The meme-inspired cryptocurrency Dogecoin has captured headlines again as it experiences a remarkable price surge, reaching $0.3292 in November 2024. This impressive rally has sparked renewed interest in whether DOGE can finally break the elusive $1 barrier. With a staggering 152% gain over the past month and an 86% increase in just seven days, Dogecoin's momentum has crypto enthusiasts watching closely.

Dogecoin News: Current Market Performance

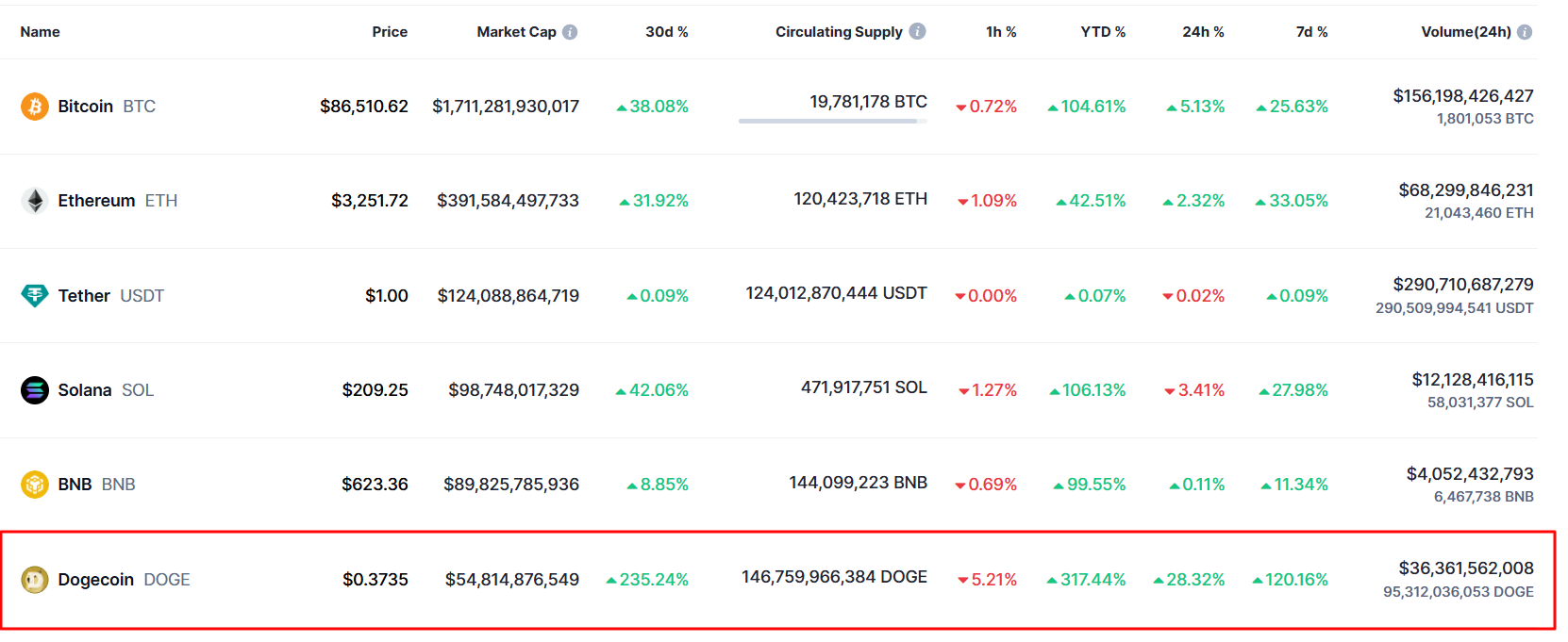

Dogecoin's recent performance has been nothing short of extraordinary. The cryptocurrency now boasts a market capitalization (market cap) of $55 billion, making it the sixth-largest cryptocurrency by market value. Daily trading volume has exploded to $21.7 billion, indicating strong market interest and participation.

The formation of a golden cross pattern on the technical charts, combined with the completion of a rounding bottom pattern, suggests strong bullish momentum. The Fear and Greed Index currently stands at 69, indicating “Greed” in the market, while technical indicators show 19 out of 30 green days with a 20.01% price volatility over the last month.

Technical Analysis and Price Targets, DOGE Price to Rise

On Tuesday, November 12, 2024, Dogecoin (DOGE) reached a new annual high of $0.43858 on Binance, marking a 40% increase. This is the highest value for DOGE since May 2021, approximately three and a half years ago.

Dogecoin is breaking out .40

— TheÐogeGlory (@GloryDoge) November 12, 2024

Where do we go now? pic.twitter.com/mrQpPjXjVE

Just this month, the DOGE price jumped over 125%.

Recent market data reveals several critical price levels for Dogecoin:

Technical Indicator | Value |

Support Level | 0.20 and $0.28 |

Immediate Resistance | $0.3756 |

Secondary Resistance | $0.5408 |

Third Resistance | 0.74 |

50-Day Moving Average | $0.123836 |

200-Day Moving Average | $0.128977 |

The price action shows a clear uptrend, with the formation of higher lows and higher highs. The cryptocurrency's ability to maintain prices above the 50-day and 200-day moving averages suggests strong bullish momentum.

Expert Dogecoin Price Prediction 2025

Various cryptocurrency analysts and platforms have provided forecasts for Dogecoin's future value. Interestingly, many of them still think Dogecoin will fall visibly from the current highs.

2024 Predictions:

- DigitalCoinPrice projects a peak of $0.17

- CoinMarketCap estimates a range of $0.1194 to $0.1443

- CryptoNewsZ forecasts between $0.085 and $0.26

- Coinjournal suggests a potential surge to $0.45

2025 Outlook:

- The long-term projections for 2025 paint an optimistic picture. CryptoNewsZ anticipates Dogecoin reaching between $0.25 and $0.39

- More bullish forecasts suggest the possibility of breaking past $1.95 and even 2.2

$doge will hit $4.20 easily this cycle

— Coochie Fiend (@Coochie_Fiend_) November 6, 2024

And I’m not even joking

Research “Golden Bull”#dogecoin pic.twitter.com/l0CGK5GK4i

The completion of Dogecoin's new utility-focused tech stack by 2025 could be a significant catalyst for price growth.

Catalysts Driving Potential $1 Target

Several key factors could propel Dogecoin toward the $1 milestone.

Market Adoption:

- Increasing merchant adoption

- Growing institutional interest

- Integration with payment systems

- Development of blockchain technology applications

Technical Developments:

- Implementation of new features

- Network scalability improvements

- Enhanced transaction capabilities

- Smart contract functionality

The current market sentiment remains strongly bullish, supported by significant whale activity and increased retail investor participation. The recent surge in trading volume suggests growing market confidence in Dogecoin's potential. If you are thinking you may have missed the rally, remember that crypto markets can surprise, shake out longs, or decline for many other reasons. You may check out another Dogecoin price prediction for buy zones to consider for a possible buy-the-dip opportunity.

Risk Factors and Challenges

While the path to $1 seems possible, several challenges remain:

- Supply Dynamics: Dogecoin's constantly expanding supply could impact price appreciation

- Market Volatility: Cryptocurrency markets remain highly volatile

- Technical Resistance: Multiple price barriers must be overcome

- Competition: Growing competition from other meme coins and cryptocurrencies

Dogecoin Future Outlook

The journey to $1 for Dogecoin depends on sustained market momentum and the continued development of its ecosystem. With the cryptocurrency market showing signs of recovery and Bitcoin reaching new heights, Dogecoin's position as a leading meme coin could benefit from overall market growth.

Market analysts suggest that while reaching $1 is technically possible, it would require significant buying pressure and favorable market conditions. The completion of the Dogecoin Trailmap and increased utility could provide fundamental support for higher valuations.

Historical Context, Elon Musk and Market Cycles

The hype cycles surrounding Dogecoin have been particularly notable since May 2021, when it reached its all-time high of $0.74. During this period, the cryptocurrency experienced a significant bull run, driven partly by Elon Musk's influence and the growing popularity of meme cryptocurrency trading.

Elon Musk, the richest man in the world, is making me want to sell all my crypto and go all in #dogecoin 🚀🚀

— WSB Trader Rocko 🚀🚀🚀 (@traderrocko) November 11, 2024

Retweet if I should go all in $DOGE 🤝 $10 🔄

PS. Elon is soon to be part of the US Govt after funding over $100 million into Trump campaign! pic.twitter.com/7ebeOn07PA

Technical Infrastructure and Development

Dogecoin's infrastructure continues to evolve, with developers working on improving its blockchain. Unlike Bitcoin's 21 million coin limit, Dogecoin has no fixed supply cap, with approximately 146 billion coins currently in circulation. This creates an interesting dynamic where every single minute, new coins enter the market.

Market Analysis and Trading Patterns

The daily chart shows a U-shaped recovery pattern, suggesting potential for upward momentum. While some consider this an unfavorable setup, others in the investment community see an opportunity. The cryptocurrency trades often follow Bitcoin's movements, as many platforms that position in and recommend Bitcoin also support Dogecoin trading.

Competition and Market Position

In the cryptocurrency industry, Dogecoin faces competition from other tokens like Pepe coin and various Shiba Inu-inspired currencies. However, anything related to the fundamentals suggests that Dogecoin maintains a strong position in the market, particularly when compared to Ethereum and other major cryptocurrencies .

Political and Social Factors

The 2024 election has significantly influenced market sentiment, with increased interest in DOGE and FOMO (fear of missing out) driving prices. The proposed D.O.G.E department and Tesla involvement have created a substantial buzz in the crypto community.

These sections incorporate the previously unused terms while maintaining relevance to the original article's theme of Dogecoin's potential to reach $1.

Latest Breaking News and Price Predictions

Breaking news suggests Dogecoin surges past the $0.20 mark as analysts predict exciting developments for the future of Dogecoin. Since the start of 2024, Dogecoin's price has shown remarkable price movements. Experts suggest Doge could reach significant milestones by the end of 2024, with some targeting the 1 mark.

Dogecoin continues to attract attention as Dogecoin remains one of the most-watched cryptocurrencies. While Motley Fool has positions in various crypto assets and stocks mentioned in their reports, they maintain that the price could continue to rise significantly. With over a billion coins in circulation, Doge's momentum shows no signs of slowing.

To stay updated on the latest developments, investors should review our privacy policy for regular market updates and analysis.

Will Dogecoin Reach $1?

While Dogecoin's path to $1 remains challenging, recent market performance and technical indicators suggest strong potential for continued growth. The combination of technical breakouts, increasing adoption, and positive market sentiment provides a foundation for possible price appreciation. However, investors should approach with caution, considering the inherent volatility of cryptocurrency markets and conducting thorough research before making investment decisions.

The current price analysis and market trends indicate that while Dogecoin may not immediately reach $1, the cryptocurrency has established itself as a significant player in the digital asset space. With continued development and growing adoption, Dogecoin's journey toward higher valuations remains an interesting story to watch in the evolving cryptocurrency landscape.

Dogecoin, FAQ

What is Dogecoin prediction for 2025?

Dogecoin's price predictions for 2025 show significant variance among analysts. CryptoNewsZ forecasts a range between $0.25 and $0.39, while more bullish predictions from Coinpedia suggest DOGE could breach the $1 mark, potentially reaching $1.07 driven by FOMO and influencer endorsements. Conservative estimates from CoinPriceForecast indicate a more modest target of $0.1228, while DigitalCoinPrice projects a maximum of $0.20.

How much will Dogecoin be worth in 5 years?

Looking ahead to 2028-2029, analysts project substantial growth potential for Dogecoin. Changelly predicts DOGE could trade between $2.08 and $2.43, while Coinpedia suggests a range of $2.52 to $3.03. These projections consider factors like Bitcoin's halving cycles, increased institutional adoption, and potential integration with social media platforms.

Is Dogecoin going to be big?

Current market indicators suggest Dogecoin maintains significant growth potential. The completion of Dogecoin's new utility-focused tech stack by 2025, enhanced merchant adoption through GigaWallet, and RadioDoge implementations could drive substantial value increase. The cryptocurrency's growing market cap and position as the sixth-largest cryptocurrency demonstrate its established presence in the digital asset space.

Will Dogecoin reach $2?

Multiple analysts suggest Dogecoin could potentially reach $2, particularly in the 2028–2030 timeframe. ForexCrunch specifically states there's scope for Dogecoin to break the $2 mark by 2030. The Benzinga price prediction table shows a progressive increase, with DOGE potentially reaching $1.81 by 2030 and continuing upward. However, this milestone would require sustained market momentum, increased utility adoption, and favorable market conditions.