In the last post we broke down cryptocurrency liquidity for retail forex brokers with a broad overview. In this article we will delve deeper into all available solutions.

Traditional retail FX brokers can no longer ignore the potential of offering leveraged cryptocurrency trading. Brokers are in situations where they must offer crypto trading instruments or run the risk of losing ‘bread and butter’ FX clients to competing firms with such products.

In order to get set up quickly with crypto Liquidity , brokers can integrate with crypto exchanges or broker liquidity providers. Once the price stream is integrated to the broker’s connectivity provider it can mark up spread/commission to capture revenue and offer it as a trading instrument on its platform such as MT4.

IS THIS RELEVANT FOR YOUR BUSINESS? GET LIQUIDITY HERE

In this article, we will assess the pros and cons of connecting to a crypto exchange versus a crypto LP for a broker that wants to offer Cryptocurrencies to their client base.

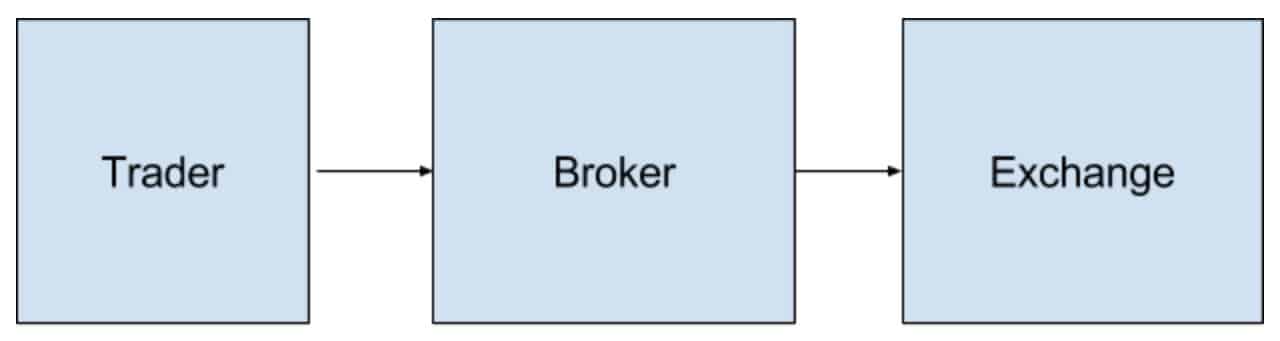

Liquidity from a Crypto Exchange

A broker can connect directly to a crypto exchange and send client trades there.

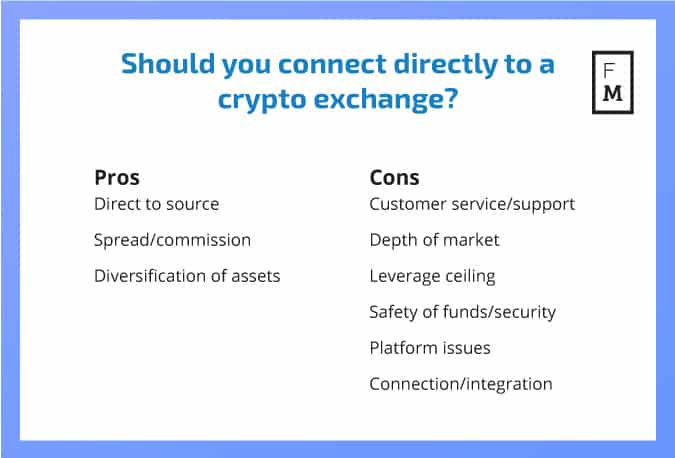

Here are the advantages and disadvantages of taking this route:

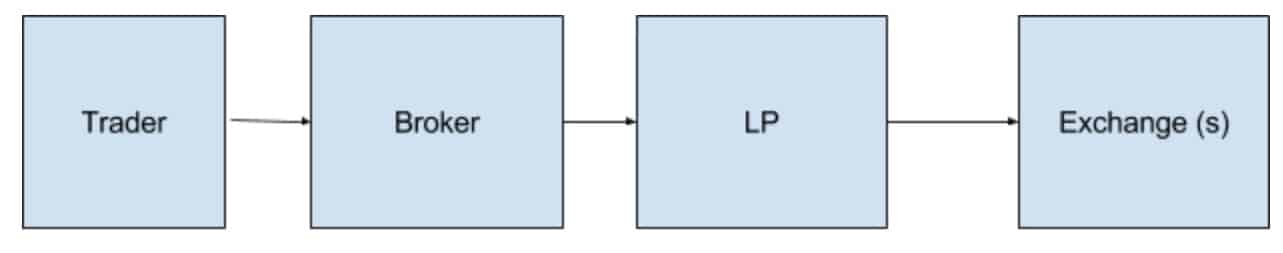

Liquidity from a Broker

Brokers can go to cryptocurrency broker-LP’s that act as either a market maker themselves or use an STP model to lay trades off to the exchanges.

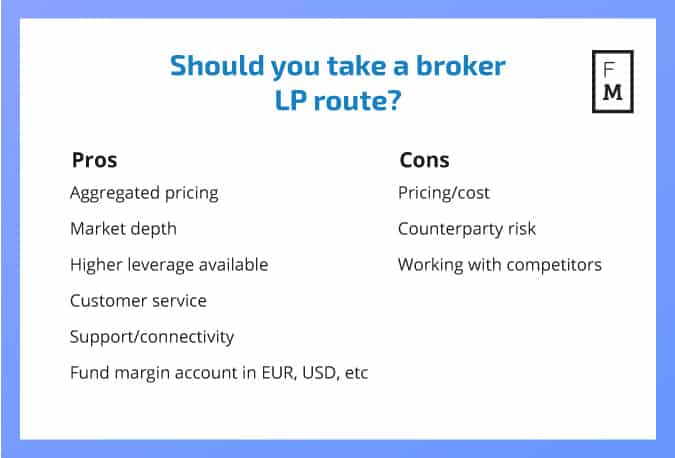

Here are the advantages (pros) and disadvantages (cons) of taking the broker LP route:

Overview

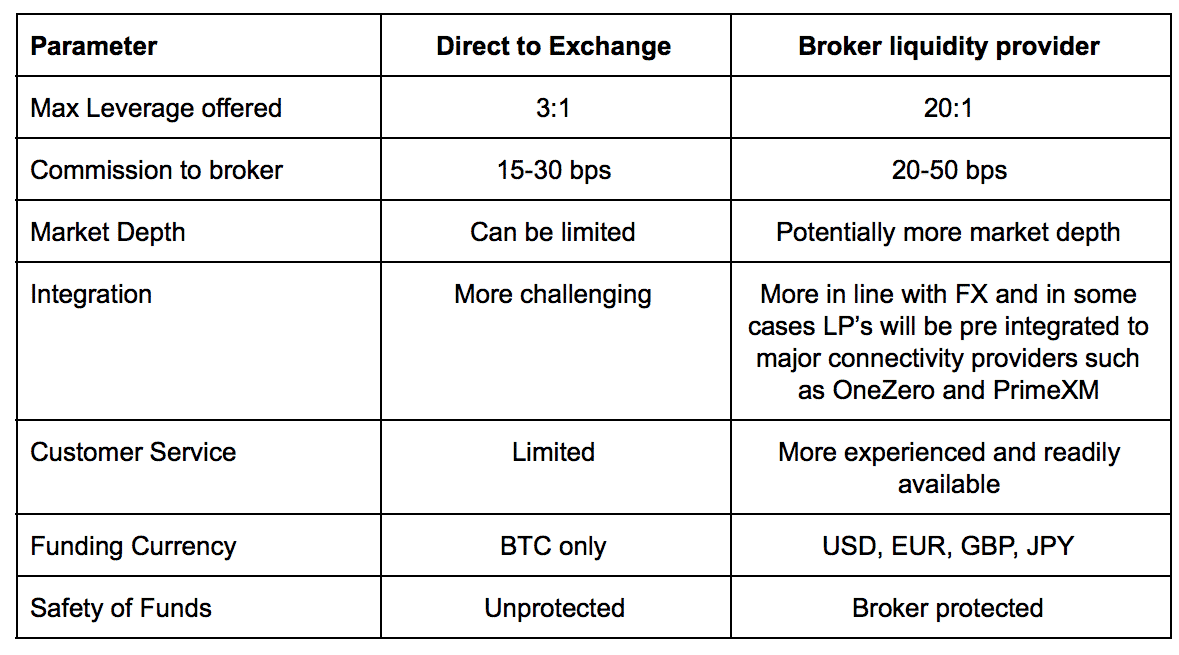

Here is a table that summarizes the the key differences between going to crypto exchanges versus crypto broker LPs.

Leverage

Most crypto exchanges are not leveraged. If they are, it’s through a system of borrowing that involves payment of interests, which gets pretty complex. Broker crypto LPs can offer higher leverage (as high as 20:1) by either acting as market makers or posing higher margin with crypto exchanges. This allows you to post less margin and gives your clients a more attractive offering.

Commission/costs

By working directly with an exchange there is one fewer party involved in the equation. This can sometimes reduce commissions. In most cases the exchanges will charge 20-30 basis points (0.20-0.30%) per trade per side while LPs will charge 25-50 (.25-.50%) basis points per side. A couple things to keep in in mind however are:

- Broker LPs may be aggregating multiple exchanges which will reduce the spread.

- Some broker LPs will no commission at all as they will generate revenue from their market making operations.

Market Depth

One single exchange typically doesn't have huge market depth, especially if you add leverage into the mix. In order to combat that, brokers may want to aggregate multiple exchanges and that requires technology that most brokers don’t have yet. Because crypto LPs typically aggregate multiple exchanges, there will be more market depth with the broker’s access to multiple venues.

Brokers may want to aggregate multiple exchanges and that requires technology that most brokers don’t have yet

API Integration

Connection and integration to crypto exchanges is not always straightforward. Their APIs are not always designed for FX brokers which can make integration challenging and time consuming. Conversely, certain crypto broker LPs are already pre-integrated into FX connectivity and bridge providers such as OneZero, PrimeXM.

This essentially makes working with them a plug and play solution for brokers. Simply do the necessary paperwork with your LP, send margin and just add the crypto LP in your OneZero or PrimeXM platform and you will have the instrument streaming into your metatrader. No integration required!

BTC/USD price chart. Source: Google Finance

Customer Service

There are very few crypto exchanges that would have a forex experienced customer service team to handle broker client issues. Brokers offering crypto pricing will have adequate forex experienced customer service, which will be easier for you to deal with.

Posting Margin

Most exchanges require you to post margin via BTC (bitcoin). They will not accept US dollars or euros to fund the margin account. Crypto broker LPs accept margin in USD, EUR or any other major currency. This will make dealing with your coverage account easier.

Safety of funds

Because of the lack of regulation in the crypto space, safety of funds is a big concern when posting margin with a crypto exchange. This issue is less of an issue when dealing a reputable LP.

Recommendation from Nekstream

Although going to crypto exchanges can be a bit more cost effective, going to a crypto broker LP has many inherent benefits and can make your life much easier, especially if you have a b2c business model.

We suggest that you aggregate multiple LPs that fit your needs. When deciding who to connect with, here are a few key parameters that you should pay attention to:

- What exchanges they connect to? You ideally want them to connect to multiple major exchanges such as xBTCE, Bitfinex, Paloniex. This way they are not fully reliant on one exchange if there is an issue like downtime, hacking or shutdowns.

- Aggregating multiple exchanges also provides a truer price for each crypto instrument and mitigates predatory trading. If they are only working with one exchange, do they have plans to add more in the near future?

- Are they making a market or acting as an STP? At this stage you ideally want to aggregate a combination or an STP and a market maker. Crypto trading is so volatile and so new that relying solely on a market maker can be a bit risky. Ideally you want to hedge your risk with both models. We will touch upon this in a subsequent article in this series.

- Do they have their own aggregator of exchanges? Connection to the exchanges and aggregating crypto liquidity is not a super straightforward process. If a company has already built the tech and established a solid connection it can be a big plus.

- Company regulation and jurisdiction. Not all crypto LPs are regulated in major jurisdictions. But when sending in funds to your coverage account you want to feel comfortable that your money is safe. So if a broker LP has been around for a while and has entities that are regulated by the FCA and ASIC, it can be a plus.

Keeping all of these things in mind and going with a solid crypto broker LP can be a great way to start offering crypto trading to your client base.

Alex Nekritin is the Managing Director of Nekstream Global, a liquidity and technology consulting company helping brokers, HFT traders and money managers to find proper liquidity and tools for their ventures. Alex has over 10 years of experience in the financial space. Contact Alex at info@nekstream.com.