Cryptocurrencies have experienced massive growth in 2017 and with a record breaking market cap of over $120 billion dollars it is fairly evident that they are not going away. With opportunities like leveraged trading, investing, mining and ICOs, people are eager to get into the cryptocurrency action.

If a forex broker can add leverage into the mix it will have a very attractive product to and engage its and client base and generate new trading volume. In this series, we will delve into various aspects of Liquidity for cryptocurrencies.

IS THIS RELEVANT FOR YOUR BUSINESS? GET LIQUIDITY HERE

How are LPs able to offer crypto liquidity?

Brokers can get cryptocurrency liquidity in one of 3 ways.

Market making cryptocurrency LP

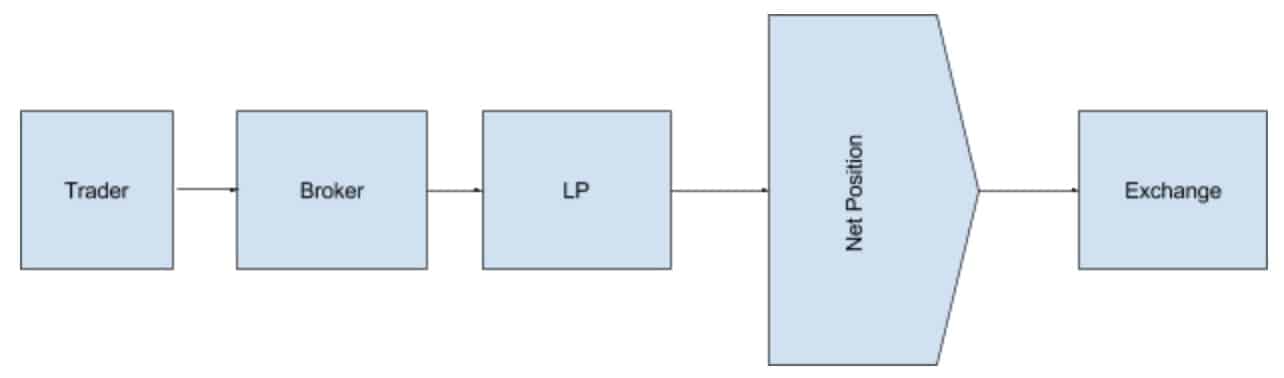

Brokers can go to a cryptocurrency LP that is acting as a market maker. The LP is simply acting as the market maker of a CFD. They can run a book for the cross rate between Bitcoin and USD or Bitcoin and EUR. What they do is accumulate the risk and hedge off any net positions directly with crypto exchanges such as Kraken or Bitfinex. In order to do that, they need lots of capital and some kind of a market making algorithm. Currently, there are a few broker LPs that do this.

STP to exchanges

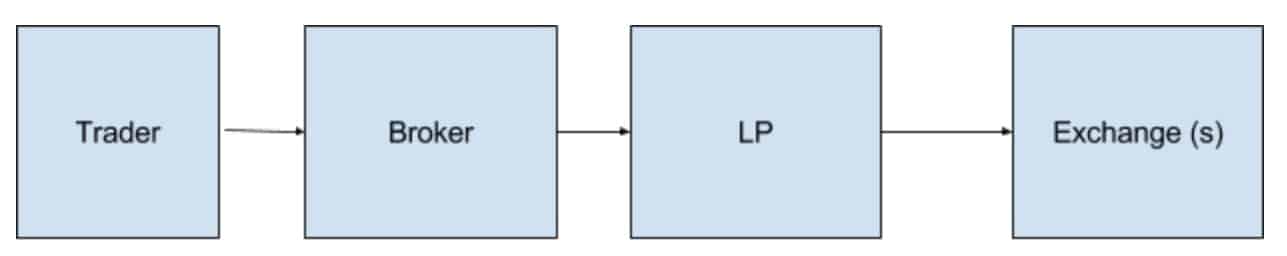

Brokers can go to a cryptocurrency LP that has an STP model to exchanges. In this case, a crypto LP (which is typically another broker) will be either connecting and sending off all trades to a single exchange or aggregating multiple exchanges.

When a broker LP connects to these crypto exchanges, it can offset their client trades into these exchanges and thus be able to offer the cryptocurrencies to its client base.

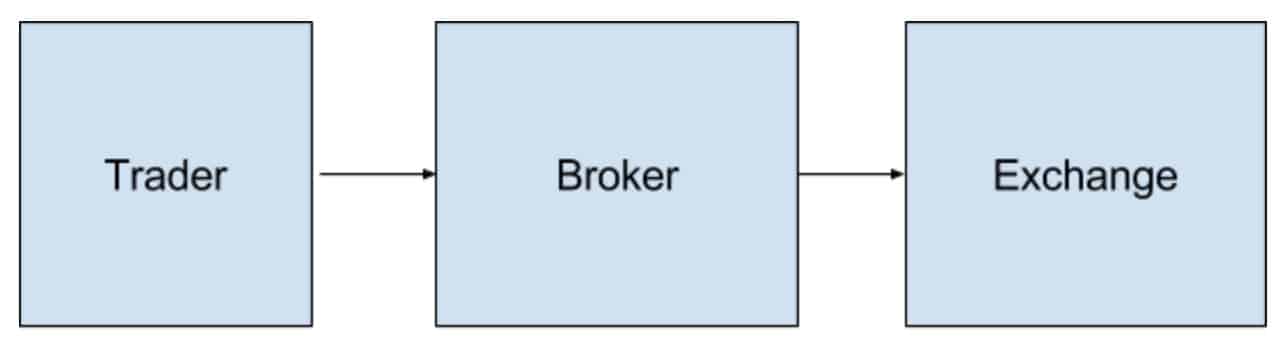

Direct cryptocurrency exchange

As the subtitle suggests, brokers can connect directly to an exchange and send client trades to it.

It is important to note that each of these three options has its unique advantages and disadvantages and brokers can choose one of these options or a combination. We will discuss the advantages and disadvantages of each of these in subsequent articles in this series.

To touch upon it briefly, going to an STP LP or multiple STP LPs that are aggregating liquidity is safer and much easier to deal with than going to an exchange. And going to an LP that is a market maker can provide brokers with higher leverage.

BTC/USD price chart. Source: Google Finance

How do cryptocurrency products work?

Brokers can connect to crypto LPs over FIX API. Integration is much simpler with broker LPs than with exchanges.

Because certain broker LPs are already integrated into popular connectivity providers such as PrimeXM or OneZero, brokers that use these LPs will be able to offer cryptocurrencies right on their Metatrader platforms.

Certain crypto LPs will connect multiple exchanges over FIX API into their connectivity provider

This can be very attractive to clients. They will not need to open any additional accounts or even log into additional platforms. A trader will be able to trade EUR/USD, Dax and crypto pairs such as BTC/USD or ETH/USD on Metatrader.

Here are some additional aspects of the operation:

Instrument

Crypto pairs are typically available on the higher market cap cryptocurrencies. Some include Bitcoin (BTC), Etherium, Litecoin, Dash, Ripple and more. These are typically crossed with USD, EUR, GBP, and JPY.

Leverage

Leverage offered depends on the business model of the LP:

If the LP connects to the exchange and all trades go to the exchange, the leverage offered is the same as it is on the exchange. This is typically around 3:1.

If the LP makes its own market, the leverage offered can be a bit higher depending on how deep the pockets of the LP are. Some offer leverage as high as 20:1 but most are around 10:1 or even 5:1.

Don’t be fooled by the fact that leverage is way lower than FX. Cryptocurrencies are extremely volatile. Some move as much as 20% in 1 day. So even at 2:1 and 3:1, price and account swings can be massive.

Commission

Commissions charged by cryptocurrency LPs are fairly similar to those charged by exchanges.

The commission is calculated based on the percentage of the dollar value of the transaction. For example, an LP may charge 25 basis points (or .25% per side).

Here is an example of how this would work: if Bitcoin is trading at $2000 and a trader buys 10 contracts of BTC/USD, he would pay $50 in commissions.

$50 is calculated as follows. $2000 x (.25%) = $5.

$5 x 10 Contracts = $50.

Regulation

Cryptocurrencies by their very nature are not regulated. And of course crypto exchanges are all unregulated. Traditional regulators are also currently not equipped to deal with a cryptocurrency offering because it’s so new.

For these reasons, most of the crypto LPs are offering crypto liquidity through their offshore entities that are not as heavily regulated. These include jurisdictions like Nevis, Vanuatu, St. Vincent.

Connecting to crypto LPs is fairly straightforward

To put customers at ease, many of these brokers are large and have entities that are regulated by major regulators such as the FCA and ASIC.

Also, crypto LPs don’t require a huge margin deposit from their broker clients. Typically a starting point of 10,000-20,000 is sufficient and some will even agree to work on a credit arrangement.

Of course, as the business grows more margin may be required, but that’s a good problem to have.

How can brokers connect to crypto LPs?

With the cryptocurrencies in place on MT4, brokers can entice current clients to trade them. Use them to engage dormant accounts and accumulate new accounts.

[gptAdvertisement]

The moves on cryptocurrencies are so huge that traders will be jumping at the chance to trade them on leverage.

Because cryptocurrencies are gaining popularity so fast, more and more education, signal and robot products will be coming out for crypto trading and investing and marketers will be looking for places to send their business so brokers should be prepared to capture it.

How can brokers engage their clients to trade cryptos?

With the cryptocurrencies in place on MT4 brokers can entice current clients to trade them. Use them to engage dormant accounts and accumulate new accounts.

The moves on cryptocurrencies are so huge that traders will be jumping at the chance to trade them on leverage.

It is extremely hard to imagine a future without cryptocurrencies as a tradable instrument

Additionally, new cryptocurrencies are coming out all the time. Brokers can update their client and prospect base about the crypto offering, crypto moves and crypto investment opportunities in a newsletter every week.

To conclude, it is extremely hard to imagine a future without cryptocurrencies as a tradable instrument, a form of payment, hedging product, and an investment vehicle. As brokers are in a race to gain market share by adding this exciting product to their instrument list, Nekstream and LQ Edge have deep rooted relationships with crypto LPs and can help you get set up and accumulate more live accounts by adding this exciting product.

Alex Nekritin is the Managing Director of Nekstream Global, a liquidity and technology consulting company helping brokers, HFT traders and money managers to find proper liquidity and tools for their ventures. Alex has over 10 years of experience in the financial space. Contact Alex at info@nekstream.com.