Poland is one of Europe’s biggest success stories. It is home to the sixth largest economy in the European Union and the largest of the former countries associated with the Soviet Union in the bloc.

Not only that, but the country’s prospects for the future continue to look bright, despite an economic downturn expected for Europe. But can the same be said for the country’s foreign exchange (Forex ) industry?

Poland: The EU success story

Since 1989, Poland has been achieving high levels of growth and is closing the gap with Western Europe. As highlighted by the World Bank, Poland’s economy continues to perform strongly.

In 2018, real GDP growth reached 5.1 percent. This was largely driven by domestic consumption and accelerating investments, the organization said. Not only that, but unemployment is below four percent.

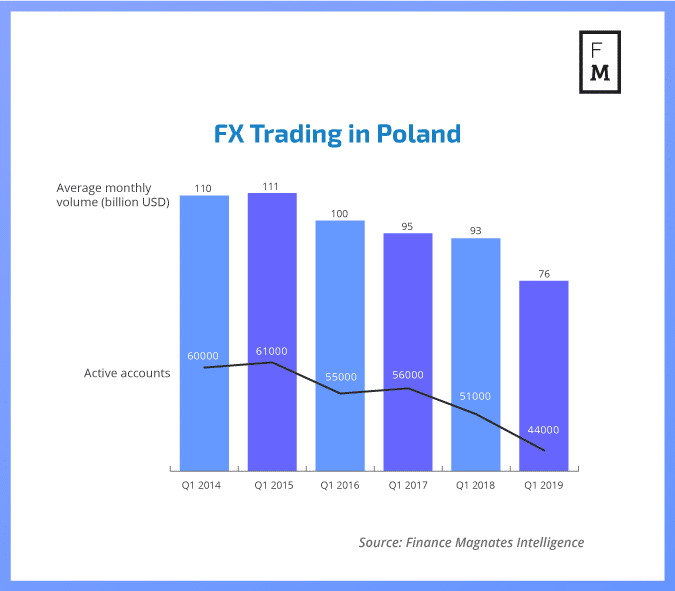

So how does the FX industry hold up? According to data collected by Finance Magnates Intelligence, the average monthly forex volume was $76 billion in the first quarter of 2019 in Poland, and there were 44,000 active accounts in the country during the period.

As outlined by the graph below, this represents a decline when measured against the volume and number of accounts in the first quarter of previous years. In fact, over the past years, we have witnessed an overall decline in FX trading in Poland.

The Bank for International Settlements (BIS) highlighted that in April of 2016, the average daily net turnover in the domestic foreign exchange market amounted to USD 9,116 million. This was an increase of 21 percent at current exchange rates when measuring against April of 2013.

Trading in Poland

Although part of the EU, Poland has retained its local currency - the Polish złoty (PLN). Nonetheless, for traders in Poland, it’s the majors that still get the most attention, such as the EUR/USD and GBP/USD. According to XTB, the leading Poland-based broker, the most popular instruments in Poland are also those based on Dax and US indices.

In terms of commodities, market favorites such as oil and gold are also Poland’s top choice. As highlighted by XTB, one characteristic of Poland is that the USD/PLN pair is also among the top 10 most popular trading instruments.

In terms of trading behaviors, XTB surveys show that between 75 percent and 80 percent of Polish traders are speculative risk takers. Under 25 percent are long term investors, who are more reluctant to take on risk.

ESMA’s impact on Poland

Since the implementation of the product intervention measures from the European Securities and Markets Authority (ESMA), data reported by eight brokerage houses regulated by the Polish Financial Supervision Authority (KNF) shows that the average level of profitability of retail investors has increased noticeably.

In 2018, approximately 40 percent of Polish traders made a profit (or at least did not incur a loss) on the Forex market. In Q1 2019, this value reached a record level of 48 percent, and in the second quarter of 2018 (before the product intervention came into force), it was lower by ten percentage points.

Polish traders look offshore

Although client losses have fallen since ESMA’s measures were implemented, it hasn’t been completely good news for Poland. Since August of 2018, brokers in the country have seen a fall in trading activity and client losses, as retail traders turn to other geographies to trade with less restrictive leverages.

XTB, the leading Poland-based brokerage, was one of the many European brokers to suffer under ESMA’s measures. Speaking to Finance Magnates, Filip Kaczmarzyk, Member of the Management Board and Head of Trading Department at X-Trade Brokers DM S.A. highlighted that the broker has seen client losses post-ESMA.

Filip Kaczmarzyk, Head of Trading Department at XTB

“Clients’ attitude has not changed because of ESMA. Moreover, we experience outflow of clients to foreign jurisdictions, which allow higher leverage,” Kaczmarzyk said.

“This shows that clients are actively looking for low margin trading. Polish Chamber of Brokerage Houses has carried out a survey, which showed that leverage is the most important feature in online trading and clients are ready to or have already moved in search for best trading conditions.”

Retail traders value leverage, above all else

The Chamber of Brokerage Houses, a self-regulatory organization in Poland, polled traders to see what impact ESMA’s measures had on their trading. According to the survey’s results, half of the respondents contemplated moving their trading account outside the EU.

Specifically, for 99.6 percent of investors, the reason for moving brokerage accounts to countries not covered by the ESMA product intervention was the possibility of using higher leverage.

Out of the investors surveyed, 84 percent nonetheless support the introduction of protection against Negative Balance , and 40 percent of them agree with the introduction of a standardized risk warning.

When speaking about the effect the measures have had on XTB, Kaczmarzyk continued: “The effect has been the same as anywhere else. The branch recorded a sharp drop in client volumes and outflow of clients.

“However, XTB has a very good financial standing and is heavily diversified both geographically and product-wise, so we are focused really hard on recovering from that drop as soon as possible.”

Poland to switch up ESMA’s measures

As Finance Magnates has reported extensively, many European countries are adopting their own permanent national product intervention measures. Although many have chosen to largely copy ESMA’s temporary measures, countries like Cyprus, have chosen to do things a little differently.

Poland is also looking at being one of these countries. Although the KNF has not officially confirmed its intentions so far, one of the institution's executives did speak about its current activities and future plans in a recent interview.

In that interview, the Director of the Department of Investment Companies in the Office of the KNF, Maciej Kurzajewski, said that the KNF is considering the possibility of introducing a third group of traders, on top of the current retail and professional clarification.

The new category, dubbed “experienced trader” is supposed to be somewhere in-between the current two statuses as defined by ESMA. However, Kurzajewski did highlight that this new category is only a concept and nothing has been formally established yet.

However, in the opinion of the KNF, such a solution would allow keeping experienced traders in Europe, who, according to industry reports, have started the migration to off-shore brokers offering much higher leverage levels and trading freedom.

XTB welcomes "experienced trader" category

Having been negatively affected by client outflow, XTB is onboard with the KNF’s idea of adding a third category: “Introducing an “experienced trader” category is something we are all looking forward to,” added Kaczmarzyk.

“However, it is not only the category that is important, but also how it is going to be calibrated, what kind of clients will be allowed to achieve that status and what the offered trading conditions are going to be. If the conditions turn out to be too strict or the leverage gain is too small, there will be no effect on the business as the client outflow will remain.”

Is the future for Poland’s FX industry bright?

Like all markets in Europe, due to tightening regulation, the market is likely going to go through a consolidation where smaller brokers will inevitably go out of business as they can’t keep up with the rising compliance and other costs regarding regulation.

This means, traders in Poland, as well as other European countries, will have less local or EU-based brokers to choose from. Nonetheless, XTB believes that for larger brokers, this will be a beneficial change.

“XTB has a very good financial standing and we are focused on expanding our offer all over the world. We think we should be able to grow steadily in the coming years. However, in the longer term, I think consolidation on the Polish market is inevitable and some of the brokers will be forced to cease their FX/CFD offer, which we see as a chance for us,” Kaczmarzyk concluded.