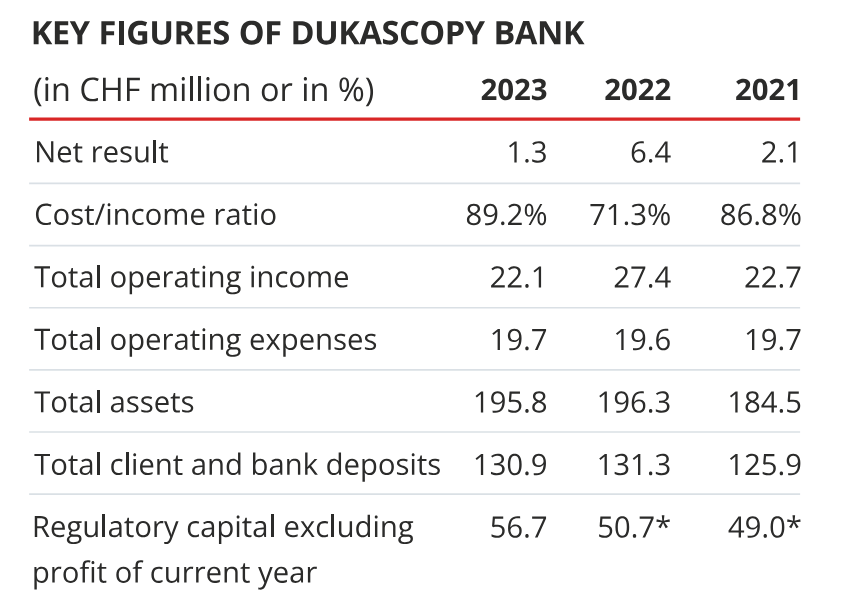

Dukascopy Bank SA published a financial report summarizing its operations in the previous year, achieving a net profit of CHF 1.3 million. This was accomplished despite "unfavorable changes in the market environment," according to the information provided in the publication.

However, this is significantly less than the CHF 6.4 million reported in the record-breaking year of 2022 and also less than the CHF 2.1 million net profit from two years ago.

Dukascopy Profitable in 2023, Yet Net Profit Drops by CHF 5.1 Million

The report published on Tuesday shows that the cost-to-income ratio increased to 89.2% compared to 71.3% the previous year. Costs remained at levels similar to those in 2022, but a decrease in total operating income by over CHF 5 million to CHF 22.1 million caused an boost in this ratio.

The results from the first half of the year, when trading income slumped 33% to CHF 9.6 million, already suggested that the results in 2023 could be worse. Especially, Dukascopy reported the second-highest-ever profit in 2022.

From the positive news, the total number of assets and client deposits only decreased marginally compared to 2022, amounting to CHF 195.8 million and CHF 130.9 million, respectively.

“What makes us proud is that in this international turmoil, Dukascopy Bank SA remains stable and reliable with a valuable product and philosophy, rooted in the Swiss tradition, and with a clear vision for the future,” reads the message from the Dukascopy Bank Board of Directors.

Dukascopy reported that brokerage services for trading accounts remained the main source of operation revenue. Aiming to expand earning potential, Dukascopy introduced the MetaTrader5 platform, complementing the MetaTrader 4 and proprietary JForex platform.

“Dukascopy Bank consolidated its strategy by focusing on its two main business areas: FX and CFD and retail banking services,” stated Veronika and Andrey Duka, the Co-Chief Executive Officers. “Despite the challenges of the financial year 2023, the Bank remains profitable. The business of all subsidiaries of the Bank as well.”

What’s New in Dukascopy

The Swiss online bank recently partnered with Options Technology to provide customers with real-time market data for US Equities, seamlessly integrated with Options' pre-deployed technology stack. This collaboration ensures clients have complete access to multi-asset class market data by ingesting, translating, and disseminating normalized and historical tick data worldwide.

However, not all news surrounding Dukascopy has been positive. The Swiss financial institution recently warned the public about a fraudulent clone website operating under the domain https://duukascoppy.com/. Dukascopy Bank SA has clarified that this deceptive duplicate is not associated with the bank or any of its affiliated entities, including Dukascopy Europe and Dukascopy Japan.

On a more positive note, Dukascopy has been expanding its offerings in the cryptocurrency space. In October 2023, the Swiss broker introduced lending services, allowing users to quickly obtain cash using their cryptocurrency holdings as collateral.