Traders Continue to Be Enchanted by Tether’s Stablecoin

Not every American football player ends up marrying a global pop superstar – taking a job in the private sector is a much more common career path. But as Bo Hines gets his feet under the table at Tether after leaving the Presidential Council of Advisers for Digital Assets, the platform’s stablecoin continues to top the charts.

Digital assets meet tradfi in London at the FMLS25.

Figures from analytics firm RWA.xyz show that USDt attracted more inflows than any other stablecoin over the last quarter, generating $19.6 billion of the more than $46 billion that has gone into these cryptocurrencies over that period.

Tether does well from the yield on the US Treasuries its tokens are backed by – so well, in fact, that it is reportedly expecting a valuation of $500 billion from a forthcoming private placement. In April, one of the major banks estimated that Tether could soon become one of the three largest purchasers of the US government’s short-term debt instruments.

The co-founder of interoperability platform Wormhole has warned that the gravy train will not run forever and that stablecoin holders will increasingly expect to benefit from that yield – and will be willing to take their business elsewhere if they do not.

You may also like: Integral Launches Stablecoin-Based Crypto Prime Broker

Bringing Hines on board can be seen as part of Tether’s strategy to protect its business if the retail side becomes less lucrative. The new CEO of USAT has been charged with building the platform’s profile as a regulated entity among the institutional community and using the US government’s desire to use stablecoins to maintain the dollar’s status as the world’s reserve currency.

Expected to launch around the end of the year, USAT will be compliant with the provisions of the GENIUS Act and will be managed and operated domestically.

A new report from Citi has projected that stablecoin issuance could reach as high as $4 trillion by the end of the decade, driven by digitally native companies. The bank says there is scope for a number of issuers to co-exist and predicts a corresponding increase in demand for US Treasuries.

We will soon find out if the institutional world is ready for it.

Read more about Tether:

- Tether Wants a $500 Billion Valuation

- Tether Launches USA₮ Stablecoin, Names Former Trump Crypto Adviser as CEO

- Europe’s Stablecoin Moment Is Now, as Dollar Wanes Under Trump’s Economic Agenda

Crypto and Sport – ‘Everything Has Changed’ or ‘Nothing New’?

Football NFTs were a financial and public relations own goal. Many fans were persuaded by the promise of owning a virtual part of their club and the marketing material featuring various club icons, only to find there was no market for their tokens when they tried to sell them.

The new wave of crypto involvement in football promises to be less contentious.

On Monday 25 August, Newcastle United lost a dramatic game to English Premier League title holders Liverpool. The League Cup holders got a better result off the field the following day, securing a long-term deal with blockchain centralised exchange BYDFi to become the club’s official cryptocurrency exchange partner.

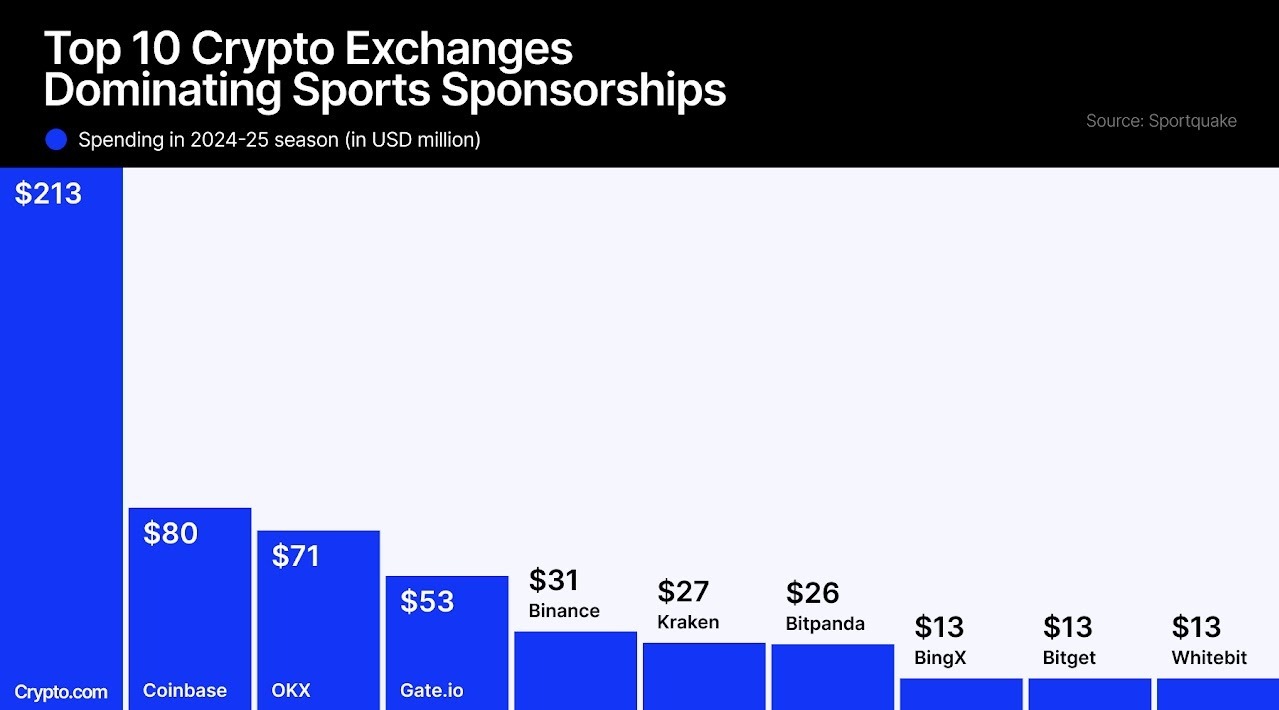

This is the latest example of cryptocurrency sponsorship in the sports sector, which is currently dominated by football-related partnerships. Data from global sports marketing agency SportQuake suggests that crypto brands spent around $565 million on sports sponsorship over the last year, the highest level since the crypto winter of 2022/23.

More than half of the teams in the Premier League already have crypto partnerships. Crypto.com and Gate.io have commercial relationships with Europe’s football federation, and Kraken’s brand can be seen on the sleeves of several European club jerseys.

Luke Jackson, sports and technology director at law firm Walker Morris, observes that as the 2026/27 season ban on gambling front-of-shirt sponsorships draws closer, clubs and other rightsholders are becoming increasingly inventive in how they look to maximise their commercial revenue. As a result, he anticipates a shift from a heavily gambling-oriented market towards crypto and other sectors.

With some crypto exchanges believing there is a role for blockchain technology in the transfer market, it makes sense to deepen ties with major sporting bodies. A small number of player transfers have been paid in cryptocurrency, and proponents claim the removal of cross-border payments could save clubs money on fiat currency conversion.

With wages outpacing revenues, football clubs across the world will be hoping it is not only the players who are better off as a result of closer ties with crypto.

Prediction Markets Not Yet Out of the Woods

Robinhood is limbering up for the latest round in its fight with a US state’s chief legal adviser over prediction markets. This time it is going up against Massachusetts over whether prediction markets constitute gambling.

It was inevitable that brokerage firms’ desire to tap into new markets would run up against America’s complex gambling laws at some point. Exchanges argue that speculating on the outcome of a sporting event is no different from speculating on the movement of a stock, while state lawmakers observe that prediction markets are a form of sports betting that necessitate state licensing.

Sports betting rules differ from state to state and there is a lack of clarity from regulators such as the Commodity Futures Trading Commission over whether prediction markets are just gambling by another name.

In accordance with the Commodity Exchange Act, the trading of derivatives on officially sanctioned exchanges is subject to the exclusive authority of the CFTC, indicating that state gambling regulations ought not to intervene. Massachusetts holds a different view, arguing that prediction markets fundamentally resemble sports betting and therefore require state licensing, regardless of federal regulation.

Earlier this week, Sleeper Markets filed a civil suit against the CFTC, alleging the regulator unlawfully blocked its application for a futures commission merchant licence in a decision that unfairly favours competitors and immediately harms its business.

The dispute in New England and the District of Columbia has not deterred sports gaming firm Underdog from partnering with Crypto.com, with the company’s CEO describing sports as the future of prediction markets.

In the meantime, Robinhood is no doubt waiting for the day when it can ask: “Is it over now?”