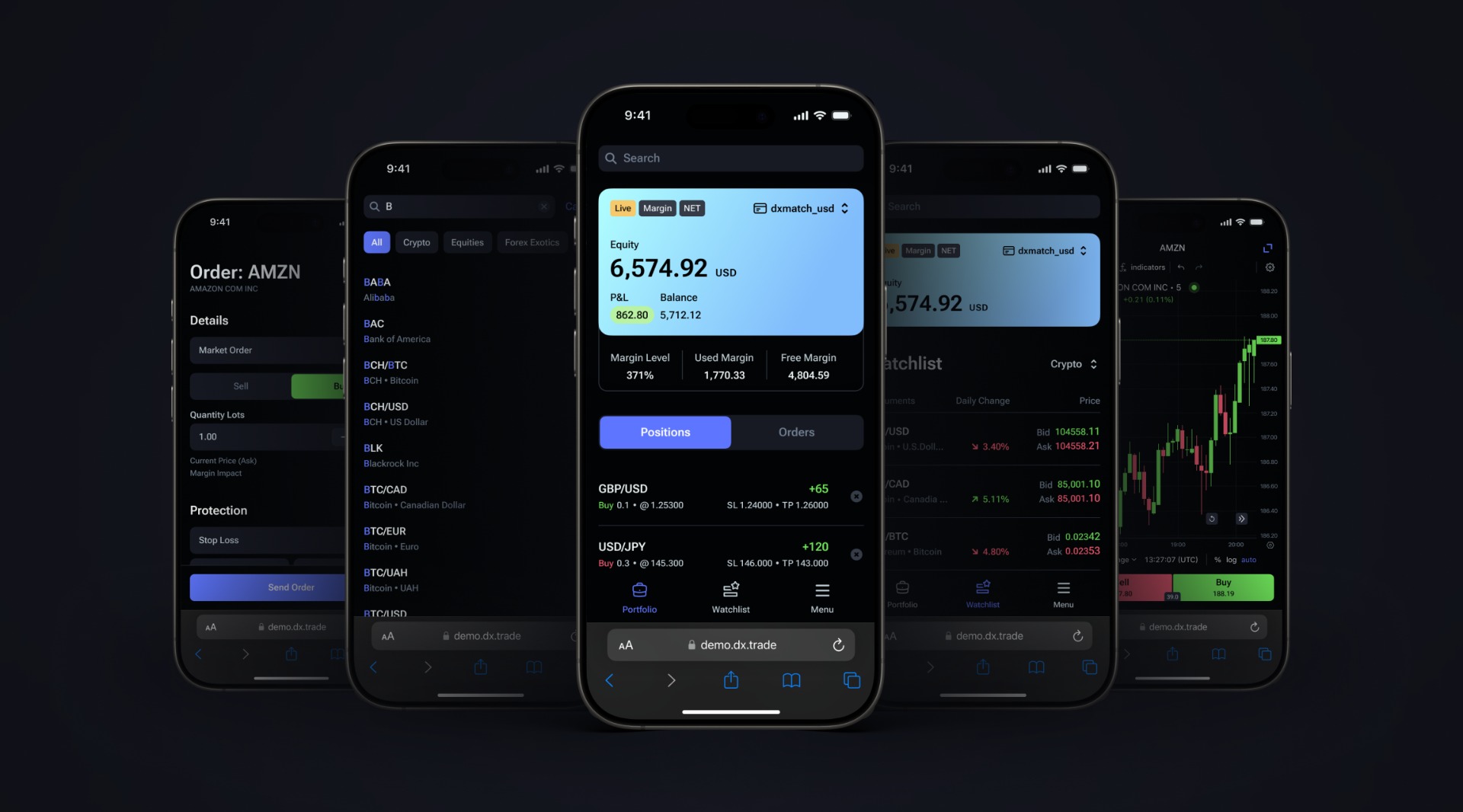

Capital markets software developer Devexperts has rolled out a mobile web interface for its DXtrade platform, giving traders access to core trading functions through their phone browsers.

The London-based company said today (Tuesday) that traders can now place market, limit and stop orders directly from their mobile devices, along with managing positions and setting stop-loss and take-profit orders. The interface runs through mobile web browsers rather than requiring a separate app download.

Devexperts Rolls Out Mobile Web Interface for DXtrade Platform

"We know that traders like to be able to access their platform whether they're at their desk or on the move, ensuring effective portfolio management and, where appropriate, timely trade execution ," said Jon Light, Head of OTC Platform at Devexperts. "This is the motivation behind our new DXtrade mobile interface, which gives traders even greater flexibility when it comes to accessing their platform, whenever and wherever they wish."

Traders using the new mobile interface can check account balances and metrics, browse preset watchlists, search for trading instruments and view charts. The system also lets users switch between multiple accounts without logging out.

The mobile interface is live now in DXtrade's demo environment. Brokers who license the platform will get access to the full version over the next few weeks, according to Devexperts’ press release seen by FinanceMagnates.com.

The update could make life easier for brokers who want to integrate DXtrade's mobile capabilities into their own apps. The web-based approach means brokers can embed the trading interface using webviews rather than building separate mobile applications.

The mobile web interface joins DXtrade's existing desktop browser platform and standalone mobile app. All three options aim to give traders flexibility in how they access their accounts and execute trades.

The platform uses what Devexperts calls “modular architecture,” designed to scale as brokers grow their client bases. Beyond trading capabilities, DXtrade includes tools for broker operations and client management.

Recent DXtrade’s Updates

The mobile interface launch represents the latest in a series of enhancements to the DXtrade platform over recent months. In June, the company integrated EAERA's customer relationship management system directly into DXtrade, allowing brokers to access CRM tools without switching platforms.

The same month saw multi-broker Blueberry roll out full TradingView integration through its DXtrade platform, giving traders direct access to advanced charting tools and technical indicators. Previously limited to a basic widget, the integration now provides complete access to TradingView's interactive charts, social trading network, and alert systems.

Romanian broker Investimental expanded its market coverage in June by adding European Union equities to its DXtrade-powered platform. The move completed Investimental's product offering, which already included Romanian and US market access, giving traders access to stocks on exchanges like Germany's Xetra and France's Euronext Paris.

Earlier in May, Devexperts partnered with BridgeWise to integrate AI-powered market analysis into its Devexa trading assistant. Users can now ask natural language questions about stocks and receive real-time investment insights, financial metrics, and macroeconomic analysis directly within the DXtrade interface.