The much-awaited FXCubic Mini-Football Tournament 2024 took place today (Friday) in Limassol. This exciting soccer sensation, organized by the fintech specialist FXCubic, brought together top FX industry brands, including brokers and technology providers, for an evening of fierce but friendly competition, complete with music, food, and drinks.

At the Wembley Mini Football in Limassol, this exciting tournament took place from 5:00 pm. It featured 16 teams, each with a maximum of seven players. These teams were divided into four groups, and the top two teams from each group advanced to the quarterfinals. Later, the players entered the semi-finals, and Equiti was crowned the winner in the finals. Here is how it all went down:

Equiti Takes the Trophy!

The mini-football tournament reached its spectacular conclusion past 9 PM local time. After hours of a hard-fought tournament, strategy, and sheer determination, Equiti emerged victorious, clinching the coveted trophy with a stellar performance against Match Prime.

Equiti's players showed incredible skills and resilience, making this win nothing short of spectacular. What a journey, what a triumph! The event was pure excitement, and we could not have asked for a better finish. Congratulations to Equiti! The team truly earned its place in the history of the FXCubic Mini-Football Tournament.

Finals

Finalists: Match Prime vs Equiti Group

After hours of intense competition and thrilling moments, the long-awaited game of the tournament happened at the grand finale of the FXCubic Mini-Football Tournament. Match Prime and Equiti proceeded to the finals. The journey to the podium finish was nothing short of spectacular. Teams gave their all, battling through precise passes, relentless blocks, hits, and, sometimes, agonizing misses.

Road to Finals

Semi-finalists: 26 Degrees, Match Prime, Swissquote, and Equiti

In an exciting turn of events at the FXCubic Mini-Football tournament, 26 Degrees emerged as the first team to secure a place in the semi-finals, showcasing remarkable skill and determination. As the competition intensified and headed toward its climax, three other teams earned their spots in the semis: Match Prime, Swissquote, and Equiti.

Match Prime then clashed with 26 Degrees, as Swissquote went head-to-head with Equiti.

Leading Up to the Semi-finals

It was game on in the vibrant city of Limassol! The atmosphere was electric as eight teams clashed in a breathtaking showdown for a spot in the semi-finals of the FXCubic Mini-Football Tournament. At this point, Equiti challenged last year’s champions, FXDS. Excitement was evident as each team attempted to book a place in the next round of the game. The action got more intense, and the battle line was drawn.

Quarterfinalists: Match Prime, Equiti Group, Swissquote, Finalto, 26 Degrees, CMTrading, FXDS, and Traders Education

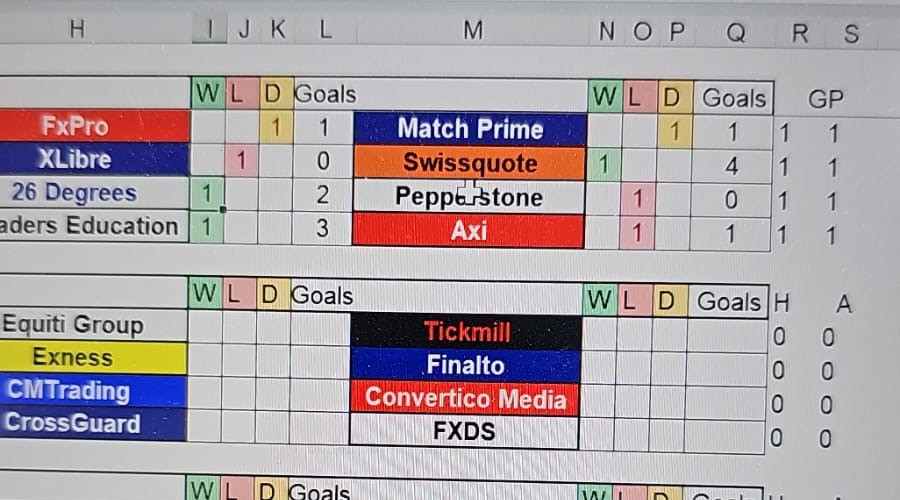

From the group stage results, Match Prime and Equiti (Group A), Swissquote and Finalto (Group B), 26 Degrees and CMTrading (Group C), and FXDS and Traders Education (Group D) got the chance to battle it out in the semi-finals. However, FxPro, Tickmill, exness, Xlibre, Convertico Media, Crossguard, and Axi have exited the group stages.

Race to the Quarterfinals Heats Up

The excitement returned to Group A as Tickmill prepared to face off against Match Prime in the highly competitive group-stage match. Four contenders pushed the limits to qualify for the winner, and runner-up slot in Group A. FxPro, Equiti Group, and Match Prime had four points each, while Tickmill had so far managed a point.

At 7 PM, Limassol time, at the 2024 FXCubic Mini-Football Tournament, FxPro and Equiti faced off to break the tie in Group A, where all teams had each bagged a point. The winner and runner-up earned a spot in the quarterfinals. The showdown was sensational, and the fans were treated to classic football entertainment.

In the electrifying encounter in Group B, Swissquote delivered a dominant performance against Exness, securing a convincing 4-1 victory. The game was played with high intensity and showcased some brilliant football skills from both teams.

In Group D of the football tournament, Traders Education led with three points. Trailing them was Crossguard with a point. The group also includes the defending champions FXDS and Axi.

Anticipation built up as teams geared up for the quarterfinals of the mini-football tournament. Every year, this event brings sheer excitement, goals, memorable matches, and more. It is an exciting, friendly competition full of action and enjoyable drama.

In Group A, FxPro, Equiti Group, Tickmill, and Match Prime tied with a point each. Looking at Group B, Finalto and Swissquote led with three points each. Similarly, in the action-packed tournament, 26 Degrees and CMTrading both scored 3 points. For Group D, Trader Education secured three points, while Crossguard followed with a point.

Commenting about this spectacular tournament, Ege Kozan, the CEO of FXCubic, had this to say: "It is great to have everyone here. We organize it every year. Get people together. It's a great event. We are happy, and we are gonna keep doing it. We are happy that everyone enjoys it a lot. So thanks everyone for coming."

Last year’s event saw FXDS crowned champions in a hard-fought final against SquaredFinancial. Orbex claimed third place, winning 2-1 against Match Prime.

2024 FXCubic Mini-Football Tournament Participants

Group A | Group B | Group C | Group D |

FxPro | Exness | 26 Degrees | Traders Education |

Equiti Group | Finalto | CMTrading | CrossGuard |

Tickmill | Swissquote | Convertico Media | FXDS |

Match Prime | XLibre | Pepperstone | Axi |

Apart from the thrilling football action, the event offered attendees a chance to unwind with an on-site DJ, finger food, and drinks. The combination of sports and socializing made it a perfect evening for industry professionals to network and relax.

FXCubic, a London-based fintech firm, specializes in low-latency software, high-performance liquidity management systems, and risk intelligence solutions. The company provides technology to enable brokers to optimize trading operations.

Tournament Rules

The participating teams were expected to observe fair play, which is the most important guideline in the Mini Football Tournament. The focus was to avoid injuries to the players.

Referees were vigilant, handing out yellow and red cards for severe fouls to keep the game clean and free from unnecessary injuries. The tournament organizers brought on board professional referees.

If two or more teams finished with the same score, they would be sorted based on points, goal difference, and the goals scored in the group stages. If necessary, penalties were taken between the teams to break the tie (three penalties each).

Congratulations to Equiti, and kudos to all the participants!