XTB shares jumped nearly 12% on Friday, closing at 84.8 zlotys in the strongest single-day rally for the Polish fintech in five years. Investors shrugged off a 25% profit decline to focus on record client growth and a new product roadmap centered on margin trading and extended trading hours.

Record Client Momentum Drives XTB Rally

XTB added 864,000 new clients in 2025, up 73% from 498,000 the previous year, bringing active clients to nearly 1.2 million. The company set a target of at least one million new clients for 2026, with early momentum showing 117,300 sign-ups in January's first 28 days.

In Poland alone, XTB opened 442,000 accounts in 2025, driven largely by IKE and IKZE retirement accounts. The rush for tax-advantaged products reflected growing Polish interest in long-term retirement planning.

- XTB Trading Volumes Jump 76% as Poland's Bull Market Roars

- Multi Asset Broker XTB Launches American Style Options Under CySEC Supervision

Seeing how Poles have rushed into this form of long-term investing with tax incentives, a real price war has been underway in the market for several months. ING Bank Securities, the country’s fourth-largest brokerage house, has now announced its intention to offer these products as well.

The Friday surge pushed XTB through key resistance levels at 78 zlotys and 82 zlotys, clearing a path to test all-time highs of 90-92 zlotys, last reached in May 2025. Since the start of 2026, XTB has gained 18%, outpacing the broad WIG index's 6.5% advance and the WIG20's 5.5% rise.

Margin Trading Headlines 2026 Plans

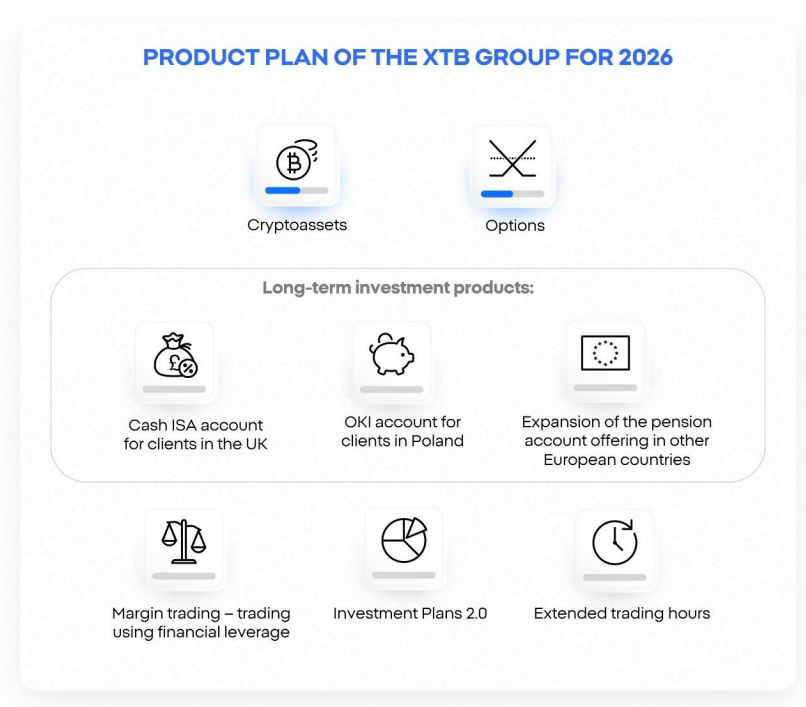

XTB's 2026 product roadmap centers on margin trading, which lets investors buy securities worth more than their account balance by borrowing from the broker. The company is finalizing the product structure and securing financing partners. Margin trading typically requires brokers to establish credit facilities or partner with financial institutions willing to fund client leverage , adding operational complexity but also opening higher-margin revenue streams.

Extended trading hours will launch first on U.S. markets, offering 24-hour access five days a week. European markets will follow later in 2026.

"XTB has repeatedly emphasized it's focused on clients, not just hard data, and the market is starting to understand that when it acquires clients this quickly and the product roadmap looks this ambitious,” Arkadiusz Jóżwiak, editor-in-chief at Comparic.pl, told FinanceMagnates.com. “Margin trading and 24/5 trading show a clear willingness to compete with the biggest fintechs in Europe.”

The product plan also includes the launch of new savings accounts in Poland called OKI and the development of retirement savings accounts in other European countries, including cash ISAs for UK clients, as well as a new version of Investment Plans 2.0.

Only 7% of new XTB clients now choose CFDs as their first transaction, down from 80% in 2019, as stocks, ETFs and retirement accounts attract buy-and-hold investors. The shift helped XTB add 864,000 clients in 2025 but pressured revenue per active client, which fell to 1,800 zlotys from 2,700 zlotys.

Profit Falls as Expenses Climb

Consolidated net profit dropped to 643.8 million zlotys from 856.9 million, while operating profit fell 15.4% to 834.3 million zlotys. The decline came despite a 41% jump in CFD trading volume, as profitability per lot tumbled 21.8% to 215 zlotys. Gold-based CFDs accounted for 38% of fourth-quarter volume, but lower unit margins offset the activity boost.

Operating expenses climbed to 1.31 billion zlotys from 886.7 million, driven by a 240 million zloty increase in marketing and 101 million zlotys in additional personnel costs. XTB warned that 2026 expenses could rise another 30%, with marketing budgets potentially jumping 50% to fund aggressive client acquisition .

Analysts at Noble Securities previously projected a path to 1 billion zlotys in annual profit by 2026, though rising client acquisition costs and European competition pose challenges.