Ethereum (ETH), the second-largest cryptocurrency by market capitalization, saw a notable increase on Wednesday as it attempted to rebound from multi-month lows. The price movement followed reports that CBOE and 21Shares plan to introduce staking options for the token within their exchange-traded funds (ETFs).

At the same time, a recent analysis by 10x Research indicates that Ethereum appears technically oversold, with its Relative Strength Index (RSI) dropping to 36%. Several upcoming catalysts could potentially support a price recovery.

Why is Ethereum’s price up today, and will ETH continue to climb in February 2025? We examine the latest expert insights and predictions.

Why Is Ethereum Going Up? 21Shares Pioneers Staking Integration for Spot ETF

Ethereum's price jumped significantly this week as CBOE BZX Exchange unveiled groundbreaking plans to incorporate staking capabilities into 21Shares' spot Ethereum ETF, marking a potential watershed moment for institutional cryptocurrency investment.

The second-largest cryptocurrency by market capitalization surged 5.3% to reach $2,800 before settling at $2,738 on Wednesday, as investors responded to the innovative proposal that could fundamentally transform the ETF landscape. This move represents the first attempt to combine traditional ETF structure with cryptocurrency staking rewards.

In a filing with the Securities and Exchange Commission (SEC), 21Shares outlined its intention to stake portions of the Trust's Ether holdings through verified staking providers. The asset manager emphasized that this approach would enhance investor benefits while maintaining accurate tracking of Ether's performance.

Joe Lubin, Ethereum co-founder, had previously hinted at such developments, revealing ongoing discussions with ETF providers about staking integration. This filing appears to confirm those efforts are moving from concept to reality.

Ethereum Shows Signs of Oversold Conditions, Says 10x Research

The digital asset, currently trading below $2,700, navigates a complex market landscape where institutional interest meets technical pressure points. The cryptocurrency's recent price action has been notably more volatile compared to Bitcoin's steady bull run, creating what market analysts describe as high-risk, high-reward opportunities around key events.

Ethereum's decline to its lowest levels since November also led to a drop in the RSI index, making ETH appear oversold once again.

„Ethereum isn’t a coin to get emotionally attached to, but history shows that when sentiment turns overwhelmingly negative, opportunities can emerge,” commented Markus Thielen, the CEO of 10x Research.

A significant catalyst approaching is the highly anticipated Pectra upgrade, scheduled for mid-March 2025. This comprehensive network enhancement, which combines the previously separate Prague and Electra updates, promises substantial improvements to Ethereum's infrastructure.

“This upgrade merges two previously planned updates, Prague and Electra, into a comprehensive enhancement,” added Thielen.

Is #Ethereum Oversold?

— 10x Research (@10x_Research) February 11, 2025

With multiple catalysts on the horizon, is now the time to buy?

👇1-12) Ethereum’s Relative Strength Index (RSI) has dropped to 36%, a level where past corrections have slowed, even as Bitcoin remains in a bull market. Unlike Bitcoin’s parabolic rallies… pic.twitter.com/vUErrViU6F

Ethereum Price Prediction. Technical Analysis Suggest $3K Mark

If the current level of $2,678 is successfully breached, the next major technical resistance level is $3,000.

Based on my technical analysis, Ethereum 's price found support in February at $2,600, marking its lowest level since November, a three-month low. Since December, ETH has been moving within a bearish regression channel, which was last tested in late January. The current support level and Wednesday's buying reaction could drive the price toward the upper boundary of the channel, which currently aligns with the $3,000 level.

However, this will present a significant resistance for bulls, and it's difficult to envision a breakthrough without substantial pushback from sellers. Whether you define it through technical analysis or price zones, such levels invariably attract a massive concentration of both buy and sell orders.

Ethereum Price and Options Markets

In the derivatives market, the upcoming options expiry on February 14 presents an interesting dynamic. Most put options become profitable only below $2,600, suggesting potential upward pressure as traders may need to adjust their positions to avoid options expiring worthless.

Institutional adoption continues to show strength, with Ethereum ETFs accumulating approximately $500 million worth of ETH over six consecutive days. This steady institutional buying provides a fundamental backdrop of support for the asset's price.

“Ethereum fee revenue remains low, with $19 million generated last week, marking only a slight improvement from $18 million the previous week,” Thielen added. “Gas fees are at just 1 Gwei, leaving little room for further declines.”

Although a 50% rally seems unlikely for the 10x Research CEO, a 10% move into the Pectra upgrade “is within reason.”

ETH Inflows Outpace BTC

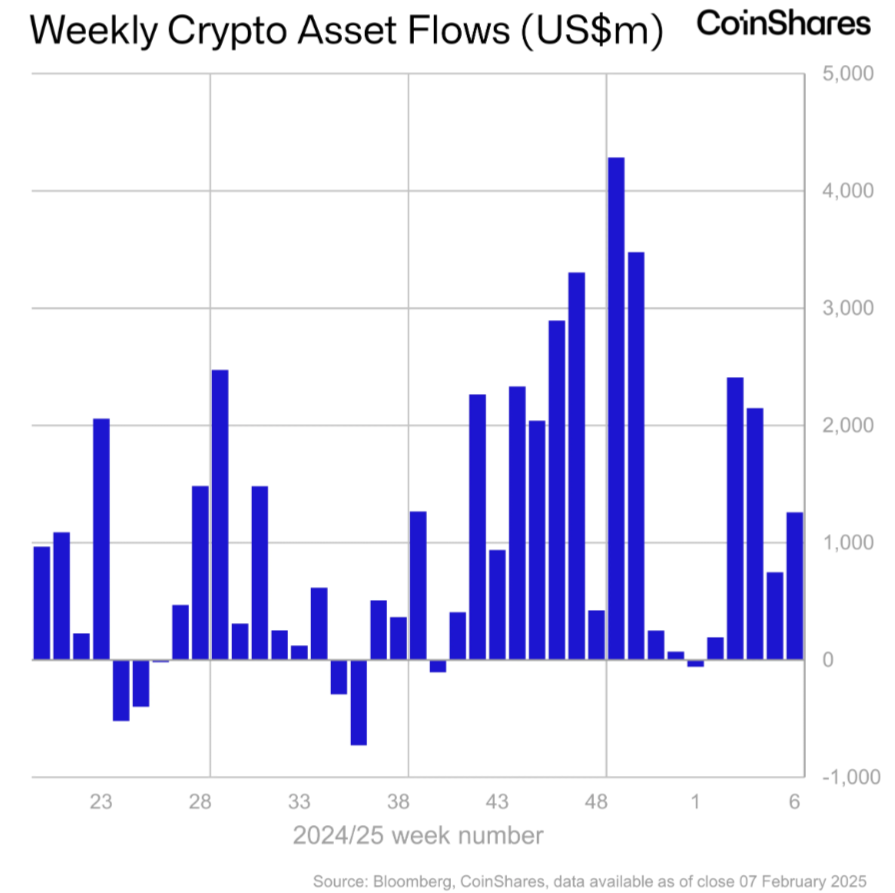

Adding to the bullish potential, Ethereum has surpassed Bitcoin in weekly investment inflows, challenging long-held assumptions about the digital asset hierarchy.

The surge in Ethereum inflows, according to the newest CoinShares report, reflects growing institutional appetite for alternative cryptocurrency exposure beyond Bitcoin. However, market experts caution against interpreting these flows as a definitive sign of Ethereum's dominance in the broader cryptocurrency ecosystem.

"The demand for crypto assets beyond Bitcoin is nothing new," explains Dom Harz, co-founder of BOB (Build on Bitcoin). "The accessibility of ETH, and potentially SOL and XRP in the future, through structured investment vehicles has made it easier for investors to gain exposure."

The competitive landscape for cryptocurrency supremacy has intensified, particularly in the race for the second position behind Bitcoin. The market narrative in 2025 has been dominated by various alternatives, including memecoins and emerging blockchain platforms, while questions persist about Ethereum's strategic direction.

Harz suggests that internal innovation, rather than external factors, will ultimately shape the industry's trajectory. "I think the real driver of the industry's future isn't policy or macroeconomic trends; it's innovation from within. And that future is centered directly on Bitcoin," he states.

Particularly noteworthy is the rapid growth in Bitcoin's DeFi ecosystem. "DeFi TVL represents about 30% of Ethereum's market cap. For Bitcoin, it's only 0.3% — yet Bitcoin's DeFi TVL has already surged over 2,000% in the last 12 months," Harz points out, highlighting the significant growth potential in Bitcoin's DeFi sector.

Ethereum Price Prediction 2025, FAQ

Why is the ETH price going up?

Ethereum’s price is rising due to increased institutional interest, technical indicators suggesting it is oversold, and market optimism surrounding upcoming developments. A key driver behind the recent surge is the announcement by CBOE and 21Shares to integrate staking into Ethereum ETFs, which could attract more institutional investors. Additionally, steady inflows into Ethereum-based funds and expectations for the Pectra upgrade in mid-2025 are fueling positive sentiment.

What drives up the price of Ethereum?

Several factors influence Ethereum’s price, including: Institutional Adoption – Growing inflows into Ethereum ETFs and structured investment products. Network Upgrades – Improvements like the upcoming Pectra upgrade, which enhances scalability and efficiency. Market Sentiment & Technical Indicators – Ethereum recently showed signs of being oversold, leading to a buying rebound.

How high can Ethereum go in 2025?

While price predictions vary, some analysts believe Ethereum could test the $3,000 level in the near term if bullish momentum continues. Longer-term forecasts suggest Ethereum could reach between $4,000 and $5,000 in 2025, depending on adoption trends, regulatory developments, and overall market conditions. However, achieving new all-time highs above $4,800 will likely require significant network growth, increased institutional demand, and favorable macroeconomic conditions.