Risk Management is the number one cause of fatalities in the retail trading space ― individuals do not have risk departments to rely upon or risk managers to bear the responsibility of maintaining discipline.

This is where the platform of choice comes into play; it is the features within that provide individuals with the safety features that are ultimately needed most, in unforeseen circumstances ― circumstances that may mean the difference between whether you are able to trade again or not.

From experience gained via usage of both pro and retail front-ends I can honestly make the observation that in the retail space platforms tend not to deviate much from each other in regards to “overall” functional look or feel.

The wings of change in the retail trading space

Platforms have gone down the route of competing on features rather than overall appearance of their respective front-ends. This has led to competition in the quality of differentials that each platform provider has to offer.

This is what we would like to explore. Whether or not one of the latest platform offerings has defined itself enough by delivering upon quality differentials that aim to aid and protect investors in achieving their goals.

The platform we will be exploring is Dukascopy’s JForex3 Java-based platform, conceived in 2016 ― is the latest addition to the existing arsenal of retail trading trade-stations worthy of gaining an audience that once only had eyes for Metaquotes’ MT4?

Exploring an alternative way of risk-minded trading

"Dukascopy Bank is a Swiss innovative online bank based in Geneva, Switzerland, providing Internet based and mobile trading services (with focus on foreign exchange, bullion, CFD and binaries), banking and other financial services through proprietary technological solutions."

JForex3 equips users with access to the Swiss FX Marketplace (SWFX) ― a FIX API connected to over 20 major banks offering a unique pool of ECN spot forex Liquidity . This coupled with the strong association of security in the Swiss banking system as a whole, provides a fantastic environment in which retail traders can participate with confidence.

From initial usage of the JForex3 platform, I can conclude that it is very intuitive to use, the layout and overall functionality of the front-end seems almost familiar (for someone used to futures intra-day trading) and not at all too complex or unpleasant to use.

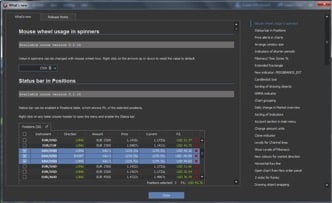

One very impressive comprehensive feature that I would like to highlight from initial launch of the platform is the “what’s new” window that pops up to inform the user of the updated features since last launch.

I found this to be a nice touch ― not only does it inform the user of what is new, it also provides the user with a historical timeline of the version updates as well. A very near feature indeed ― providing a full road map of the transition and growth of the platform.

One of the major plus points of JForex3 is that it operates in an environment that is heavily protected and regulated within its three subsidiaries via FINMA (Switzerland), FCMC (Latvia) and JFSA (Japan) ― with all clients benefitting from a guarantee of 100k CHF deposit insurance via FINMA and 20k EUR deposit via EU regulation.

In addition to consumer protection and regulation, transparency in its pricing model is also very reassuring. Transparency in the data feed assures retail-traders of a fair and honest market, granting the same price feed to all clients.

This omits the possibility of price manipulation and further can be verified via data publicly available ― an aspect that is worrying many traders within today’s retail trading space. This is made worse because not all service providers are equally transparent.

There are always sceptics who claim there are shady reasons for such concealment. And it makes one wonder… is there meat on the bone of such claims? Is there a reason for such concealment? Shady or unethical operations perhaps?

Furthermore, with regards to transparency, JForex3 offers the capability of viewing ‘market depth’. A tool first inspired by professional front-end platforms, and now brought forth to the retail market. A very important tool for gauging the true nature of a particular market at any particular point during the trading session:

Market depth can be utilised in order to gauge whether there is sufficient liquidity and volume when entering or exiting positions. This is more of a prevalent tool when trading the more exotic currency pairs as opposed to the heavily-liquid major pairs such as the example above of EUR/USD.

The Nuts and Bolts

An aspect of the platform that embodies the notion of risk management is the multiple options for different types of stop orders available.

The common stop order usually gets triggered via a printing/trading of a new price, which then activates a resting order that has been selected with parameters set and then continues to “flatten” one’s position “at market” in order to fulfil the stop-order conditions.

This is a very primitive type of order ― as markets became more sophisticated over time, so have its participants. The prevalence of such primitive and basic stop orders allowed for the rise of the phrase “triggering stops” ― a strategy that solely exists to exploit individuals’ risk parameters and force traders to “pay up” due to price reaching levels that far exceed individual comfort/affordability zones.

An almost underhand way of trading via taking advantage of the type of order and its execution parameters ― something reminiscent of my experiences first-hand whilst trading Eurex Exchange traded German Bunds, via the flipping of prices contentiously accredited to the famous Paul Rotter a.k.a. The Flipper!

As a result of such strategies that target the “basic and powerless common stop order”, more sophisticated order types have been developed that are more in-tune with the modern sophistication that prevails within the retail space.

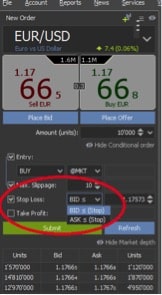

JForex3 offers an array of sophisticated stop order types that have been well designed with the user in mind and the various different environments in which the order can be implemented. Stop orders can be set on both sides (BID or ASK) independently. This feature allows for protection of stop orders against being triggered during market spikes ― where wider spreads often occur which can cause the activation of stop orders.

The platform also allows one to limit slippage for entry stop orders ― in practise this is a STOP-LIMIT order.

In addition, it is also possible to set an MIT order (Market if Touched) ― which can be used if one desired a better than current market price (typical for limit orders). This can be used simultaneously with or without Slippage Limitation ― for example one would have the choice whether or not to use this feature during a news announcement, dependent upon one’s risk appetite. Furthermore, Trailing Stops and OCO (Order Cancels Order) options are available for consideration.

Taming Slippage

In addition to this type of stop order, the platform also has the option of ‘slippage control’ via the choice of variance for entry of positions. This function aims to mitigate against slippage within a volatile market when entering positions in order to protect retail traders against entering into positions that are way-off from their initial desired price:

This function comes in very handy during very volatile trading times. The slippage control functionality could be utilised during, for instance, ECB or FOMC interest rate announcements whereby market volumes tend to be on the more cautious side during such economic events ― paving the way for retail traders to take on advantageous positions whilst airing on the side of caution regarding the entry level price that one is willing to accept. A very favourable risk management and capital preservation tool for the marathon ahead (which some view as a sprint).

Managing Equity

Further to the above-mentioned capital preservation tools, JForex3 also offers the option of equity management. Allowing for individuals to not only set limits for individual trades but also set limits for overall equity of an individual’s trading account.

This function acts as a double layer of protection for individual retail traders. Not only are risk parameters considered and defined for individual trades, risk parameters for overall equity available and capital invested is also further taken into consideration via equity management tools ― a great tool for longevity within this game that is a test of endurance.

As I continuously familiarise myself with the JForex3 platform I find myself more and more intrigued with how Dukascopy has managed to build this platform solely with the end-user in mind.

With the availability of historical tick data at one’s disposal strategies can be tested in a uniform manner, identifying the possible pros and cons of each strategy.

Some would also argue that tick data is a more purist form of charting (especially those who pursue the route of creating automated strategies), however, coming from a technical background I personally can never be unfaithful to “ye old faithful” le-candlesticks!

Another very interesting aspect of the JForex3 platform is the option of “making a price” within a forex pair that may not be so efficient ― for instance if a particular market was trading 5 @ 10, an individual has the option to bid 6’s or offer 9’s (provided the new order is a minimum volume of 100,000 units) ― resulting in price registering on LIVE tick charts and in historical data. Smaller volume orders can be placed but will not be shown on chart or market depth.

This creates a very interesting scenario, whereby individuals are able to tighten spreads as well as have the chance of winning spreads. A feature that is very prevalent within professional front ends.

Bottom Line

To conclude, JForex3 is a suitable platform for the modern-day trader, with a multitude of trader-focused tools and a lot of thought about the user behind it. While there are more pieces I’d like to see in the puzzle – live squawk box for news and announcements would be first – it provides an extensive offering for both retail and institutional traders.