The Finance Committee of the Knesset, the Israeli Parliament, ratified today for the first time ever regulations on the financial trading industry, mandating that Israeli brokers must acquire a licence, limiting the maximum Leverage offered to traders and implementing various other requirements.

Maximum leverage on marginal trading was an issue that Israeli brokers were very concerned about, and it was finally clarified today. Currencies and gold-based trading is now considered low-risk in accordance with the law and can offer 100 to 1 leverage. Stock Market Indices of seventeen developed economies, as well as Government Bonds of Israel, U.S and countries with AA rating are considered medium-risk and CFDs based on them can carry maximum leverage of 40 to 1. All other trading instruments will automatically be considered high-risk and can only offer leverage of 20 to 1.

In 2010, the Knesset had already passed an amendment to the Israeli securities law with the aim of regulating the country's Trading Arenas (as the law refers to FX and CFD brokers). But since then and up until today the regulations that validate the law have not been ratified. Brokers in Israel have been operating completely free of regulations or licensing and the Israel Securities Authority (ISA) has repeatedly called for urgent action to be taken by lawmakers in what it considered a dangerous market following a number of high profile lawsuits against brokers.

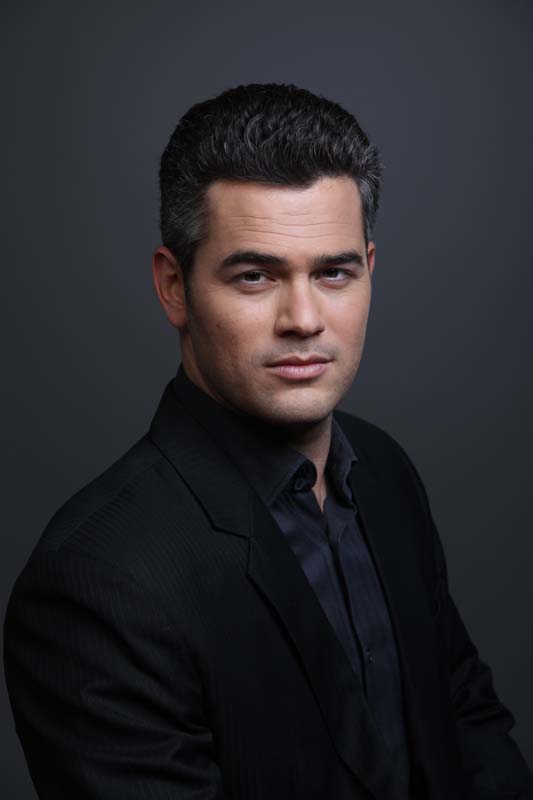

Boaz Toporovsky, Chairman of the Securities Sub Committee, Knesset

Boaz Toporovsky, Member of Knesset and Chairman of the Securities Subcommittee of the Israeli Parliament, who has been leading the legislative process until today, commented after the approval: "It is important to have regulations in this unguarded field enabling both safe investments and the continued operations of the trade arenas after years of no regulation. I am happy that we reached this day following discussions with the ISA and the trade arenas in finding the middle road to protecting citizens. Today we regulated a new and promising market in Israel, another path for investment and economic activity that is under the tight control of the ISA."

Answering Forex Magnates' questions following the approval, regarding the possible effects the regulations will have on the brokers and traders in Israel, Toporovsky said: "It is clear to me that the regulations will cause some trading arenas to cease their business in Israel, some to merge and some to apply for a license according to the law. It makes sense that there will be a fewer number of arenas that can overcome all the control hurdles, but at the end of the day - our goal is one - to protect the citizens and ensure fair trade. In my opinion, the number of traders will grow and they will turn the market much more active and vibrant, as they will be assured their money is under the supervision of the ISA. When a citizen will feel safe and understand that the arenas are are under the watchful eyes of the ISA they will understand it can be a safe and legitimate investment."

The Chairman of the ISA, Professor Samuel Houser, commented today: "I see great importance in regulating the trade arenas field they operated until today without regulatory supervision and without proper protection of the public interest. These measures of control and licensing are meant to guarantee the client funds will be safe and making sure that there will be commercial fairness in the operation and the marketing of the arenas and in protecting client funds."

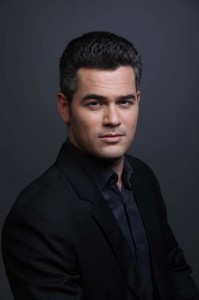

Tal Itzhak Ron, Managing Partner & Chairman, Tal Ron, Drihem & Co

This law comes as no surprise to those who work or provide services to companies within the local market and had to prepare for the regulations. An Israeli lawyer who renders legal services to 130 brokers operating in the FX industry, Tal Itzhak Ron, told Forex Magnates that this bill sets a similar standard as in Europe, USA and similar developed financial markets. He said: "On the one hand it will allow Israeli clients to trade in a higher volume with their brokers, and in a more secure manner, while on the other hand it will set the standard for all brokers operating in this field, while this regulation should be more flexible and easier to implement than the European one, while the capital requirements shall be a bit more reachable."

Main New Aspects of the Regulation:

1. Licensing – Brokers will now need to apply to the ISA for a licence to operate in Israel.

2. Reporting - Brokers will now need to file reports to the ISA to insure client funds.

3. Leverage – 5% for high-risk financial product, 2.5% for medium-risk and 1% for low-risk.

4. Conflict of Interests - Brokers will now no longer be able to represent a client unless they explain their counterposition to the client. Brokers will not be able to offer advice on any product that they offer.

5. Client Funds – Customers’ money will need to be held in 3rd-party trust accounts, segregated from company funds. Brokers will not be able to use a client’s money without his/her approval.

6. Client Reports - Brokers will now need to present clients with biweekly and monthly reports about all their activity, including deposits, trades, commissions, charges and interest.

7. Client Adequacy Verification - Brokers will now need to make sure that the client is eligible and fully understands the financial mechanism they operate, and to verify that the client is not a minor and is sufficiently competent. Additionally, the firm needs to document the entire procedure.

FX Industry in Israel

In our Q2 2014 Quarterly Industry Report, Forex Magnates reviewed the state of the Israeli FX business, the country's impressive financial technology hub and the possible effects of the regulations which were finally passed today. Such country reports and many other types of high level quality analysis make the Forex Magnates' QIR essential reading to everyone involved in the FX industry. For a free preview of the report, please click here.