The U.S. online trading provider Firstrade has added digital rollover technology from Capitalize to help clients transfer old 401(k) accounts into individual retirement accounts on its platform.

The move addresses a growing pool of abandoned retirement savings that has nearly doubled over the past decade.

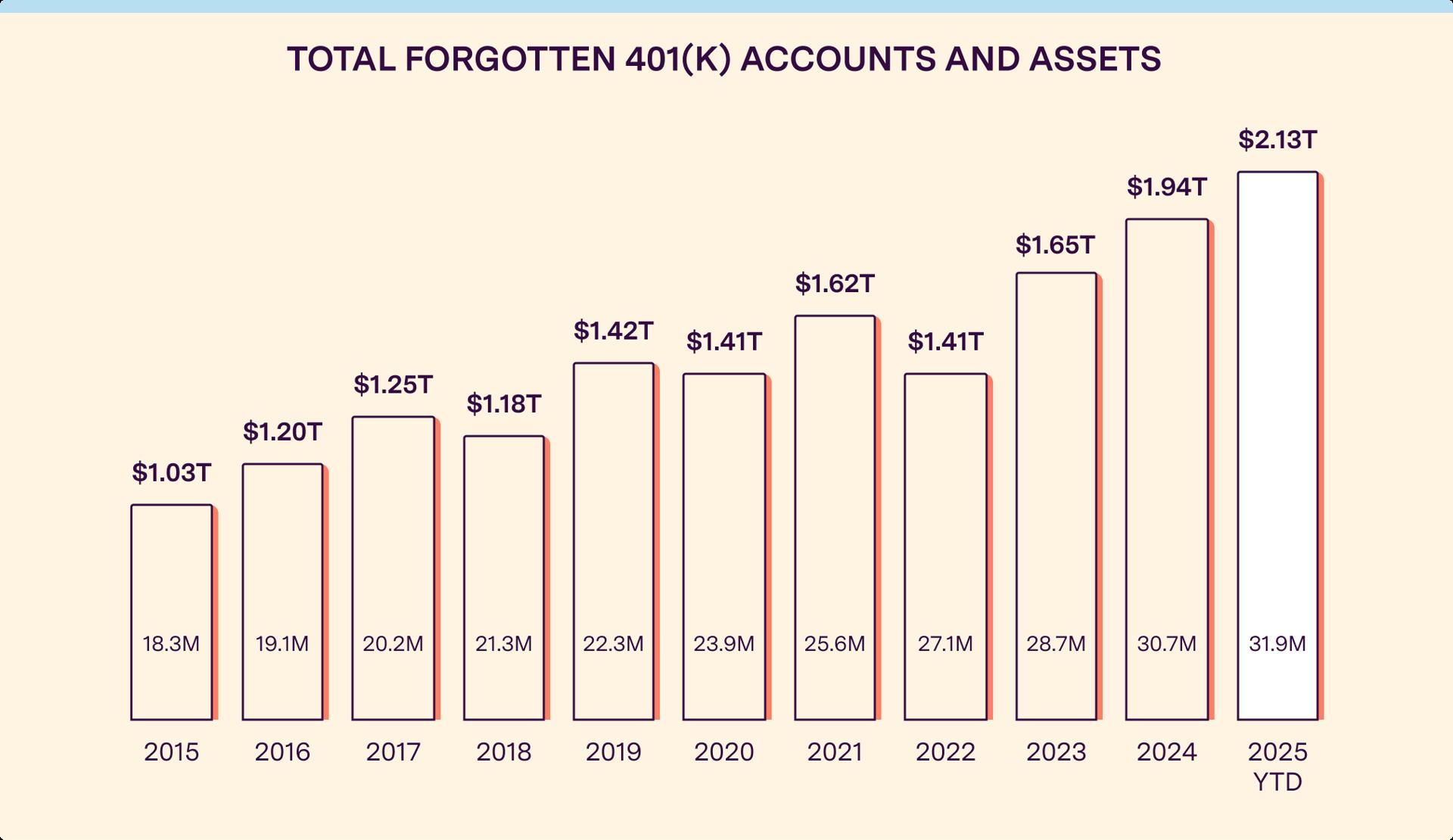

Forgotten Accounts Pile Up to $2.1T

About 31.9 million Americans have left 401(k) accounts at former employers, holding roughly $2.1 trillion in assets, according to September data from Capitalize. The average forgotten account contains $66,691, up from $56,616 two years earlier.

Nearly three-quarters of savers cannot complete a rollover without assistance, based on Capitalize's research with the Center for Retention Research. The process typically requires paperwork, phone calls with multiple providers, and waits that can stretch for weeks or months.

“This partnership gives Firstrade clients a more streamlined, digital-first way to prepare for retirement,” said John Liu, CEO of Firstrade. “By collaborating with Capitalize, we're making it easier for investors to consolidate and manage their retirement accounts in one place.”

The commission-free brokerage integrated Capitalize's application programming interface, allowing users to locate former employer retirement plans and initiate transfers without leaving Firstrade's website or mobile app.

- If You're a Night Owl, Firstrade 20/5 Stock Trading May Be for You

- US Brokerage Firm Firstrade Taps Global Investors With Overnight Trading

Growing Adoption Among Brokerages

Firstrade joins several competitors that have adopted Capitalize's rollover technology this year. Public integrated the API in March, Webull added it in February, and SoFi implemented the system in July. Robinhood also partnered with the company back in 2023 to simplify 401(k) rollovers.

Capitalize's technology has processed billions of dollars in retirement transfers since 2020, according to the firm. The platform uses data aggregation to locate old accounts and automates much of the documentation required by 401(k) plan administrators and receiving institutions.

“We're excited to partner with Firstrade to bring our seamless rollover experience to even more savers and investors,” said Gaurav Sharma, CEO and co-founder of Capitalize. “Together, we're making it easier for people to consolidate their old retirement accounts and ensure their savings keep working for them.”

Fee-Free Retirement Accounts

Firstrade's IRA products charge no account minimums, maintenance fees, or inactivity fees. The brokerage, founded in 1985, offers commission-free trading in stocks, exchange -traded funds, options and mutual funds, along with fixed income products.

The firm recently expanded trading hours and plans additional platform enhancements. Firstrade operates as a member of the Financial Industry Regulatory Authority and Securities Investor Protection Corporation.

Job mobility has accelerated the accumulation of forgotten retirement accounts. Workers who switch employers often leave behind 401(k) plans rather than rolling them into new accounts, creating administrative headaches and potential gaps in retirement planning.