Can the FCA Do More with Less?

The FCA has recently been keen to present itself as an organisation aiming to ease the reporting burden on UK-regulated firms.

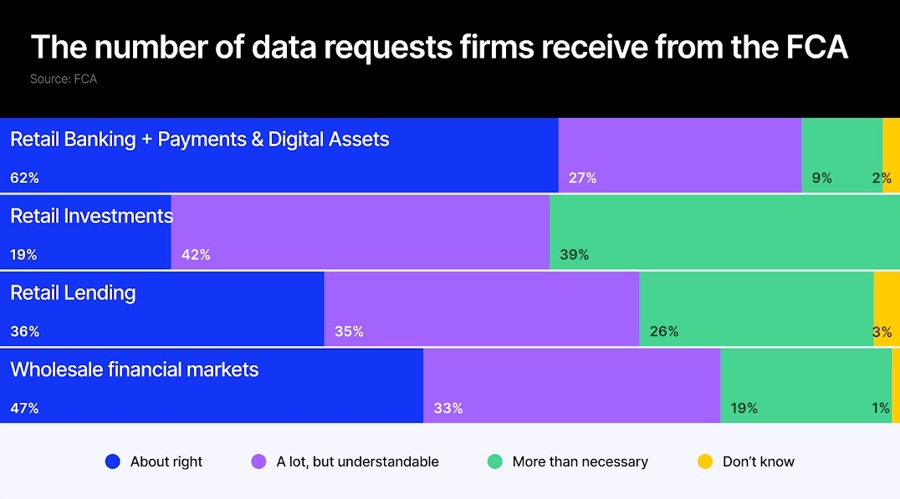

Chief Executive Nikhil Rathi told a conference in late June that the regulator was taking a more proportionate approach to data, claiming recent changes would benefit around 16,000 regulated firms. This point was echoed days later by Chief Data, Information and Intelligence Officer Jessica Rusu, who said using technology would help the regulator stop asking firms for data it didn’t need.

From 27 June, the FCA reduced the data collected from firms that provide intermediary services for arranging and/or advising on retail investment products, including information required on individual retail investment adviser complaints notification forms.

One adviser suggested the FCA’s decision to simplify its data reporting requirements was helpful. However, he also warned that firms are yet to be convinced the FCA is making the most of the data they still need to provide.

This follows the regulator’s earlier move to scrap proposed rules around diversity and inclusion, which small firms in particular argued would increase their compliance workload without meaningfully improving equality.

Read more: FCA Will Be Clear with Its CFDs Data Requirement

The FCA’s push to make London more appealing received further urgency this week with UK fintech Wise deciding to take a dual listing and shift its main listing from the London Stock Exchange to the US.

The new US listing is expected to take effect in the second quarter of 2026, supported by a majority of shareholders who believe it will widen the online payment company’s investor base.

According to Wise, the addition of a primary US listing would bring several strategic and capital markets advantages, helping the company move forward and deliver more value to its customers and shareholders.

Will a reduced data compliance burden stop the next up-and-coming UK fintech from heading to the US? Probably not—but the FCA is hoping it will support the impression that the UK capital market is open for business.

From Noise to Signal

The limitations of backward-looking data such as GDP or employment figures are well understood. Even monthly US job reports are already out of date when released on the first day of the following month—before even considering that the sample only covers around one-third of all non-farm payroll jobs.

The growing impact of trade sentiment on real-time moves across equities, commodities, FX, and rates is reflected in a new report from data intelligence provider Permutable. In today’s markets, where perception often moves faster than policy, sentiment has started to matter more.

The study reviewed 47 major trade-related events between September 2024 and July 2025. Perhaps the clearest example was a 17% single-day surge in copper prices in July, caused by a US tariff announcement—the biggest one-day move ever for the metal.

Other cases include the US dollar index climbing above 97.00 on a mere rumour of 10% tariffs targeting BRICS countries, and gold dropping from $3,339 to $3,311 on hints of trade progress. Even safe-haven assets like US Treasuries have shown sharp price swings based on shifting sentiment rather than underlying economic changes.

The market is measuring future results and earnings. Right now what the market's sniffing out is access to new markets at a reciprocal tariff price somewhere around 15%. That's the assumption. Now, let's take Europe. This is big news. That's a massive market to gain access to.… pic.twitter.com/knVPPmrGYR

— Kevin O'Leary aka Mr. Wonderful (@kevinolearytv) July 29, 2025

According to Permutable, today’s markets are shaped by fast-moving stories rather than firm fundamentals. The report notes that ‘sentiment is the new macro’ and that portfolio strategies must now account for changes in narrative alongside traditional economic and geopolitical risks.

Still, traders should be careful—positive sentiment doesn’t always lift markets. For example, optimistic updates from last month’s US-China trade talks in London didn’t affect the dollar much. It will be worth watching the impact of Friday’s tariff deadline.

Get live market updates and technical analysis on investingLive.com.

The Wane (and Gain) in Spain

It’s been a turbulent year for the main stock index of the Bolsa de Madrid—and the volatility seen since early 2025 may well continue through the rest of the year.

Nearly €80 billion was wiped from index stock values in the first nine days of April after a drop of over 10%, sparked by US tariff news. BBVA was hit especially hard, losing 14.7% of its value, though it recently confirmed its continued interest in acquiring Banco Sabadell despite new conditions set by Spain’s Council of Ministers.

From a low of 11,583 on 7 April, the index recovered to close at 14,331 on 29 July. The rebound has been supported by strong earnings from banks due to higher interest rates and growing investor preference for defensive energy utility stocks.

Investors should also note the rising use of share buybacks in Spain as a way to reward shareholders. Over €47 billion of shares were repurchased between early 2022 and mid-2025, compared to about €32 billion in the previous ten years.

You may also like: Spain CFD Trading Base Drops to 35,000 in Fourth Straight Annual Decline

Still, dividend payments remain the most common form of shareholder return. Dividends paid out in the first half of this year exceeded €21 billion—an increase of almost 9% compared to the same period in 2024.

Looking ahead, investors should consider risk factors that may weigh on IBEX 35 stocks, including a weak economic outlook and persistent inflation.

Regionally, Catalonia’s new progressive property transfer tax for homes valued above €600,000, and proposed changes affecting concession contracts on around 1,000 km of motorways, are other issues that could reduce dividend payouts.