Binance Exits the Dutch Market

Binance, the world's leading cryptocurrency exchange, has instructed its Dutch users to withdraw their crypto assets from the platform by 17 August, according to a report from the news agency ANP.

The company, which had been operating without regulatory permission, declared in June its intentions to leave the Dutch market due to its failure to register. Binance had been fined earlier in the year by the Dutch Central Bank for its unauthorized operations within the country.

Nasdaq Reports Q2 2023 Results

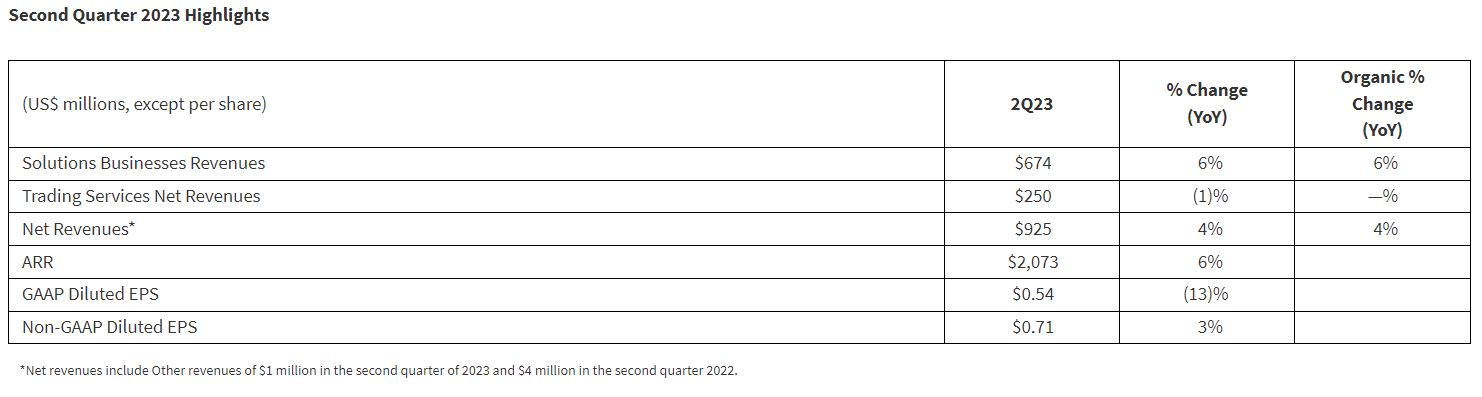

Nasdaq, Inc. announced strong financial results for Q2 2023, noting an increase of 4% in net revenues compared to the same period last year. The company's Solutions businesses saw a rise of 6% in revenue, with Anti-Financial Crime revenue notably jumping 19%.

Despite a decrease of 13% in GAAP diluted earnings per share, non-GAAP diluted earnings per share increased 3%. The firm returned $109 million to shareholders in dividends during the quarter.

Yonesy Núñez Appointed CISO at DTCC

Yonesy Núñez has been appointed as the new Managing Director and Chief Information Security Officer (CISO) at The Depository Trust & Clearing Corporation (DTCC). Núñez will be leading Information Security and Technology Risk Management as DTCC pushes forward with its technology modernization efforts.

Prior to joining DTCC, Núñez served as CISO at Jack Henry & Associates and held key positions at Wells Fargo, Citi, and Price Waterhouse Coopers.

ESMA Analyses Cross-Border Investment Activity

The European Securities and Markets Authority (ESMA) and national competent authorities completed an analysis of cross-border investment services in 2022. The findings highlighted that approximately 380 firms provided cross-border services to retail clients, with 59% being investment firms.

Cyprus emerged as the primary location for firms providing these services, followed by Luxembourg and Germany.

OKX Wallet Enables BTC and BRC-20 Staking

OKX, a Web3 tech firm, announced that its multi-chain wallet now permits users to stake Bitcoin (BTC) and BRC-20 tokens. This move follows the launch of the BRC20-S protocol, allowing users to earn BRC20-S tokens by staking their Bitcoin or BRC-20 tokens.

The protocol also enables DeFi developers to establish staking pools on OKX Wallet, aiding user engagement and community-building efforts.

Rakuten Securities Launches ChatGPT-Based AI Assistant

Rakuten Securities, a major Japanese broker, has launched an Artificial Intelligence chat service, called Investment AI Assistant, developed using the core model of OpenAI's ChatGPT. It aims to support beginner investors with their decisions.

The AI chat service has been launched as a beta version until the end of September with a cap on the maximum number of users. It will operate on a first-come, first-served basis and terminate the service as soon as the daily limits are reached.

Velocity Trade Onboards New Director

Velocity Trade, a global broker-dealer, has strengthened its management by onboarding Will Robbins as a Director. Based in Sydney, he has already assumed the role.

Robbins joined Velocity Trade from IS Prime Limited, where he was the Head of Asia for more than six years. He was a Senior Institutional Sales at Itiviti (then Ullink). Other companies he worked at include Investec, Argonaut, Renaissance Capital, and Aon.

Argo Blockchain Raises £5.134 Million

Argo Blockchain, a cryptocurrency mining company, raised £5.134 (about $7.5 million) from institutional investors with the latest private share placement. A total of 51,340,000 new Ordinary Shares have been placed with institutional investors by Tennyson Securities at a pre-decided price of 10 pence per share. It separately raised about £616,000 from a share placement to retail investors.

"The Placing Price of 10 pence represents a discount of approximately 14 percent to the 30 trading day VWAP of the Company's existing ordinary shares for the period ended on 18 July 2023, and a discount of 25.92 percent to the closing mid-price of the Company's ordinary shares on 18 July 2023," the filing with the London Stock Exchange noted.

The proceeds will be used to reduce the company's debts.

TP24 Raises £345 Million

TP24, which provides revolving business credits to SMEs, announced today (Wednesday) that it had secured £345m in debt funding from UK parties Barclays Bank Plc and M&G Investments. From the total, the startup will utilize £240 million for lending to SMEs in the UK and the Netherlands. The company detailed that Barclays is providing up to £200m in warehouse financing, while M&G is providing up to £40m in mezzanine funding.

"The support from established parties like Barclays and M&G confirms the strength of our innovative product and the talent of our team and gives us the opportunity to grow further," said Niels Turfboer, the Managing Director of TP24 in the UK and the Netherlands.

Danske Bank to Sell a Part of Banking Business

Danske Bank has agreed to sell Norwegian personal customer and private banking business and associated asset management portfolios to Nordea. Announced today (Wednesday), the acquisition is strategic and will strengthen Nordea's market position in Norway.

"It will add significant scale to our Personal Banking business in Norway and offers value creation opportunities through clear revenue and cost synergies," said Frank Vang-Jensen, the President and Group CEO of Nordea. "Most importantly, this will serve our new customers, who will benefit from our broad financial offering, expertise, and leading digital services."