Revolut has submitted an application to operate as a licensed bank in South Africa, filing paperwork with the country's Prudential Authority as it targets its first banking license on the continent.

The London-based fintech confirmed it has lodged a Section 12 application under the Banks Act, starting the regulatory process that typically stretches 18 to 24 months before approval or rejection.

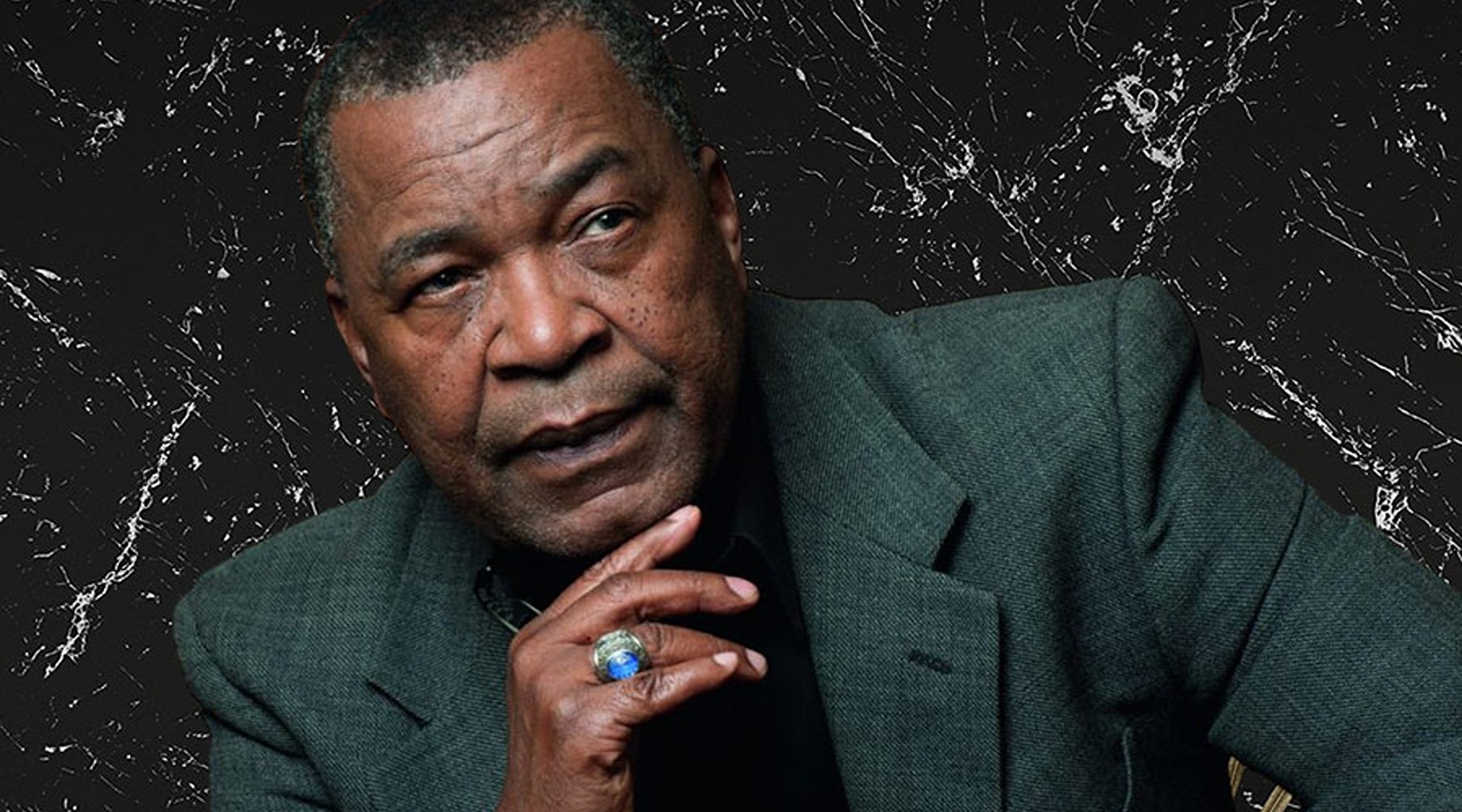

Revolut Names Veteran Banker as Chairman for South African Operations

To steer its South African operations, Revolut tapped Dr. Gaby Magomola, a four-decade banking veteran who previously ran African Bank and served as Deputy Chairman of the Development Bank of Southern Africa until recently. Magomola will formally assume the Chairman role in January 2026.

“Revolut has proven to be a catalyst for change in global finance, and I look forward to guiding its mission in South Africa,” Magomola said. “Our goal is not just to launch a product, but to champion greater financial access and innovation for everyone across the country.”

- Revolut Launches Dollar-to-Stablecoin Swaps Under New EU Crypto License

- Revolut Just Got Permission to Sell Crypto to 450 Million Europeans

Revolut continues to seek new markets, and the strategy appears to be paying off. Last week, the fintech reported that its Singapore unit saw a 125 percent surge in customers. In the second quarter, the company’s revenue reached $1.4 billion, growing by nearly 50 percent compared with 2024.

Crowded Field for Digital Challengers

Revolut's move puts it in direct competition with several digital banks already fighting for customers in Africa's most developed banking market. Old Mutual launched OM Bank in September after a near-decade buildup that included a 2022 license application and more than $135 million in technology investment. TymeBank claims over 8.5 million account holders, while Discovery Bank and Bank Zero have built smaller but growing customer bases since their respective launches.

The South African banking sector holds roughly 900 billion rand ($50 billion) in assets, with the five largest institutions – Standard Bank, FirstRand, Nedbank, Absa, and Investec – controlling nearly 90% of total sector assets as of March 2023.

Revolut operates with banking licenses in Lithuania, Australia, Mexico, and Japan, although the authorization in its home country, the UK, remains restricted. The company announced in September it would deploy $13 billion across global expansion efforts, targeting 100 million customers by mid-2027.

South Africa represents its entry point for Africa, with additional license applications underway in Mexico, Colombia, and Argentina.

Regulatory Gauntlet Ahead

If regulators move without delays, Revolut could receive initial feedback by mid-2026, with full approval possible in late 2026 or early 2027. A full license would allow the company to take deposits, extend credit, and offer multi-asset financial products under South African law.

Jacques Meyer, who runs Revolut's South African unit, said Magomola's counsel would prove useful as the company works through local regulatory requirements.

“His strategic counsel will be critical in navigating the local regulatory environment, ensuring we build a locally relevant service that addresses the financial needs of all customers in South Africa,” Meyer said.

Magomola spent years at Citibank, Barclays, and First National Bank before leading African Bank. He holds honorary degrees from the University of South Africa and the University of Zululand, and received Freedom of the City honors in Birmingham, Alabama.

Revolut was founded in 2015 by former derivatives trader Nikolay Storonsky and software engineer Vlad Yatsenko. The company is currently eyeing an IPO with a potential market cap of $75 billion.