Equiti Group is actively collaborating with regulators to act against scammers impersonating its brand to deceive investors. The unregulated company has been targeting the UAE community, prompting Equiti to work diligently to protect investors and maintain industry integrity.

Equiti Group Combats Corporate Scam Impersonating Its Brand

Mohammed AlAhmad Ketmawi, the Co-Founder of the Equiti Group and CEO of Equiti Securities Currencies Brokers LLC, emphasized the company's commitment to safeguarding the community from malicious fraud.

"As an established brand in the region, it's our commitment to ensure we can protect the community from malicious fraud," stated Ketmawi.

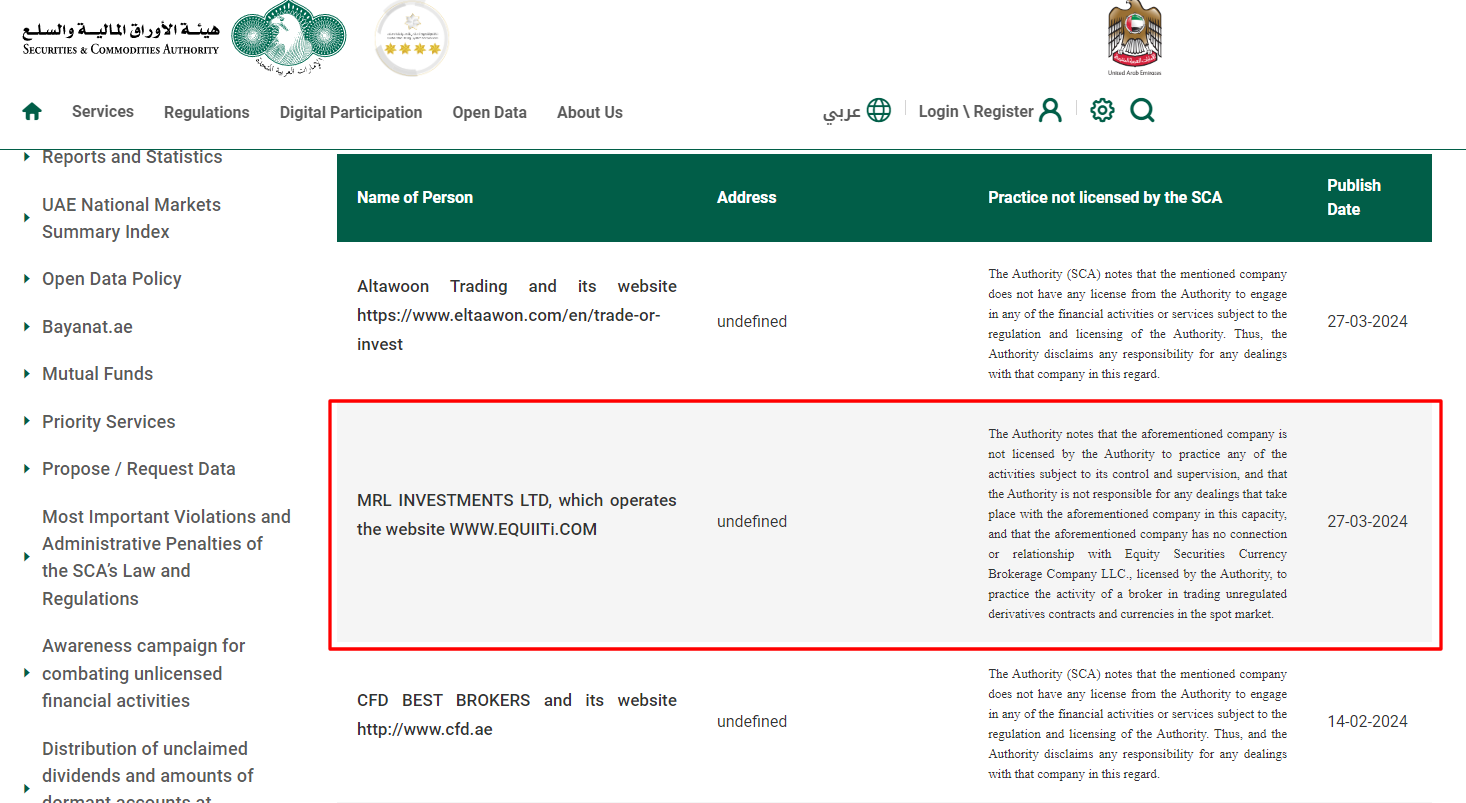

The Securities and Commodities Authority (SCA) in the United Arab Emirates has warned against unregulated companies across its official platforms. Equiti is taking every available initiative to protect investors in the UAE and maintain industry integrity. The company urges investors to verify regulatory details before engaging with financial entities and promptly report any suspicious activities.

The warning was issued on 27 March 2024, concerning MRL Investments Ltd., which uses the website address equiiti.com, deceptively similar to that of a regulated entity.

“The company is not licensed by the SCA to practice any of the activities subject to its control and supervision, and the Authority is not responsible for any dealings that take place with the aforementioned company in this capacity,” the SCA commented.

This is not the first time a fraudulent entity has impersonated Equiti. A similar situation occurred in the UK in 2019 when M.Success FX was identified as a clone of the company's local branch, Equiti Capital UK Limited.

The market watchdog added that the fraudulent company has “no connection or relationship with Equity Securities Currency Brokerage Company LLC., licensed by the Authority, to practice the activity of a broker in trading unregulated derivatives contracts and currencies in the spot market.”

Equiti Securities Currencies Brokers LLC, a subsidiary of Equiti Group, is regulated by the SCA as a Category 1 Trading Broker for Over-the-Counter Derivatives Contracts and Foreign Exchange Spot Markets under license number 20200000026. A year after obtaining the license, the company decided to open an office in Abu Dhabi.