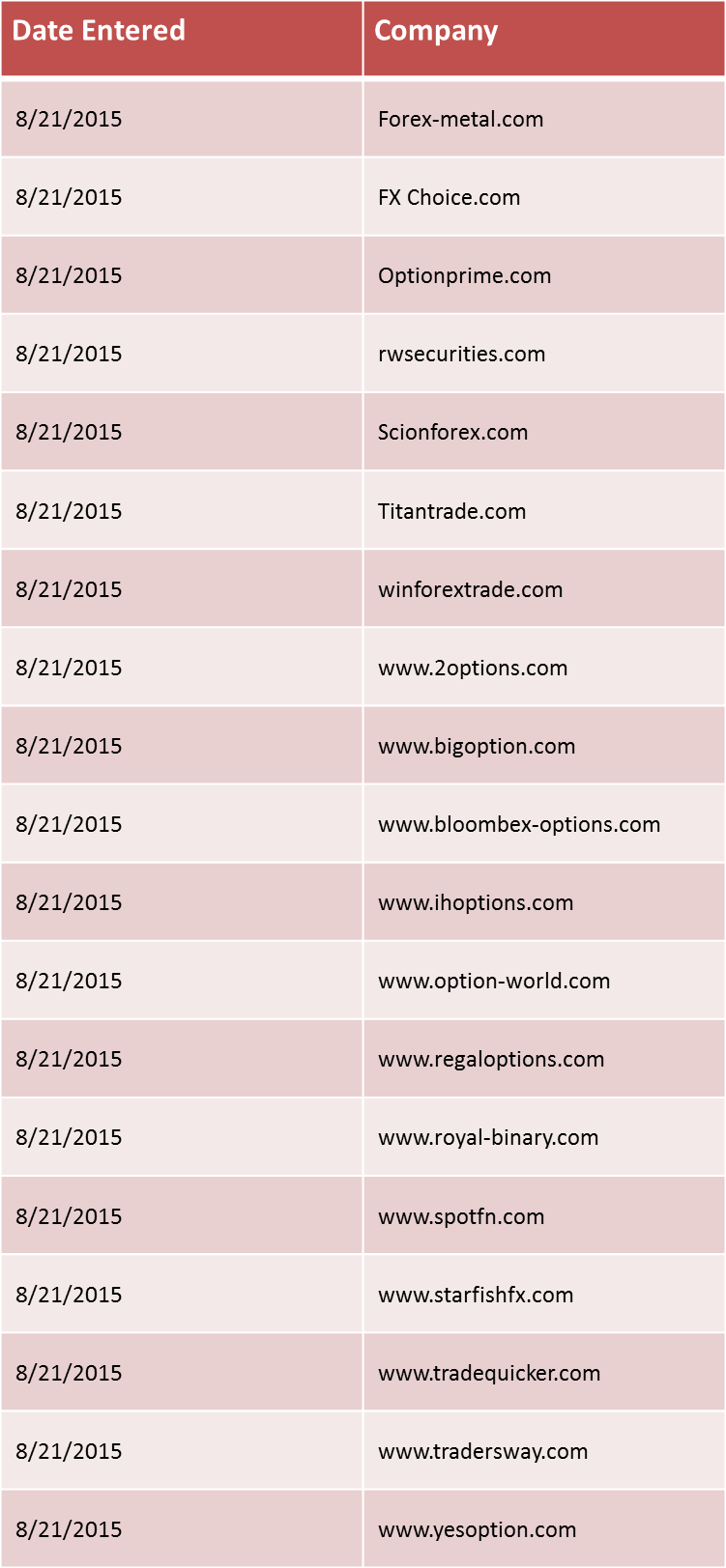

The U.S. Commodity Futures Trading Commission (CFTC), the independent agency that regulates futures and option markets, today launched a new website on which it warns U.S. retail traders of foreign companies that are operating in the country without formal permission.

Short for "Registration Deficient List", the RED list follows other examples from regulators abroad, such as the AMF (Autorité des marchés financiers) in France, which allows investors to identify unregistered foreign entities that may be engaged in illegal practices.

Indeed, those foreign Exchange (Forex ) and binary options brokers that appear to be soliciting and/or accepting funds from U.S. residents without having obtained CFTC registration are published on the new site, providing transparency for investors.

According to the CFTC, many of these foreign entities are acting in a capacity requiring them to be registered with the CFTC. Registration allows the agency to provide greater security and oversight of the industry by examining whether firms meet minimum financial standards as well as disclosure, reporting and recordkeeping requirements, for example.

The RED List is an important new tool that will further protect customers from bad actors.

Commenting on the launch, Tim Massad, CFTC Chairman, said: “Today, I’m pleased we are launching the RED List, an important new tool that will further protect customers from bad actors. This initiative will allow people to make more informed decisions about investing.”

When Finance Magnates looked into the listed companies, two companies (www.ihoptions.com and www.option-world.com) displayed the same page, restricting access to the site, while the sites of both royal-binary.com and winforextrade.com were offline completely.

Moreover, most of the entities do not appear to be limited companies and do not divulge their full company details, while some listed their parent companies and payment addresses in places such as the Marshall Islands, Cyprus, Panama, Belize and the Seychelles. The Trader's Way website even went so far as to explicitly state that its offerings were not directed at U.S. or U.K. traders.

The RED list is part of a broader drive by the agency to help investors identify and protect themselves against financial fraud, including the CFTC's SmartCheck tool, which allows traders to check the background of financial professionals and stay informed on the latest fraud schemes.