This article was written by Marcus Taylor who is the Chief Marketing Officer of TradeSocio.

The foreign exchange industry is not getting any less competitive. As a result of this, acquiring and retaining traders is becoming increasingly difficult and expensive. Because of this a lot of brokers are re-evaluating their marketing strategies. Below are ten predictions that I believe we’ll see in the FX industry this year, purely from a marketing perspective. Please feel free to add your own predictions in the comments below.

1. FX brokers will adopt big data

The FX industry has been talking about big data for a while now. Yet few brokers actually use it. In fact, it’s not uncommon to see brokers stuck in the dark ages of Excel spreadsheets and poorly configured Google Analytics setups.

So, why is big data so valuable to brokers? Because it enables brokers to predict a trader’s future behavior ahead of time with a high degree of accuracy. You can, for example, predict whether a trader is about to leave to another brokerage, and then have your sales team reach out to him.

With more and more technology being developed to help brokers harness and make sense of the reams of data being pumped through their MT4 servers, I think 2016 will be the year that brokers finally adopt big data.

Marcus Taylor, CMO, TradSocio

2. An increase in content marketing

While not exactly new, content marketing is one of the smartest long-term marketing strategies from a digital marketing standpoint. Not only does producing a constant stream of content (such as blogs, videos, and ebooks) help attract and engage traders, but it compounds.

While your first 2-3 months of content marketing may be quite grueling, as you’ll be putting in a lot of effort with only a minimal amount of traffic to show for it, you will eventually reach a point where you have 100, 200, or 500 blog posts - all bringing in ~100 visits per month. As you build this bank of content, you’ll soon reach a tipping point where you’re organically attracting thousands of traders at no ongoing cost.

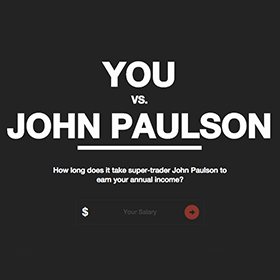

A few brokers are doing this exceptionally well already. MahiFX is one of the best examples with the ‘You vs. John Paulson’ infographic. I imagine we’ll see more brokers jumping onto the content marketing bandwagon in 2016.

3. A focus on landing pages and onboarding forms

I was recently chatting to a friend who told me that a brokerage he was working with had an exceptionally low conversion rate of 0.21%. From my own experience I’ve seen everything from 0.5% to around 4.5%.

Why such a variation? Well, branding and reputation obviously play a key role. However, the largest contributing factor is the design and user experience of the overall onboarding process. I know this, having personally quadrupled the conversion rate of an onboarding process using design elements alone.

With an increasing shift towards digital marketing, I think the FX industry will start to pay more attention this year to things like landing page optimization, and form usability. After all, it’s the main bottleneck in virtually all brokers’ marketing funnels (even the very good ones). An improvement here can literally increase the number of active traders by hundreds of percent.

The FX industry will start to pay more attention this year to things like landing page optimization

4. The year of mobile trading

Facebook estimate that over 30% of all trading activity currently takes place on a mobile device. While I imagine this is skewed heavily by the Asian markets, it wouldn’t surprise me if western brokers started to see mobile trading activity reach unprecedented levels. As apps improve, and trader expectations increase, brokers without mobile solutions will likely suffer and lose a significant number of traders to mobile-friendly competitors.

5. Marketing automation and retention technology will become widely adopted

In five years, the marketing automation industry has grown from being worth $225 million to $1.62 billion. Over the past few months forex brokers have started to catch onto this trend.

One of the biggest challenges facing brokers is retaining traders and increasing lifetime value through targeted marketing campaigns. Marketing automation tools solve this by enabling you to automatically setup personalized campaigns that are ‘triggered’ when certain criteria are met.

2016 will be the year where many brokers switch over from using email marketing software to more powerful marketing automation tools.

6. Brokers will take digital marketing focus in-house

Surprisingly, very few brokers have a dedicated digital marketing team. Yet, those that do seem to be doing extremely well. This makes sense given the increasingly online nature of forex trading.

Brokers need to start hiring top digital marketing talent and begin building dedicated teams around conversion optimization, search marketing, and paid acquisition. I strongly believe that the brokers who fail to do this probably won’t be around in five years’ time.

Currently, most brokers approach this by engaging external digital marketing agencies. This won’t suffice for long, as digital marketing is largely a zero-sum game (i.e. as an agency you can’t make all of your forex clients rank #1, or have the best cost per acquisition). As such, brokers will need to start hiring savvy digital teams in-house, and not externally.

7. Widespread adoption of social trading

The demand for copy and social trading has increased by over 400% in the past six months, according to search data from Google. Not only are traders increasingly looking for a broker with a social Trading Platform , but brokers are increasingly seeing the benefits of social trading on their conversion rates, retention, and acquisition.

Solutions available on the market make it easy for brokers to offer a high quality social trading offering, I think we’ll likely see a sharp increase in brokers adopting this technology.

(Photo: Bloomberg)

8. Media buying / Adwords budgets will shrink

The cost of media buying and PPC will soon reach a tipping point, where only a few brokers with highly optimized landing pages and offerings will be able to profitably acquire traffic.

I anticipate 2016 being the year where brokers currently relying on Google Adwords will start to consider other paid acquisition outlets like Facebook Ads, Twitter Advertising, Dianomi, Outbrain, and Taboola.

9. More sports sponsorships

2015 saw a wave of brokers jumping onto the sports sponsorship bandwagon. Going into 2016 I think we’ll see more of these, but executed in a more integrated way. It’s likely that we’ll see some brokers sponsoring individual players – or other high-value sports, such as golf.

10. An increase in marketing on instagram

Instagram has a very active community of affluent traders. In fact, you only need to search for the word ‘forex’ to see over 306,000 posts from traders sharing pictures of their cars and favorite Wolf of Wall Street quotes. Occasionally they even share content related to trading!

For brokers, there’s an opportunity to be a part of this community and reach new traders. However, it will need to be approached in a non-promotional way in order for brokers to actually build their followings.

And there we have it. They’re my ten predictions for 2016. Now it’s your turn - what do you think we’ll see more or less of from a marketing perspective this year?