"It was important to ensure that the new website was SEO optimized," Melissa Downes, the Global Head of Marketing at 26 Degrees, said pointing out at the challenges of SEO after rebranding. Rebranding of a brokerage brand is a herculean task. In the first part of the series Finance Magnates explored the rebranding strategies and costs, among other things.

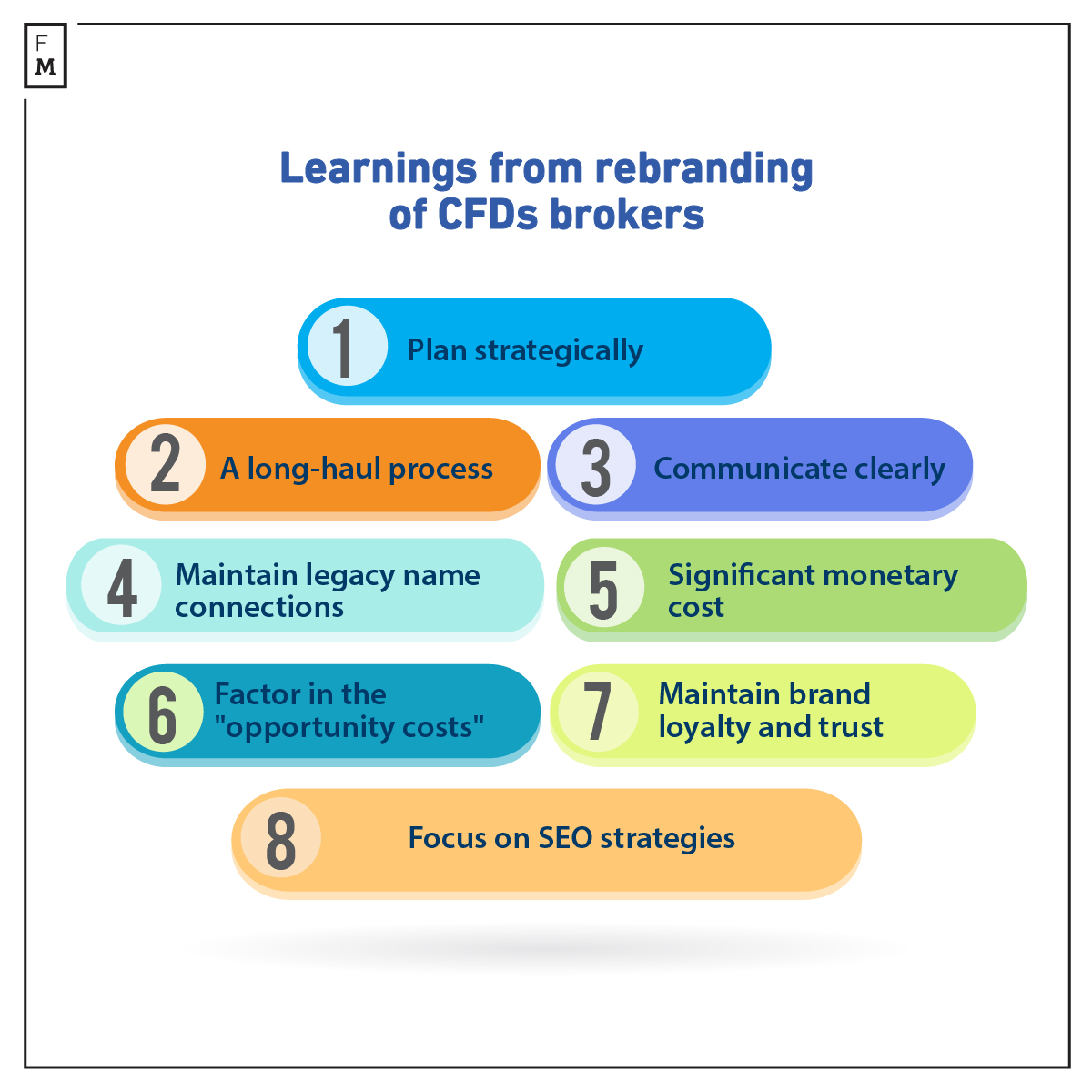

The process often takes months, if not years, to strategize (depending on the size of the broker) and is costly. Although none of the brokers disclosed rebranding costs, multiple executives highlighted it brands as "significant." Also, brokers had to factor in their spending time and the so-called "opportunity cost." Now, lets dive into the challenges that comes with rebranding, especially around SEO.

Many Challenges of Rebranding

Besides the costs, rebranding brings many other significant challenges to brokers. With this daunting task, marketers must ensure that brand recognition, loyalty, and trust remain intact.

"Rebranding is an interesting thing in our particular industry. We have often seen that brands have rebranded out of necessity or internal struggles and difficulties," said Melissa Downes, the Global Head of Marketing at 26 Degrees.

"It was critically important that none of the brand loyalty and trust we had built with our Invast Global brand over the past decade was lost and that the new brand had an obvious purpose, mission statement, and ethos built on our strengths."

Rebuilding SEO for the New Brand

Unlike many qualitative areas, brokers can easily quantify the impact of rebranding on search engine optimisation (SEO). Established brokers spend hundreds of thousands of dollars, if not millions, in SEO to drive organic website traffic. Rebranding hastily has the potential to undo the years of SEO work overnight.

"It was important to ensure that the new website was SEO optimized and the migration from our old site to the new site was as smooth as possible," Downes said. "Building SEO on a new website with a new brand name is always going to be difficult and something that is built over time. However, with the assistance of our agency partners, we ensured that the new website had solid foundations to maximize SEO growth."

According to 26 Degrees, which rebranded last June, it witnessed a 150 percent increase in organic impressions since the first month of rebranding. Its website session additionally increased by 55 percent. Interestingly, the company still maintains its legacy website of the Invast Global brand and redirects potential customers to its new 26 Degrees website. This way, they are redirecting the organic traffic to the old brand keywords to the new website.

Retail brokers are not willing to give up the traffic to their legacy brands. For Admirals, the broker still offers services with its legacy website in some non-European markets.

Detailing the SEO strategy of Taurex, its Founder and CEO, Nick Cooke, said: "Our SEO team took the lead from the start, focusing on optimizing every aspect of our new website for search engines. We strategically implemented 301 redirects to ensure a smooth transfer of our online presence. We carefully updated our backlinks to maintain link equity. We promptly submitted our sitemap to Google Search Console. These proactive steps allowed us to migrate as much of our established authority as possible to Taurex."

Vantage further credited its "restructured marketing and branding framework" for an improved SEO after the rebranding. Geraldine Goh, the Chief Marketing Officer at Vantage Markets, said: "With brand search terms and SOV, we've been hitting new highs quarter on quarter."

"Some challenges we faced at the time included getting all of our global teams onboard with the changes since every market and region had their own requirements, initiatives, and priorities to keep the business running smoothly."

Rebranding a CFDs broker can disrupt the SEO performance of the website, as it involves changing the domain name, the logo, the content, the design, and the links of the website. These changes can affect the ranking, the traffic, the conversions, and the reputation of the website, as well as cause technical issues and errors.

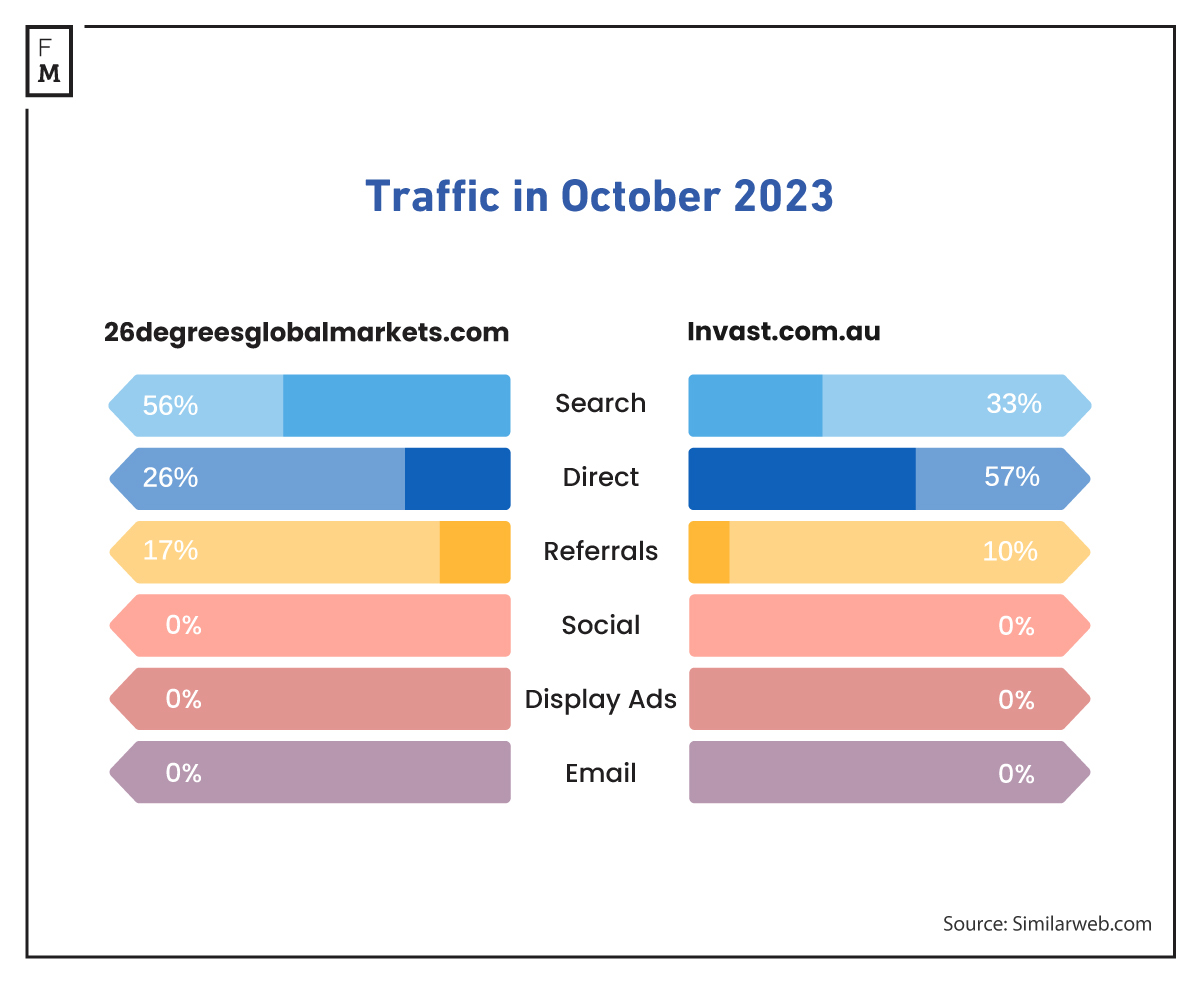

According to Similarweb, 58 percent of traffic to the Taurex website came from direct visits and about 15 percent from organic searches in October. Vantage, on the other hand, got 20.4 percent from search and 67.88 percent from direct.

For 26 Degrees, the monthly visit to its new website, according to Similarweb, was 14,100 in October, whereas its old website got 8,700 hits. 56.45 percent of the traffic to the new website was generated from organic searches, compared to 33.3 percent of the old one.

Direct and Indirect Impact

Rebranding decisions have direct and indirect impact, and brokers quickly recognize them. Detailing the immediate implications for the retail brands, Taurex noted that it witnessed "a significant uptick in new account registrations," while Vantage saw "the biggest improvement in customer perception."

"We set a record in October, and interestingly, we've already surpassed those numbers in November, demonstrating a clear trend of month-over-month growth," Cooke said. "Equally important, there's been a substantial increase in deposits, reflecting enhanced trust and commitment from our clients. This is exactly the tangible, measurable impact we anticipated and aimed for."

Speaking on the indirect impact, Goh said: "Our refreshed brand has drawn more partners to work with us, enabling us to work with top-tier partners in different fields to advance our goals, vision, and businesses in tandem."

A Successful Move or Unnecessary Burning of Cash?

All of the retail and prime CFDs brokers that Finance Magnates talked to had their own reasons for rebranding. Although branding is qualitative, marketers use both qualitative and quantitative parameters to measure the success of rebranding.

"We measure the success of our rebranding on metrics like web analytics, social media engagement, and media coverage as the basic benchmarks of our success… We have been very pleased with the results and are not ready to stop yet," Goh added.

For Taurex, too, the success of rebranding "involves more than just looking at traditional metrics," as Cooke said: "While the significant rise in new account registrations and the increase in client deposits may show a positive market reception of Taurex, there's much more to it."

"It's about our reputation in the market. The online trading industry thrives on trust and credibility. The way our clients perceive and discuss Taurex is crucial to us… Our reputation is also reflected in how our partners and industry peers respond to the new brand."

"While metrics are important, the true measure of our rebranding success lies in the sustained trust and respect we earn from our clients and peers."