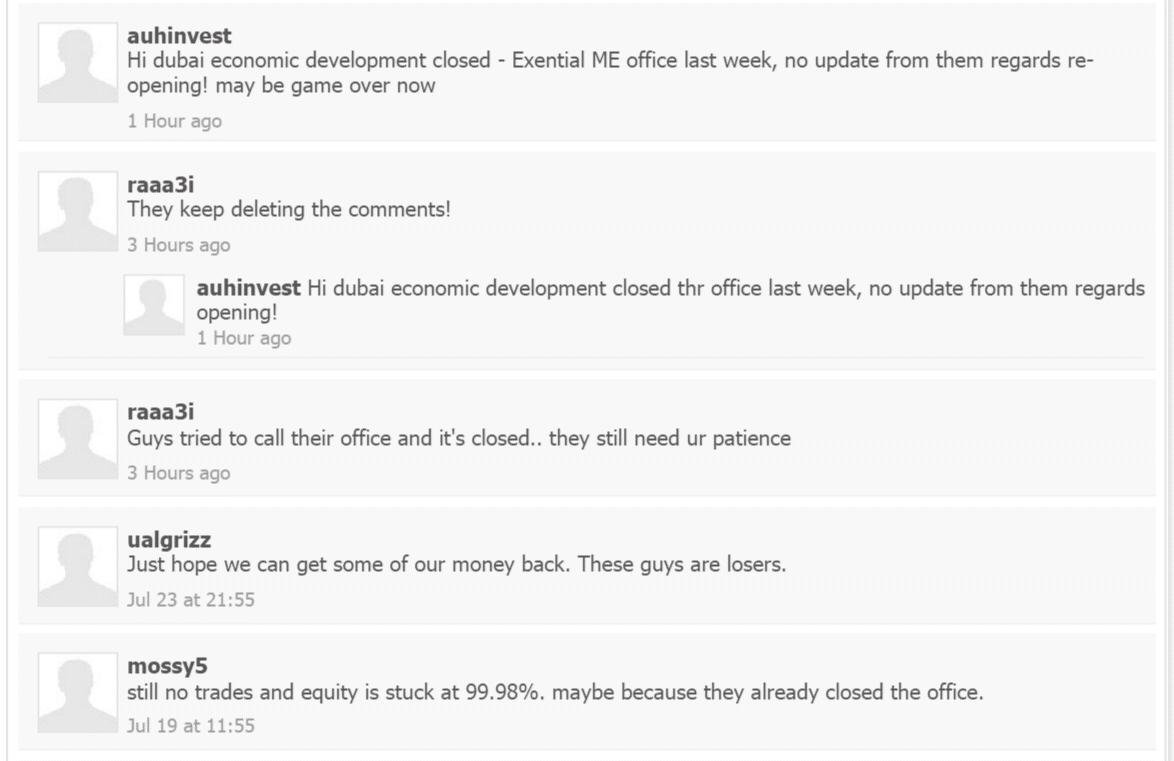

Exential Group clients' comments on myfxbook

Exential Group also managed to defraud people outside the UAE. One example is David, an IT engineer in Nairobi who has never been to Dubai, but was encouraged to invest $40,000.

“A friend in Dubai showed me her returns and they were good. I have a young daughter and a wife, who does not work, to support. I have had to sell my car. It is very stressful," he said.

It says normal practice!

Meanwhile, Exential Group issued the following statement on social media: “The office was visited by DED and was ordered to close the office in result to the complaints which were submitted to DED by clients. We are working to resolve this situation at the earliest and we will be back to normal operations as soon as possible. This is normal practice by DED and will be resolved by us as we are committed to carry on the business. Any other information that states anything else is not accurate. We urge you to remain calm as we are working to resolve the issue.”

Investors have been advised to lodge complaints with the Department of Economic Development’s business protection department. Each complaint will cost ُِAED 2,020 ($550) to submit.