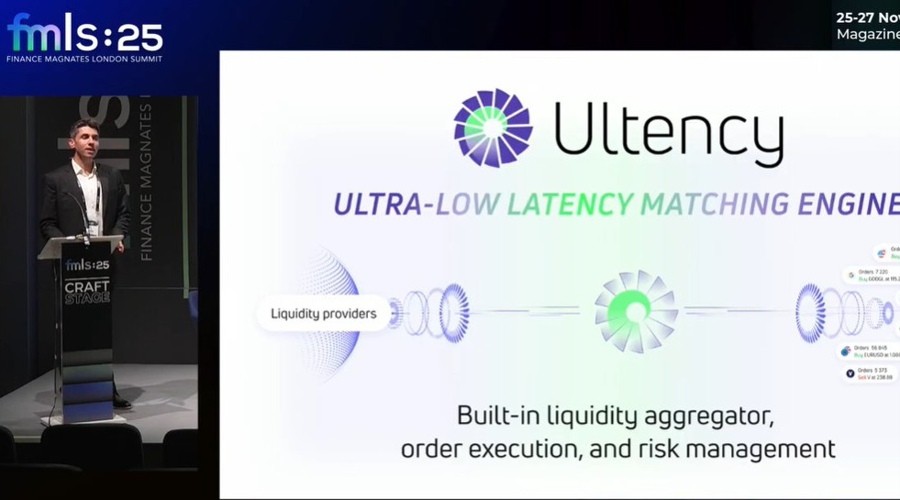

At the Finance Magnates London Summit 2025, MetaQuotes introduced Ultency, its new matching engine designed to give MetaTrader 5 (MT5) brokers and liquidity providers control and speed in trade execution.

Christoforos Theodoulou, the Head of Global Business and Sales at MetaQuotes, described the new platform as a purpose-built, “ultra low latency” platform developed entirely in-house to remove the reliance on third-party bridging technologies – a longstanding friction point in the brokerage infrastructure stack.

“Ultency, it's a game changing solution for MetaTrader 5 brokers and liquidity providers seeking for the best in-class ultra-low latency solution for their liquidity connectivity, aggregation, distribution, and also for their execution and risk management,” he explained.

A Native, One-Click Setup

Theodoulou emphasized that MetaQuotes invested “millions” in global server infrastructure to support the new ecosystem. Ultency’s hosting network reportedly spans Equinix data centers in London (LD4), New York (NY4), Hong Kong (HK1), Singapore (SG1), and Tokyo (TY3).

- “Retail Brokers Know the Client, Institutional Players Know the Flow,” Insights from FMLS:25

- FMLS:25 Kicks Off With Networking Blitz at The Folly in London

- The FM Events App Is Now Live!

“And we also now introduced SG1 in Singapore and TY3 in Tokyo. And the deployment of a matching engine of MetaTrader 5 for Ultency is done straight from each MetaTrader 5 broker with just a couple of clicks,” he added.

You may also like: “We Can Create Infinite Content at Close to Zero Cost, but Can We Turn It into Trust?” Insights from FMLS:25

Setting up the system, he said, can take “three seconds” and “a couple of clicks” via the MT5 administrator terminal – a simplification aimed at reducing operational overhead. There’s reportedly no integration complexity or third-party maintenance.

Control and Transparency for Brokers

Beyond speed, Ultency’s core pitch reportedly lies in transparency and risk control. Every trade routed through the engine is tracked from the client’s MT5 terminal to the liquidity provider with “microsecond precision,” allowing brokers to pinpoint slippage, track pricing discrepancies, and visualize market depth on execution.

“It brings brokers and liquidity providers together for liquidity access and distribution, and it offers full capabilities for price aggregation, liquidity aggregation, order matching, and execution for both A-book and B-book as well as C-book hybrid operations based on the risk management strategies of the brokers,” he said.

MetaQuotes changing the game again, by releasing Ultency: a new Matching Engine that connects Liquidity Providers straight to MT5 servers.

— Sheik Algo (@SheikAlgo) December 4, 2025

Props can use this tech to get the best trading conditions imaginable in seconds.

But also to slip your ass to Narnia.

Guess their choice. pic.twitter.com/PDMq7CQHSg

Additionally, the system also includes monitoring dashboards and risk management tools integrated directly into the MT5 manager terminal. Brokers can see exposures, A-book and B-book flows, and identify toxic order flow in real time.

Liquidity Access Made Simpler

MetaQuotes also announced a built-in “liquidity gallery” enabling brokers to compare providers based on latency and performance metrics without leaving the MT5 platform.

“We have already integrated liquidity providers and we are adding them intuitively in a gallery for the brokers to access them straight within their Meta Trader 5 platform, so they can see their offerings, their details, and they can see some crucial information that is going to help their brokers to decide which liquidity provider they're going to work with,” he explained.

More from FMLS:25: “Retail Brokers Know the Client, Institutional Players Know the Flow,” Insights from FMLS:25

The engine’s internal communication system allows direct negotiation and onboarding of liquidity partners from within the trading environment – a feature Theodoulou expects will streamline institutional relationships.

@FxProGlobal подключил агрегатор ликвидности Ultency от @MetaQuotes_News https://t.co/ExMjYIEdTq pic.twitter.com/LXiECuD8H0

— Finance Magnates RU (@ForexMagnatesRu) November 17, 2025

“We're going to extend this further and we're going to show real statistics regarding the quality of execution for each liquidity provider to have for each broker to be able to understand the quality of execution with each liquidity provider if it's executing on their promises,” he emphasised.

“So it's going to help them better decide with which liquidity provider to work with,” he concluded.

Target Users and Market Impact

Ultency is aimed broadly at MT5 license holders – from brokers and hedge funds to banks and proprietary trading firms. By eliminating third-party bridges and reducing infrastructure costs, MetaQuotes positions the product as a scalability enabler for firms expanding into new markets.

“No third-party bridges are needed for Ultency to operate,” Theodoulou explained, “because it has everything we discussed, all the connectivity with liquidity providers and reduces any development costs or maintenance that may come with other technologies.”

“Ultency supports various order types including market orders, limit orders and so on and has all the risk management tools embedded into your MT5 and to the Ultency matching engine so you can have the different rule sets to apply for different market volatility trends and so forth to match your clients' requirements,” he added.

In closing, Theodoulou invited brokers to test Ultency free for three months. “We believe Ultency takes MT5 to the next level – faster, more transparent, and easier to scale.”

He summarized MetaQuotes’ push to reinforce its trading infrastructure as markets demand ever-lower latency and greater execution transparency.