“If you stumble upon a crypto press release on a news site, odds are better than 50/50 that the project behind it is of low credibility or worse,” Tal Shmuel Harel, co-founder of Chainstory, told FinanceMagnates.com.

His warning comes as Chainstory’s new research exposes how the crypto press release industry has evolved into a distribution channel for market manipulation, with dubious projects exploiting pay-to-play platforms to bypass editorial scrutiny and manufacture credibility.

“Better Than 50/50 the Project Is Low Credibility”

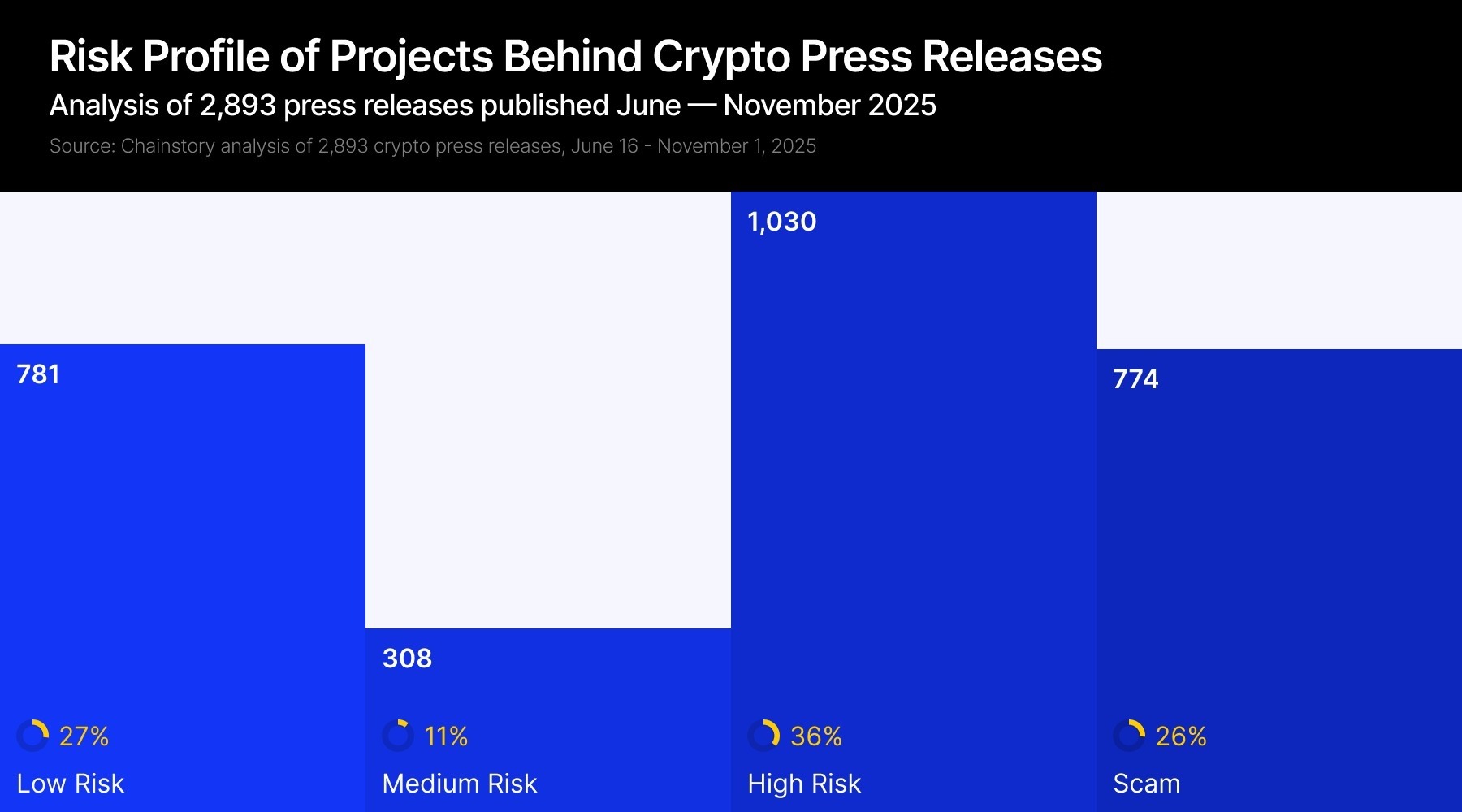

An analysis of 2,893 press releases published between June and November 2025 found that 62 percent came from projects flagged as high-risk or outright scams. In the cloud mining sector specifically, 90 percent of issuers fell into those categories.

More than half of all releases covered routine events that traditional newsrooms would dismiss, including product tweaks, exchange listings, or token sales. Only 58 releases, roughly 2 percent, related to substantive developments like funding rounds, mergers, or research reports.

- Binance Reworks SAFU Reserves, Shifting $1B From Stablecoins to Bitcoin

- South Korea Proposes Crypto Exchange Ownership Cap; Upbit, Coinone May Reduce Stakes

- Following Bitcoin and Ether, Grayscale Files with SEC for Spot BNB ETF on Nasdaq

The largest category, representing 49 percent of releases, consisted of product or feature updates. Another 24 percent announced trading listings or exchange promotions.

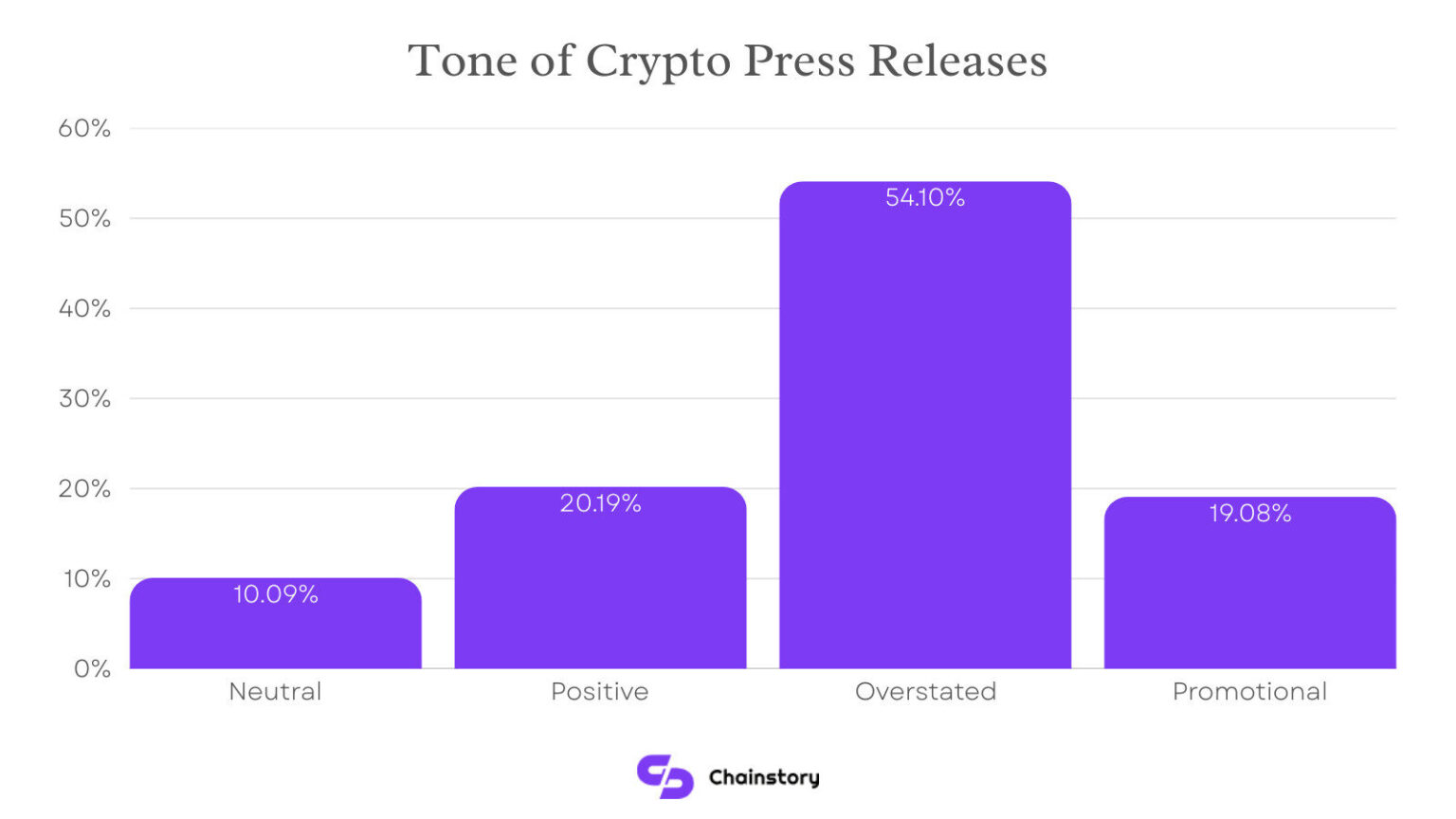

The tone skewed heavily promotional. Roughly 54 percent were tagged as “overstated” and another 19 percent as “promotional.” Only 10 percent used neutral, factual language.

Fake Walmart Partnership Exposed Systemic Weakness

The vulnerability of press release systems came into sharp focus in September 2021, when a fake announcement claiming Walmart would accept Litecoin appeared on a traditional newswire. Major outlets including Reuters and CNN initially reported the story, sending Litecoin's price up roughly 30 percent in minutes before Walmart denied the claim.

“If a fake press release could dupe even Reuters and CNN, it's easy to imagine how everyday retail crypto investors, who see press releases on aggregator sites or social media, might be misled by the steady stream of paid announcements that look like real news,” Chainstory notes in its report.

Distribution services claim to perform compliance vetting, but by their own admission, it's impossible to rigorously fact-check thousands of daily releases. The onus falls on clients to be truthful, creating what the report calls a “fox guarding the henhouse” scenario.

Projects Buy Credibility Through Guaranteed Placement

Crypto-specific distribution platforms operate differently from traditional services like Business Wire or PR Newswire. Instead of syndicating announcements to journalists for review, crypto wires sell guaranteed placement across partner websites, bypassing editorial filters entirely.

Projects with a few thousand dollars can secure publication on dozens of sites, including some that auto-post releases in sections labeled “Press Release” rather than “Sponsored Content.” This creates what the report describes as a “false hierarchy” where paid announcements shed the stigma of advertising.

Harel explained that distribution platforms have exclusive contracts with crypto websites and are motivated to push high volumes of releases.

“A few years back, the service was called ‘article placements’ or ‘link building brokerage,’ where everything was handled manually,” he said. “This model is a bit more sophisticated since there's software in place, which is integrated in third-party websites and acts as a ‘bridge’ to publication, designed to place advertorial content at scale and high volumes.”

Exchange Listings Create Illusion of Activity

Major exchanges flood press release channels with listing announcements to signal constant activity, even for obscure tokens that mainstream outlets would ignore. The practice serves multiple purposes: satisfying token projects that expect promotional support, generating permanent web pages for search optimization, and creating the appearance of dynamic growth.

The SEO strategy largely fails due to duplicate content filters. When identical text appears across dozens of domains, search engines typically index only the original source while hiding remaining placements. Clients pay for guaranteed placement on 100-plus websites believing they've bought visibility, but most links remain hidden from average users.

Buzzword Bombing Targets Retail Investors

Press releases frequently deploy trending terminology – AI, NFT, DeFi, Web3, Layer-2, Metaverse – regardless of actual relevance to the project. Titles read like clickbait designed to trigger FOMO: “Project X Blazes Into Web3 with Unprecedented Growth,” “Startup Y Tops Global Charts in Security.”

“This keyword bombing approach is a hallmark of promotional writing aimed at investors and not genuine tech announcements,” according to the analysis.

Any seasoned editor would recognize such language as a rejection flag, which is precisely why these projects bypass editorial channels entirely.

Research shows automated trading algorithms compound the effect. Some bots scrape news feeds for keywords like “partnership” or “launch” to execute trades. A press release crossing the wire with the right buzzwords can trigger algorithmic buys before anyone realizes the source was just paid placement with no external validation.

Regulatory Gaps Leave Enablers Unscathed

The FTC hasn't enforced native advertising transparency rules against crypto newswires despite clear violations. Harel attributes this to regulatory bandwidth.

“In fast-moving markets, regulators typically target the ‘obvious’ fraud after investors cry foul, which is the projects themselves, while the 'enablers' (the distribution platforms) remain under the radar,” he said.

The SEC has prosecuted stock promoters for issuing misleading press releases to pump prices, with data from 2002–2015 showing press releases appeared in 73 percent of 150 pump-and-dump cases targeting penny stocks.

“Distribution platforms shield themselves with Terms and Conditions that dump all accountability onto the issuers, claiming it's ‘impossible’ to fact-check every claim,” Harel said.

“On the other hand, their publishing partners shield themselves by hosting these releases with minor disclaimers, often with paid disclosures omitted, effectively acting as a ‘convenience’ for readers while profiting from the placement.”

Information Quality Crisis Threatens Market Integrity

The proliferation of unvetted promotional content disguised as news creates an alternate reality where every project appears best, biggest, safest, and revolutionary according to its own paid output.

Harel warns that investors cannot rely on single sources of information. “In an environment where even Tier-1 outlets can be manipulated or rush to report inaccuracies, relying solely on unvetted press release distribution platforms is a recipe for disaster,” he concluded.