"When the loudest person in the room is shouting 'Buy,' the smartest person is usually looking for the 'Exit' sign," says Constantinos Shakallis, CEO of Scope Markets EU, warning that Wall Street's aggressive gold price targets may be creating exit liquidity for institutions rather than genuine investment opportunities for retail traders.

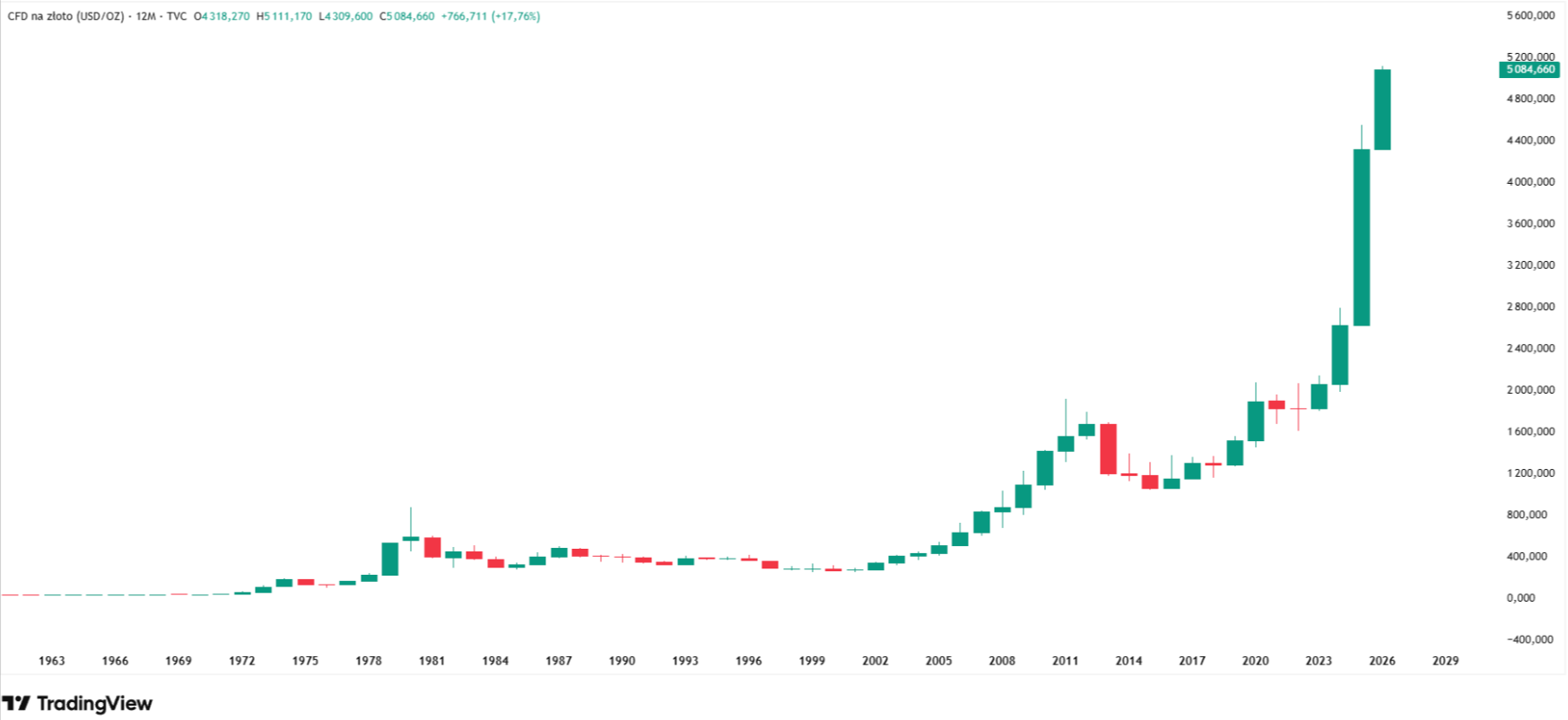

Gold's parabolic rise, 65% in 2025 and 18% in just the first 26 days of 2026, has sparked what Shakallis calls "a psychological contagion" across social media and trading communities.

The precious metal is dominating conversations on X feeds and Telegram groups, with retail traders treating Goldman Sachs' $5,400 forecast and Bank of America's $6,000 whisper number like gospel. But the Cyprus-based brokerage executive, who watched his country's financial crisis unfold from the front row in 2013, sees troubling parallels to past market manias.

"This reminds me of something. I have seen this movie before and we in Cyprus had a front-row seat for the previous sequels," Shakallis wrote in a LinkedIn post Sunday evening.

"It was the 'dot-com' elevators of 1999, the 'house prices only go up' frenzy before the 2008 crash, and the crypto-mania of 2021."

Institutional Permission Fuels Gold Retail FOMO

The rally isn't happening in a vacuum. As mentioned above, Goldman Sachs recently raised its December 2026 target to $5,400, citing structural shifts in private-sector diversification away from dollar assets.

Bank of America analysts have gone further, with some strategists predicting $6,000 by spring as the "debasement trade" accelerates amid Federal Reserve independence concerns and geopolitical tensions over Greenland.

- Gold’s Structural Shift: Why Liquidity Models Must Evolve

- Plus500 Enters Weekly Options Game with Gold, Oil and Indices

- Why Silver Is Surging With Gold and Why Analyst Predicts $375 Price in 2026

These institutional calls are giving retail investors what Shakallis describes as "permission" to chase gold at $5,000, believing there's still 20% upside to capture.

But “history shows that institutions often use this retail 'buy-side liquidity' to exit their own massive positions without crashing the price," Shakallis said.

The warning comes as gold trading volumes surge across platforms, with precious metals now accounting for the majority of CFD activity at several major brokers.

Even crypto exchanges like BingX report gold contracts generating over $500 million in daily volume, a testament to retail appetite for the rally.

When Safe Havens Act Like Meme Coins

Shakallis doesn't mince words about the current market dynamics.

"How can a market survive when its 'safe haven' starts behaving like a meme coin?" he asked, comparing gold's vertical price action to speculative crypto assets rather than traditional store-of-value behavior.

The technical picture supports his concern. Gold is currently trading nearly 20% above its 200-day moving average, a level that historically precedes mean reversion.

"A market that goes parabolic is a market that is breaking. Gold rose 65% in 2025 and is already up 18% in the first 26 days of 2026. This is not 'healthy growth' it is a vertical limit," he wrote.

The last time gold experienced this kind of euphoria, the aftermath was brutal. In January 1980, gold hit a then-record $850 per ounce before losing 57% of its value over the next two years. Investors who bought at the peak needed 28 years just to break even.

Macro Catalysts Are Real, But So Is the Rubber Band

For the first time in 30 years, gold has surpassed U.S. Treasuries as the world's largest foreign reserve asset, with Poland, China, and India leading a central bank buying spree five times higher than pre-2022 averages.

"They are no longer just 'investing'; they are insuring their reserves against a world where fiat assets can be frozen or sanctioned at will," he noted.

Yet even with these structural tailwinds, the pace of gains raises sustainability questions. Scope Prime, the institutional arm of Shakallis's parent company, recently adjusted gold spreads in response to CME margin requirement changes.

The Offloading Trap Awaits

Shakallis admits he could be wrong. If the dollar truly collapses and geopolitical maps get redrawn by force, gold might not just hit $6,000, it could become the only functioning currency.

But his core message remains cautionary.

"In every cycle, high-profile bank targets can lure retail investors into high-risk entries at the absolute top of the mountain, providing the exit liquidity the big players need to take profits."