A trio of trading technology companies has joined forces to deliver visual automation tools to the retail brokerage sector, betting that simplified algorithmic trading can boost client engagement and retention rates.

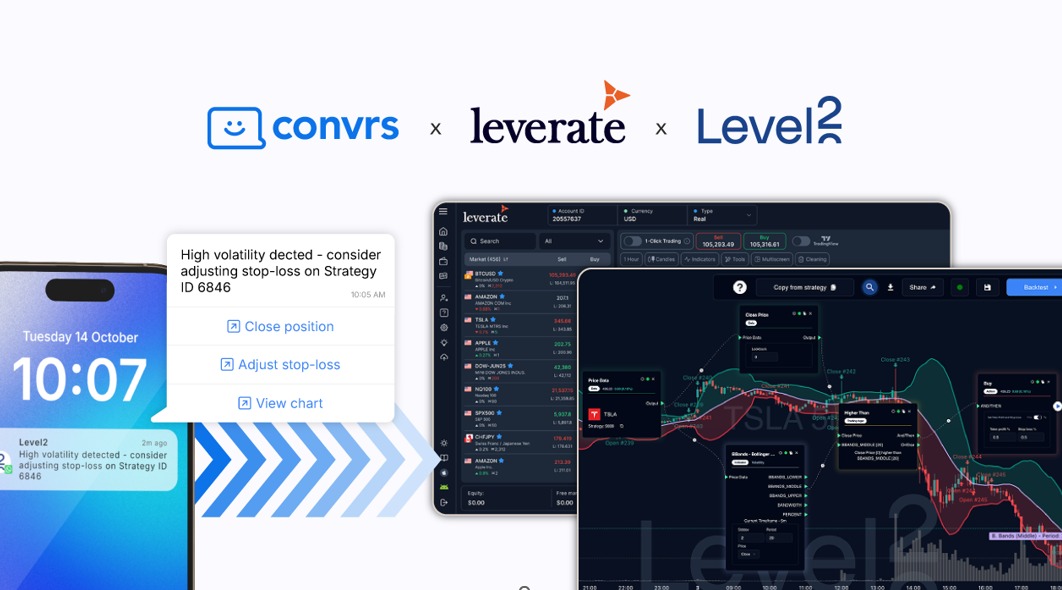

Level2, which builds no-code trading automation platforms, is teaming up with messaging provider Convrs and brokerage technology firm Leverate to distribute automated trading capabilities across Leverate's broker network.

The companies shared exclusively with FinanceMagnates.com their combined offering will let retail traders design, test, and deploy trading bots using drag-and-drop interfaces instead of programming languages.

Visual Tools Replace Code Requirements

Level2's platform says it eliminates traditional barriers to algorithmic trading by converting technical analysis and automation into a visual interface. Traders can build strategies by selecting conditions and actions from menus rather than writing scripts or learning specialized programming languages.

"By combining Level2's visual automation , Convrs' communication platform, and Leverate's extensive broker network, we're making systematic trading both intuitive and accessible. a first for the industry," said Andrew Grevett, Founder of Level2.

- Lightyear Bets Automation Can Fix Europe's Investment Follow-Through Problem

- ActivTrades Ties with Conv.rs to Enhance Client Engagement

- Leverate Promotes Idan Stambulchik to Head of Product

The system connects to Convrs' messaging infrastructure, which delivers real-time alerts and performance updates through popular chat apps. Convrs has been expanding its presence in the brokerage sector, working with more than 50 FX and CFD firms including CMC Markets and FxPro.

The push comes as brokers look for new ways to differentiate themselves in a crowded market. Leverate recently gave away free access to its MetaTrader stack for three months.

Distribution Through Existing Broker Network

Leverate will distribute the integrated solution to brokers using its technology platform, which includes liquidity connections, risk management tools, and CRM systems. The company has been building out its messaging capabilities through partnerships with Convrs since early 2025.

"Brokers don't need to piece together algo trading from separate vendors. It's native to our platform, alongside everything else they need to compete: liquidity, risk management, CRM, and now sophisticated automation with social features," said Shmulik Kordova, Chief Operating Officer at Leverate.

Enis Mehmet, Co-Founder of Convrs, said the combination of automation, broker distribution, and real-time communication creates what he called "a trading experience that keeps traders informed, confident, and connected."

“And we’re very proud to help brokers bring this level of experience to their traders,” he added.

Growing Focus on No-Code Automation

The announcement follows similar moves in the retail trading automation space. Level2 previously partnered with Lightspeed to offer no-code bot building tools, while several brokers have added AI-powered features to their platforms.

Questions remain about how quickly retail traders will adopt algorithmic strategies and whether simplified interfaces can deliver performance comparable to hand-coded systems used by institutional clients. The companies did not disclose pricing or provide timeline details for broker rollouts.

The integration gives Leverate's broker clients a built-in answer to competitors offering algorithmic trading, though it's unclear whether the visual approach will prove more popular than existing MT4/MT5 expert advisors or other automation tools already available in the market.