This is the full document of the class action suit filed against Bank of New York Mellon (BNY Mellon) by Southeastern Pennsylvania Transportation Authority (SEPTA). If this is indeed what happened then it's simply terrible:

As detailed in the Florida and Virginia Actions, from at least 2000, and continuing through the present day, BNY Mellon has manipulated FX transactions executed by the Company in order to maximize profits to BNY Mellon at the expense of the Company's clients, such as SEPTA.

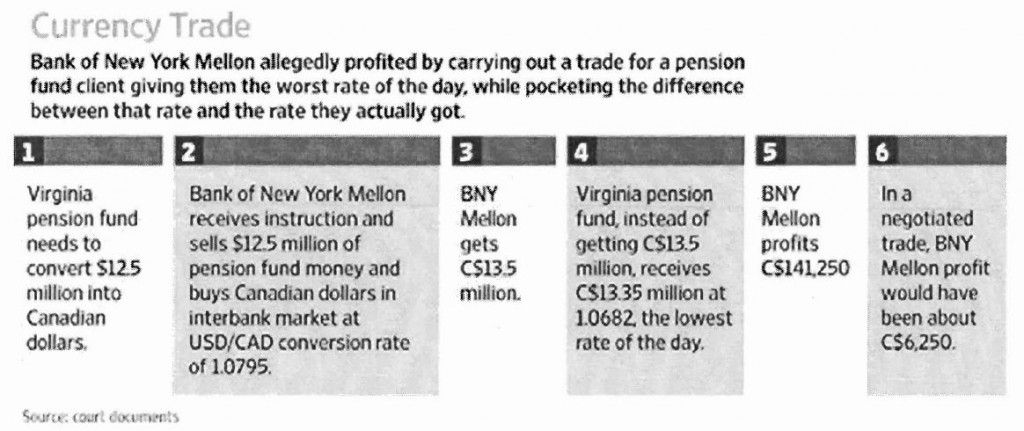

In essence, BNY Mellon charges its clients inflated FX rates when buying foreign currency, and deflated FX rates when selling foreign currency. The rate BNY Mellon actually charges clients is set after a FX transaction is executed and after the Company has an opportunity to observe post-Execution changes in the FX currency market. The difference between the actual FX transaction price and the amount ultimately charged to BNY Mellon's clients is pocketed by the Company as profit.

BNY Mellon's practices remained unknown to Plaintiff and the Class until the Florida and Virginia Actions were unsealed because, inter alia, the account statements provided to BNY Mellon's clients failed to provide pertinent details including time stamps for each FX transaction. Without FX time stamps, clients were unable to verify that the FX rates charged by BNY Mellon were consistent with the actual FX rates at the time the FX transactions were executed. Moreover, according to the Florida Action, in order to avoid detection of its conduct the Company provided its clients account statements that showed FX rates that fell within the daily trading range. BNY Mellon also used employees located in New York and Pittsburgh to hold "reconciliation" calls to "choose foreign exchange rates, i.e., the Falsified FX Rates, of the false price to charge" the Company's clients.

BNY Mellon's actions have generated hundreds of millions of dollars annually in unwarranted profits - wrongly taken from BNY Mellon's clients -and may account for more than one-half of BNY Mellon's entire annual FX trading profits.

SEPTA relies on the action brought against BNY Mellon by FX Analytics in Virginia and Florida, which amongst other things states the following:

According to the complaints filed in the Virginia and Florida Actions, when BNY Mellon received instructions to execute a foreign trade, it would convert funds from USD into a foreign currency to complete the transaction. After the trade was executed, "[BNY Mellon] would note the low and high exchange rate of the day for the two currencies involved in the FX trade."

At the end of the trading day, BNY Mellon sinlply "ignored the price [it] paid for the FX [conversion]" and charged its clients for the "FX transaction as if the trade occurred at either the high or low of the day (depending on the nature of the transaction, buy or sell), in order to charge [its clients] the least favorable rate that occurred that trading day."

Example of a transaction brought in the document:

Click Read More below to see the full court document.

// <