In our previous article about the MIFID 2 rule change we discussed how MIFID 2 would impact the ways that FCA and MIFID regulated brokers can work with IB’s that refer EU and UK clients.

MIFID 2 IB Rule Changes

[gptAdvertisement]

Here is a summary of the new rules as they relate to IB’s – all IB’s that bring European clients to brokers have to be MIFID or FCA registered as well. In order to qualify to receive an IB payment, the IB must provide an ongoing service to all European clients that they bring to a broker.

The amount that the IB makes will be disclosed to clients. All this is especially challenging for IB’s that are not located in Europe. There are many brokers that rely heavily on affiliate and JV relationships to procure business.

If you are one of these brokers the rule will certainly have an effect on you. In this article we will discuss how you can get ahead of this rule by optimizing your marketing process.

Focus on “Marketing” vs. “IB”

The IB agreement is the most common way to work with Affiliates . It originated in the US futures industry. It is easy for brokers to set up an IB deal because with this approach they are not taking on any risk upfront in paying for leads. An IB can best be described as a company that procures and services retail-trading accounts.

Are there relationships that you have or can create where you simply buy traffic or leads or even accounts in order to get clients? Do these classify as IB relationships? With an optimized conversion funnel and the right connections you can accumulate leads fairly economically and convert them at high rates.

Buying Leads is Not as Scary with a Proper Conversion Funnel

Paying upfront is what turns off most brokers about buying leads. They feel like all the risk is on them. A big reason why is they don’t know how to price leads properly and don’t have an optimized conversion funnel in place.

There are some simple and efficient ways for you to accumulate leads and automatically convert them into accounts. You just need a CRM and a conversion funnel. What if you knew that you could convert 1 out of every 100 leads (1 percent) into an account and you knew that your average lifetime profit per account was $2,000? That means that you could pay up to $20 per lead to break even.

Based on the above example you can determine the cushion to give yourself when buying leads. For example you can say that you want at least a 100 percent return on your lead purchases so you will not pay more than $10.

Conversion Funnel

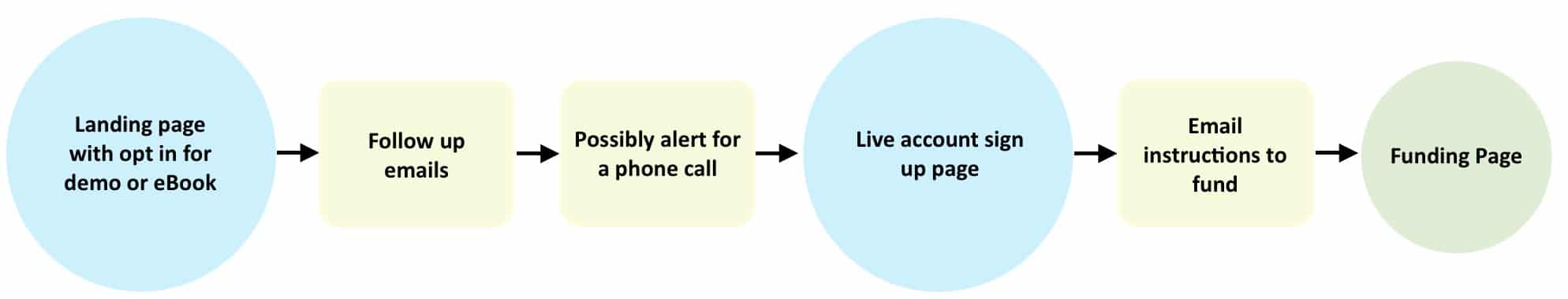

Think of your conversion funnel as a machine into which you will put in leads and take out profit. The objective of the conversion funnel is to get the lead to open a demo account, than a live account than fund and than trade.

Your conversion funnel must be optimizable in order to purchase leads. Here is an example of a conversion funnel:

The idea is to split test and optimize your conversion funnel in order to maximize the percentage at which you convert leads to active accounts. At Nekstream we work with some of the biggest and best marketing experts in the financial industry. They can help you with the setup of your conversion funnel and CRM. Simply email info@nekstream.com for more information.

Where to Get Leads

Search engine PPC and banner network is what comes to mind when you think of lead accumulation. The issue with that is that it is very saturated for the FX industry. There are some more cost effective gorilla ways to get leads.

Traditional Lead Accumulation in FX

You really need to focus on the financial info product marketing industry. Financial info product marketers are marketing professionals that sell financial info products. They are typically experts in marketing rather than finance and they have figured out highly advanced methods of lead accumulation.

Financial info product marketers often use certain tactics to be very efficient in your lead accumulation process. You can take advantage of their marketing efforts by purchasing their leads directly or from lead brokers that are tapped into their industry.

This is where you can set up a lead acquisition deal and drive the leads into your newly created sales funnel. Nekstream is connected to some of the biggest financial info product marketers and lead brokers in the space and can help you with your lead accumulation process.

Taking Advantage of the Crypto Boom to Get Leads

With cryptos the situation is somewhat different. Lots of people want to get in and crypto exchanges and brokers can hardly keep up. People that don’t even know about FX or CFD trading are now dying to get into cryptos and smart marketers are capturing those leads.

Lead Accumulation with Cryptos

Info product marketers are getting the leads very cheap because so many people are going crazy for cryptos. They are also converting their leads at very high rates. Smart brokers that have a crypto offering can get those leads in the door to trade cryptos and then nurture them to trade FX and CFD’s as well.

If you don’t yet have a crypto offering you can use our Liquidity tool lqedge.com to find a crypto LP that will fit your needs. Or simply email info@lqedge.com and we can help.

These sales processes can be done with multi asset newsletters ones that address Cryptos, CFD’s and FX all in one. And you can create a custom eBook and follow up sequences. To get crypto leads active in all instruments.

Bottom line is that not offering cryptos as a financial institution during this boom will put you at an extreme disadvantage when accumulating leads.

Payment per lead

Now that you realize that you need to create a conversion funnel you need to determine how much you could pay to financial marketers for lead. Obviously first determine the maximum that you can pay based on your conversion rates, profit per account and the return on margin you are going for.

As a rule of thumb if you pay over $25 per crypto lead to someone they will be ecstatic. You can very likely get away with paying $12-$15 per lead. The key is to test each source to see how well the leads convert. There is a bit of risk but you will not have to pay out on your large accounts for their lifetime with this approach.

Also to mitigate your risk you can adjust your conversion funnel to sell your leads to a lead broker is they don’t convert after a certain time. Financial lead brokers will be happy to purchase your leads and use them to sell financial info products.

Just to be clear when selling leads you are not giving away prospect info. You are simply putting an offer in front of the leads to opt in for an eBook or a free report that will opt them into the lead brokers funnel and the lead broker will pay you per opt in.

Here is how the process works

The cool thing is that you can sell the same leads to multiple lead brokers. By having these channels in place you can bring your cost of leads to nothing. With MiFID 2 here, you are heavily reliant on IB’s for EU and UK clients you need to make adjustments. If you don’t have a conversion funnel in place create it. It will help you open accounts automatically.

If you do have one optimize it. Once your conversion funnel is in place connect with financial marketers to accumulate leads. Make sure that you have a crypto offering because it is a great way to accumulate a ton of leads and get market share. Optimize your conversion funnel so that you earn more on each lead than you pay for it!

Disclaimer: Please keep in mind that we are a consulting firm and these are some creative ideas that we have of the adjustments to your marketing strategy that you can make in light of the new rules. We are NOT lawyers or compliance professionals. So if you like any of our ideas PLEASE check with your legal counsel or compliance officers before acting on any of them.

Alex Nekritin is the Managing Director of Nekstream Global, a liquidity and technology consulting company helping brokers, HFT traders and money managers to find proper liquidity and tools for their ventures. Alex has over 10 years of experience in the financial space.