Trader-funded firms (TFFs), popularly referred to as prop trading firms (although this is technically incorrect), are fortunate to have access to a rather wide array of marketing strategies and tools, primarily because they are incorporated as non-financial entities. Marketing, particularly paid marketing, is a highly accessible field for them, largely because there are very few advertising restrictions on major platforms such as Google Ads and Meta (Facebook and Instagram).

While paid marketing campaigns are undoubtedly competitive and can be quite costly, these issues are minor compared to the advertising restrictions faced by retail forex and contracts for differences (CFDs) brokers.

The legal and customer success teams at Google Ads generally have limited understanding of FX and CFD regulations. Every FX and CFD industry marketer I've spoken with (both B2B and B2C) has encountered problems with them at some point, often over trivial issues.

The surge in popularity of TFFs correlates directly with the decline of start-up brokerages due to legal and technological constraints. Therefore, it's no surprise that marketing for TFFs is often likened to the early, unruly days of binary options and FX.

The Tactics of Heavy Bot-Spamming

I firmly believe that every business should commit to a proper, long-term marketing strategy. However, many TFF founders lack patience, and concepts such as building awareness, capturing interest, establishing trust, and demonstrating strong performance records are frequently overlooked in favor of quick, spammy campaigns. These include bot-driven Facebook, Telegram, and WhatsApp campaigns, and fake groups that impersonate established TFF influencers and companies.

Does heavy bot-spamming work? I would be lying if I said no. It does work, but only for a maximum period of 1-2 months and in certain regions.

The biggest downside is the damaged reputation and the inability to sustain future growth, as these spammy techniques are short-lived. The same applies to large, short-term paid Google campaigns that are often discontinued within the same 1-2 months because they are not sustainable in the long term.

Overall, the lack of planning is very common among retail FX and CFDs brokers, and this issue is even more prominent with TFFs.

A Look into the Data

Even a simple domain overview of TFF websites can reveal a wealth of data about those companies' marketing tactics. Unfortunately, retail traders rarely conduct these checks.

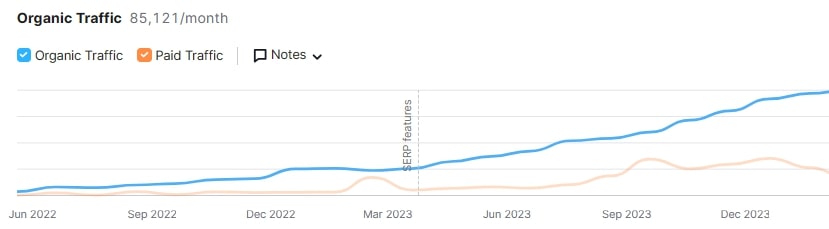

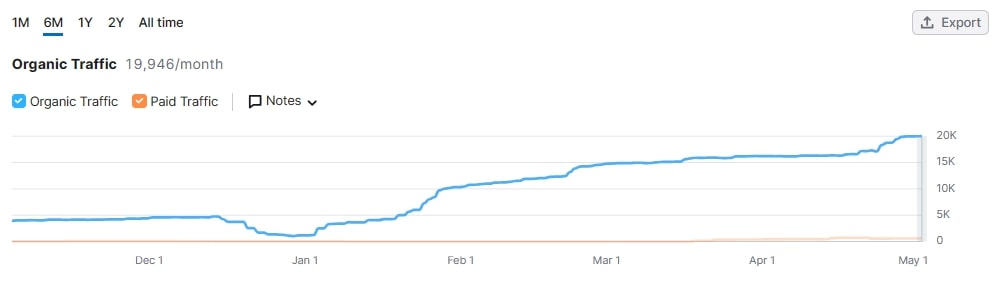

Here is an example of consistent organic growth of one established TFF.

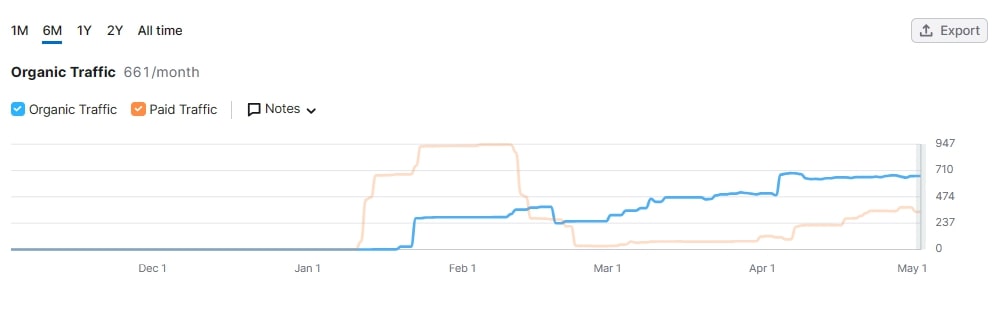

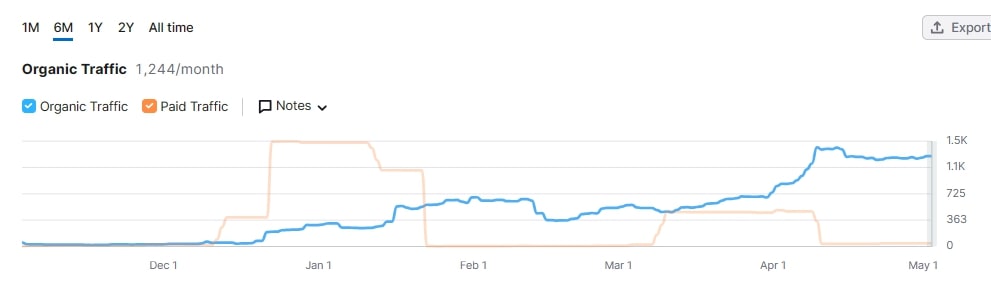

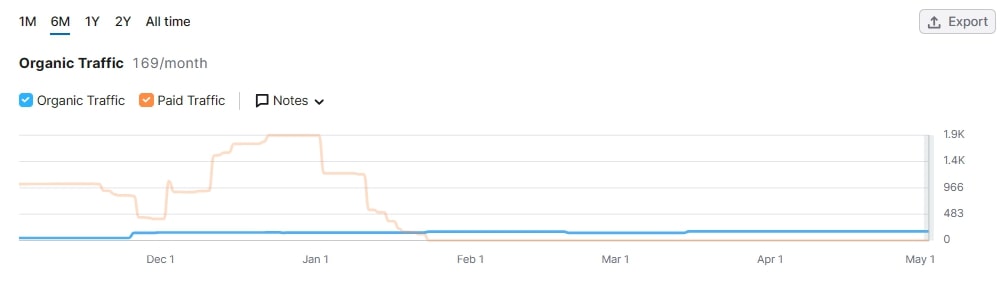

When it comes to newly-created TFFs, the paid efforts to grow the businesses are very clear. Most of them heavily invest in paid ads to trigger organic traffic.

Newly-created TFF 1: There was a heavy investment in paid ads for a couple of months that along with other marketing campaigns triggered organic growth as well. This firm continues to invest in paid marketing at a more sustainable pace.

Newly-created TFF 2: This company had two sprints with paid advertisements, and both worked. The later was strategically timed when the organic growth was plateauing, which gave it a push higher.

Newly-created TFF 3: The paid marketing strategy of this TFF did not translate to organic growth. However, it is to be noted that this TFF was affected by the MetaQuotes' “grey-label cancelling spree.”

Newly-created TFF 4: Here is one of my favourites: this TFF is a one of few firms that benefited from “prop firm crisis” as they have own MetaTrader5 license. They also have socially active founders and a decent organically created community of traders that attributed to the growth.

The trends in these charts are so prominent that even a non-marketer can spot the differences.

The Right Way to Market TFFs

There is no doubt that the TFF industry is now somewhat crowded, bringing a challenge to organic growth for new players. Paid ads work as long as they are strategically planned and coordinated with organic growth.

Some of the basic marketing strategies a newly-created TFF must establish are:

Mobile-optimized website with live support

CRM

Mass emailing tool of any kind

Non-spammy content for Twitter and Discord (or Instagram; depends on the region)

Experienced and energetic community manager

Apart from the bare minimum basics, the TFFs must apply some other most common marketing strategies as well. Some of them are the following:

1. Video reviews have the highest conversion rates, especially when the influencer gets the % from the sales (to be fair, there are fewer of these in 2024). TFFs must produce YouTube Ads and organic educational videos.

2. Influencer marketing is ideally structured around paid dedicated content, including short and long-form videos, reels (Instagram, YouTube) and written posts. TFFs must consider such market avenues.

3. TFFs should explore traffic routing and partnerships with FX-focused educational portals of all kinds.

4. TFFs must have strong referral programs: keep in mind the average referral among 100 TFFs is 15%. Interestingly enough, while many TFFs desire to onboard retail IBs as referral partners, it is often not possible as rebates are not attractive enough compared to retail FX.

5. Community building/social selling is another key marketing channel. For TFFs, these communities are often structured around socially active Founders who are traders at heart.

However, no marketing efforts go without errors, and TFFs are no exception. From what I have seen, the most common mistakes TFFs make are:

Not running basic CAC analysis.

Not having an established trader community of some sort prior to the launch, hoping that paid ads will drive 500+ clients in the first month (in reality, they will not, not in 2024).

Not having retention programs in place. The average trader has at least 3 funded accounts at competing companies.

Not investing in quality educational content and, instead, actively using AI-generated blurbs, often entirely copied from established firms’ websites, along with the use of flashy laughable 80' style images, videos, and slogans.

Fully relying on one trading platform (a costly mistake many realised earlier this year).

From what I have seen, YouTube and TikTok probably have the best organic growth results. Further, quite a few TFFs have organically grown because of the active presence of their founders on Twitter and TikTok, who have decent trading experience and are capable of producing decent content.

Download the TFF Marketing Checklist along with the data insights on aggregated social stats of 100 trader-funded firms (it includes the top 6 social platforms, volumes, who takes on the majority of market share, 3 months organic traffic stats, and more).