Deriv’s SCA authorisation enables onshore operations and raises standards for transparency, client protection, and trust in the UAE’s dynamic trading environment.

Rakshit Choudhary’s success journey at Deriv is distinctive. Starting more than a decade ago as a quantitative analyst intern, Choudhary moved into strategy and operations, became COO, then co‑CEO, and for the past three months has led Deriv as its sole CEO.

Shortly after obtaining its SCA licence, Finance Magnates spoke with Rakshit about the milestone, how it advances Deriv’s growth in the UAE, the company’s commitment to localisation, and the role of AI and education in shaping its vision for retail traders in the region and globally.

FM: Congratulations on Deriv’s recent SCA authorisation in the UAE. Why does this milestone matter for your company and for the UAE trading ecosystem?

Rakshit: Thank you. Securing the SCA authorisation is a pivotal step for Deriv in how we see sustainable growth. The SCA has established one of the region’s most rigorous frameworks for investor protection, disclosure, and operational transparency. Our onshore licence allows us to raise the bar, set new standards for transparency, security, and client protection, ensuring that our offerings are both locally relevant and globally compliant. For traders in the region, it means access to regulated services they can trust. For us, it’s about long-term commitment, responsible scale, and supporting market evolution in one of the world’s most dynamic financial hubs.

FM: What drove Deriv to pursue onshore licensing in the UAE at this particular time?

Rakshit: The UAE’s regulatory environment and its vision for fintech really stand out. Over the past decade, the UAE has launched Dubai’s Blockchain Strategy, the Virtual Assets Regulatory Authority (VARA), and frameworks in Abu Dhabi Global Market (AGDM). These signal a blend of openness and robust investor safeguards. As a company that prioritises both technology and compliance, we wanted to be part of that journey. We saw a dynamic, digital-first population, a growing appetite for new asset classes, and a demand for accessible, well-regulated trading platforms. With our 26-year global legacy, the UAE felt like the perfect next step. The timing reflects readiness on both sides: a framework that prioritises investor protection and a platform that can meet those expectations.

FM: How is Deriv localising its platform and operations for UAE clients?

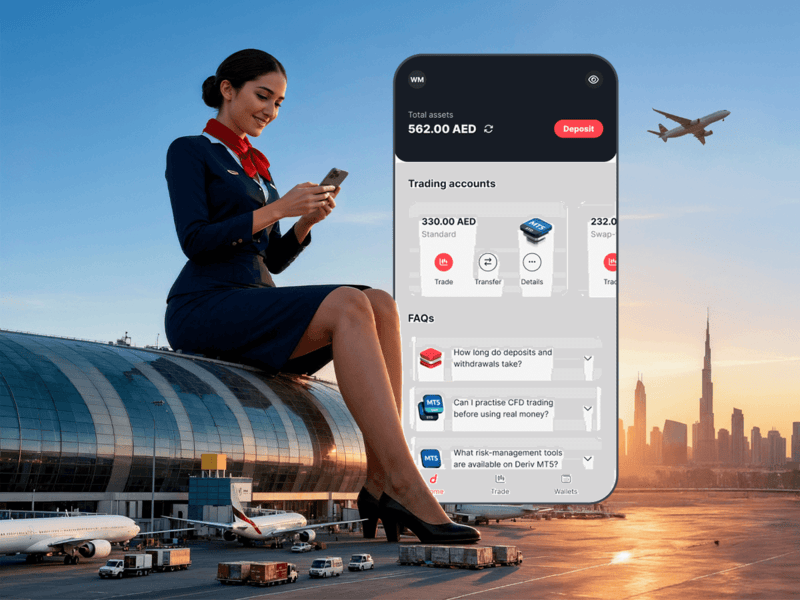

Rakshit: Localisation centers our rollout. We’re supporting clients in several regional languages, including Arabic and English, and have introduced region-specific payment options for instant, hassle-free deposits. Our team ensures local onboarding, support, and education so clients feel supported. Education is built-in. Through Deriv Academy, we offer clear explanations, practical examples, and risk‑management modules that match different experience levels. Our phased product launch ensures we grow responsibly and adapt to evolving client needs.

FM: You’ve mentioned that education-led client acquisition and transparency are central to your UAE strategy. Can you elaborate?

Rakshit: Absolutely. In online trading, access is only meaningful when paired with understanding and transparency. Through transparency in pricing, operations, and regulatory status, we create trust and set the standard for disclosure. The goal is to build relationships with our clients that last, with safeguards and clarity every step of the way. Our educational resources cover how products work, where they can go wrong, and how to size positions sensibly, so clients grasp not just the benefits but also the risks of trading. Deriv Academy resources are tailored to diverse backgrounds and experience levels.

FM: AI is getting a lot of attention in fintech. How is Deriv utilising artificial intelligence across your operations and client experience?

Rakshit: 2025 has been transformational for us in becoming an AI-first organisation. We have and continue to embed AI into every part of our operations, from engineering to compliance, product development, marketing, and even HR. AI helps us spot unusual activity faster, answer routine support questions quicker, and improve code quality and testing. Clients see this in smarter dashboards and predictive tools that add value and save time, while AI-driven monitoring and analytics strengthen compliance and help us stay ahead of regulatory requirements. In parallel, our workforce uses AI as their everyday copilot, practical training and simple tools that help them do their jobs better and quicker. We’re also steadily updating our platforms and processes to make the most of AI in a safe, transparent way. Ultimately, AI helps us deliver on our mission of accessible and seamless trading for anyone, anywhere and at any time.

FM: How do you see Deriv’s role evolving as the UAE establishes itself as a world-class fintech hub?

Rakshit: The UAE’s ambition in digital assets, fintech, and financial services matches our own global outlook. As we grow here, we hope not just to serve, but to help set standards. We’ll keep broadening our product suite, deepening our educational programmes, and investing in technologies that put clients first. We’ll work with regulators, share what we learn, and invest in local talent. If we do that consistently, we help the market shift from hype to trust. That’s good for clients, good for the UAE, and ultimately good for our business.