Arizet Labs, which has been offering risk and CRM solutions to prop firms, has expanded its product line and launched a trading platform specifically designed for the prop trading industry, FinanceMagnates.com has learned. According to Arizet’s CEO, David Davtyan, the new platform will prioritise an educational and gamified experience for prop traders.

“None of the existing platforms does that,” Davtyan said. “If you think about MetaTrader 5, that’s a great one, and they have been around for quite a long time, but it’s almost kind of a dinosaur, especially with their APIs and all that, and everybody knows that.”

“We Have a Lot More Freedom to Be Creative”

Although the use of gamification in real trading has attracted regulatory attention in many places, prop trading is mostly simulated. The sector is unregulated, as firms do not handle any client money for trading.

“We have a lot more freedom to be creative,” Davtyan explained, pointing out the unregulated structure of the prop industry.

He detailed that gamification for Arizet’s trading platform would mean “built-in innovation and gamified features in the evaluation stages,” adding: “That is not something that you can easily do in actual real trading because there are tons of regulations, etc. But in a gamified evaluation experience, you can do that.”

Read more: “Every Design Choice in Prop Trading Creates a Corresponding Risk”

Highlighting the importance of education, Shervin Arian, Arizet’s Chief Strategy Officer, said that the success rate among broker clients is 15 per cent, while it falls to 7 per cent for prop firms. “Our goal at Arizet is to educate them and provide clear goals and the tools they need so they can be successful and make money.”

Another Platform to Fill the Market Gap

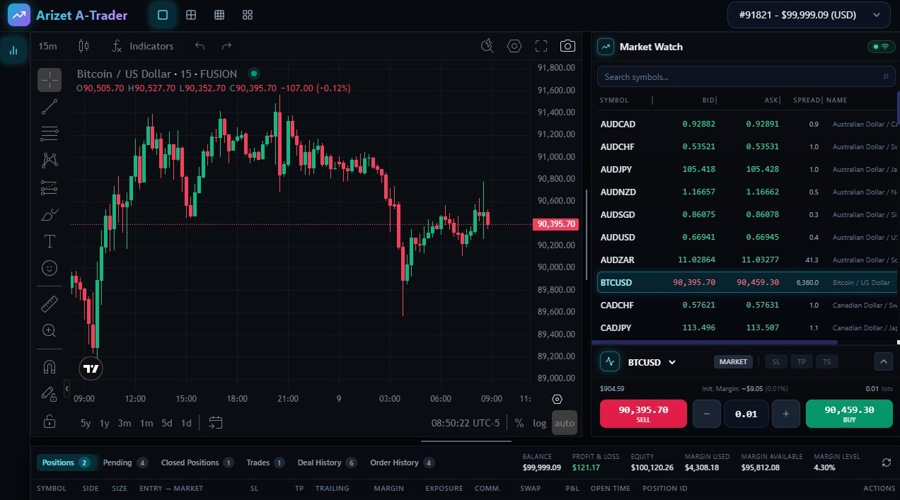

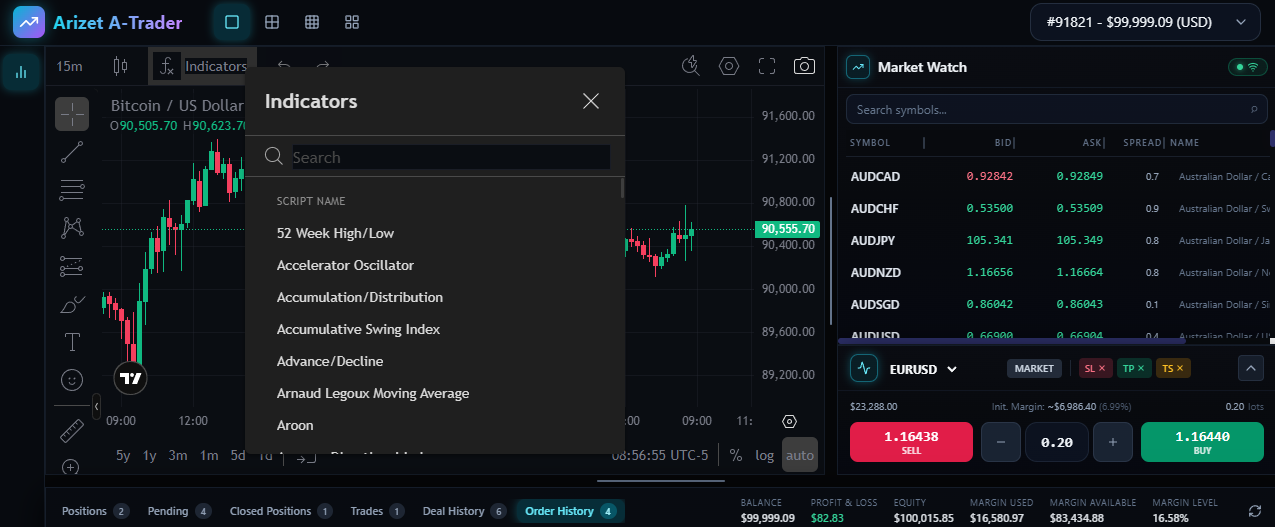

Known as Arizet A-Trader or Platform A, the trading platform will target both futures and contracts for differences (CFDs) prop firms.

According to Arizet, it is already in talks with six prop firms, including futures and CFDs ones, for the integration of its new trading platform.

The launch of the platform also comes at a similar time to Project X, a futures trading platform believed to be linked to Topstep, which is set to stop offering services to third parties, except for Topstep itself.

Although MetaTrader remains a preferred platform for many traders, most prop firms, except FTMO, cannot offer it to US-based customers. The action taken by MetaQuotes against prop firms using its platforms in the US in early 2024 also created opportunities for other trading platform providers.

Arizet’s platform will include an app store where traders can download additional tools, but it will not be open to third-party developers at the initial stage.

“We do not want that app store to become like a traditional one with all kinds of applications,” Davtyan said. “We want to stay focused and control what we launch there, so it remains consistent with our focus on gamification and education.”

“In the future, we might first start partnering with some other technology companies to provide them with the opportunity to present their apps there. And then, who knows, maybe it can just become like an app store.”

- Inside Prop Trading’s iGaming Psychology Engine

- Prop Traders Want to Hear About Others’ Experience: Is That Why They Trust YouTube?

- FTMO Comes to India: Opening Market It Previously Excluded

“We Are Not Going to Be the Cheapest”

Discussing the business model, Davtyan said A-Trader will not be the most expensive option, but it will not be cheap either. “We are not going to overcharge, obviously, but we are not going to be the cheapest because we do believe that the quality of our platform is higher than a lot of our competitors.”

The platform will offer different licensing options for prop firms, including a payment-per-active-account model.

Davtyan added that prop firms will also receive a share of revenue from paid apps available on Arizet’s app store. “This is very unique,” he continued. “Every other platform is a cost line for prop firms; some of them are relatively cheap, some of them are expensive. Arizet’s platform is not going to be a cost; it’s going to be an additional revenue source for them.”

You may also like: Inside Prop Trading’s iGaming Psychology Engine

The prop trading industry remains unregulated, but it has drawn regulatory attention. Finance Magnates previously reported that the pan-European regulator carried out initial checks and discussed possible rules for the sector.

Although Arizet believes any future rules would not focus on gamification and education, the firm says it is prepared for different outcomes.

“If the regulation says that you can provide educational experiences, but they cannot be tied to the funded stage or real trading experience, because that’s the riskiest part, we are ready for that,” Davtyan stressed.

“We have two different execution engines. We can either connect to liquidity providers and facilitate trading in the traditional manner, or we also have our own simulated engine, which is extremely realistic. So we will just separate that, and that’s it.

In the evaluation stage, during the gamified stage, there will be no A-book or real execution; however, customers will have a realistic trading experience based on a probabilistic approach to slippage, taking into account volumes and liquidity. We have a liquidity simulator as part of the trading platform.”