“SNB unpegs Swissy from Euro” -those are the words that echoed through my mind on the morning of Thursday 15th January 2015. A period in time in which I had been engaging in some cross-STIR hedging against euro denominated products, rather naively in hindsight. Who knew they were going to remove the peg hey!

This was a period in time in my career whereby I had the luxury of using both professional and retail front-end platforms (a mix of Trading Technologies, Stellar Trading Systems, Bloomberg, Reuters, CQG, ICE BLOCK and a whole host of retail offerings). This, coupled with my experiences, gives me privy access to the comparisons of professional setups versus retail service offerings and their respective Risk Management tools offered.

[gptAdvertisement]

Unforgettable for traders. Swiss National Bank President, Thomas Jordan.

The most significant and obvious difference between professional and retail service offerings is the cost of entry. During my time as a prop (proprietary) trader I had to pay significantly for the privilege of having direct market access along with having to pay monthly rental for a city-based desk along with the rest of the whistles and bells that one could possibly fathom to have.

Benefits of a four-digit market access fee

A brief breakdown of said approximated costs is as follows: Front-End software (£1500), Desk fee (£1200, rental of city desk space), CQG charting system (£400, professional data service), Exchange access fees (£200), additional screens (£200) and research & analysis services (£150). This, coupled with the fact that my account profit and losses were in (mainly) Euros or Dollars, made each month's expenditure/outlay all the more challenging.

However, trading prop and having to pay such extortionate monthly fees does come with its benefits, you get to be in the company of like-minded individuals all with a common goal, you get access to live squawk-box news wire services, greater pooled knowledge is available and in-house IT staff/resources are readily at beck and call should one require such services (let’s just hope it isn’t the requirement of a new mouse during a non-farm announcement whilst legged-up in some sort of weird and wonderful strategy, I have been there!).

Let’s fast forward to the present day! A different era from the one where I had initially ‘cut my teeth’.

A level playing field

In today’s world, I find that the retail space really has progressed leaps and bounds. The industry has developed into an expanse that is more accessible to the masses. A new era, in my eyes, in which the barriers of entry have been decreased immensely.

No longer is the industry exclusive to those with deep pockets or those privy to the latest technology. Technology advancements have enabled greater access, greater transparency and greater availability for the masses (no longer do you need a double-barrel surname, one of those fraternity sovereign rings or one of daddy’s chums high up in the food chain in order to be granted access into this arena).

No longer does an individual have to pay through the roof in order to trade the current financial markets. Current retail platform offerings mirror professional front-end systems emphatically, offering individuals access to financial markets at a fraction of the cost of entry within the prop space, a cost built into the spread.

In the world today, via retail platform offerings, we are able to access financial markets without having to pay front-end software costs, desk fees, currency exposure fees, IT service costs and individual charting software fees; this is all encompassed and offered within current retail platforms in order to better aid individuals towards focusing upon their chosen strategy at hand.

It's all about the risk

From my experiences gained from extensive usage of both professional and retail front-end platforms, I can honestly say one of the most important aspects of a front-end system is the risk management tools available; one has to have the necessary tools available at their disposal in order to account for one’s own risk appetite (otherwise one may find their aspirations disappear hurriedly down the rabbit-hole). This is so that an individual is prepared for any unforeseen circumstances that may occur ― such as the unpegging of the Swissy from Euro.

Now, obviously, for a front-end system speed, responsiveness, latency, ease of use, user-friendliness of the interface, security of data and availability of automated strategy trading options are of utmost importance. however, in today’s world most platforms perform admirably on these counts (assuming one’s own connection and hardware are up to scratch). Risk management, in my humble opinion, is the number one widow-maker within this industry (much like the Porsche GT2 is for car enthusiasts, the industry and the subsequent windows to follow).

Gone are the days of a simple stop order. The minefield of different parameters for risk management has grown and advanced immeasurably. This is due to the many once-in-a-lifetime occurrences that we have borne witness to: Northern Rock, Bear Sterns, Lehman Brothers, Washington Mutual, Glitnir (I did not know who they were either) and Landsbanki. Oh, and of course, multiple bailouts, coordinated rate cuts and not forgetting the wonderful QE programme.

Let me re-iterate ― risk management tools are the single most important aspect of trading, period! This statement is not said lightly, all of the above-mentioned casualty cases are the product of inadequate risk management. I personally have witnessed many an individual having to close out positions (at market) and leave their desks permanently simply due to their lack of risk management.

In a professional prop environment one of the actual services that you do benefit from is the physical presence of a risk manager ― the infamous MR Risk manager, never wanted to see him EVER; if I did I was in big trouble in little China. However, in the retail world, there is no Mr Risk Manager patrolling and scrutinising your risk parameters and underlying PnL (profit & loss), there is only yourself and the front-end platform of choice (along with all the sophistication that is offered within the modern day platform).

Bearing this in mind ― retail platforms have endeavoured to equip users with an array of risk management tools ― highlighted are a few key functionalities that retail investors should consider with high regard: variety of stop-orders, variety of linked-orders (OCO, IFD), Slippage control functionality (VAR, value at risk), leverage control, deposit insurances, option of bank guarantee account funding and alternative execution services.

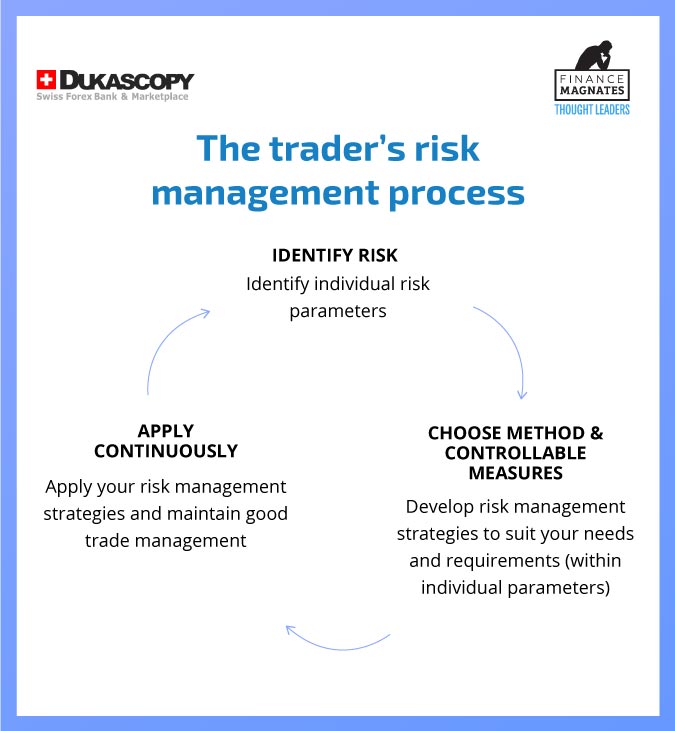

Along with simply identifying risk and its parameters, implementation and constant application is crucial in maintaining longevity within this game ― some try to run before they can walk, those are the ones that disregard the fact that this game is a marathon and not a sprint! This perpetual risk management cycle is depicted in the following representation:

Only game in town? Not in 2017

With risk management identified as the number one priority and with the present days’ service offerings granting access to all who show a slight interest in the world of financial markets we have to consider the consequent question of ‘which platform is right for you?’

From a quick search online I can conclude that there are many brokers willing to offer their services, with the majority of their service provisions routed via the offering of MT4 as the prevalent forerunner of retail front-end platforms; a platform that seems to have dominated the industry from its inception back in 2005.

However, we find ourselves in present day 2017, post ‘08 turmoil, and have to consider whether the experiences of the industry has been taken into consideration in regards to platforms and their service offerings relating to safeguarding individuals and their subsequent 401k plans and pensions (referring to the credit crisis and subprime mortgage fiasco).

Does a platform that was conceived back in 2005, prior to what we have all witnessed, take into account the risk parameters that are prevalent in today’s world? Or are there alternative platforms out there that embody the notion of risk management far better? Is MT4 the only way? Surely not right!