Cryptocurrencies have quickly entered the public consciousness, sweeping up both populist support and commercial interest in the form of swathes of investors (and traders).

For average people, Bitcoin represents a new currency that is based on a decentralized blockchain-powered design. The entire concept bases its foundation on airtight mathematics, whereby real-time updates to a single decentralized ledger ensure a temper-proof medium of exchange.

For investors and traders alike, Bitcoin presents a supreme profit-bearing opportunity and quite possibly, a long-term store of value.

Historically, all sorts of asset classes could be likened to Bitcoins – whether it be property, stocks, bonds, or even fine art. The key difference is that usually, asset classes have some form of physical backing, whereas Bitcoins are digital assets that bear value only because other people believe it to have value.

The value of any commodity (digital or otherwise) can rise and fall, which tends to attract the interest of investors as much as it does consumers or collectors.

So too with Bitcoin.

Demetris Zamboglou

However, asset classes are also inherently prone to what’s known as “bubbles,” in other words, price inflation based on future expectations. In the investment community, price inflation can occur for all sorts of reasons including a lack of supply, heightened demand or just the perception of some future change in the fundamentals that influence a particular market.

When future expectations go off on a tangent and extend beyond rationality, it is said that “bubbles” inflate, and eventually, burst.

The Causes of Bubbles

According to financial market researchers in the 1980’s, bubbles are said to be “a situation when speculators purchase a financial asset at a price above its fundamental value with the expectation of a subsequent capital gain.”

Almost thirty years on, following the exuberance of the 1980s and the dotcom bubble in the early 2000s, researchers expanded upon their definition of bubbles by adding the word “speculative.”

Access to financial markets increased rapidly over the past few decades, allowing mums and dads to invest in the stock market directly, not to mention the vast growth of financial derivatives, including retail trading. Speculating on the value of stocks and bonds became a populist venture which brought forth the concept of “speculative bubbles”, described as “a situation in which news of price increases spurs investor enthusiasm which spreads by psychological contagion from person to person…in the process amplifying stories that might justify the price increases and bringing in a larger and larger class of investors, who, despite doubts about the real value of an investment, are drawn to it partly through envy of others' successes and partly through a gambler's excitement.”

A rather long-winded way of saying that people tend to follow others, more so than take independent decisions. In other words, ‘herd behavior.’

Another key concept that further adds to speculative bubbles is the possibility of selling assets investors do not already own – otherwise known as “short selling” and further accelerated by “shorting” newly-founded derivatives markets, such as futures and options.

As more people began participating in financial markets, it was discovered that speculative bubbles could be both rational and irrational. The concepts of speculation and contagion led to negative bubbles which were deemed to be a mirror image of a speculative bubble, resulting in dramatic price falls.

Even novice traders know that markets tend to go upstairs when appreciating, yet, go down like an elevator when depreciating. All market participants realized in 2008 when the GFC wiped out trillions of dollars in asset values after an unprecedented (and largely unexpected) bubble burst in the US property market.

Bubble Mania

So, with multiple bubbles seen and felt by investors globally over the years and in almost all asset classes, are any markets immune from bubbles?

It would seem so.

Foreign exchange market bubbles were investigated by Van Norden (1996) in the mid-1990s. (Van Norden, S.,1996 Regime Switching as a Test for Exchange Rate Bubbles. Journal of Applied Econometrics Vol. 11, No. 3 (May - Jun., 1996), pp. 219-251). He used his two-regime model of speculative bubbles on four major currencies: the German mark, the Japanese yen, and the Canadian dollar, amongst others, from September 1977 to October 1991, to conclude that “no significant evidence” of bubbles was detected.

#Bitcoin isn't going away, and there is a price at which it falls no lower.

To me, it is a store of value. An investment for life. I imagine it will bubble and pop from time to time, and I will accordingly de-risk and take on more risk. Bitcoin is a part of my life plan. — The Crypto Dog? (@TheCryptoDog) November 28, 2018

This could potentially mean that the more accessible and larger a market is, the less likely it is to experience a bubble. The counterclaim, however, could be that national governments persistently manage currencies via interest rates, open market operations, and oftentimes, outright currency intervention to prevent chaotic volatility.

With all that being said, market participants are unlikely to forget anytime soon the Swiss National Bank’s (SNB) market actions in January 2015.

An unexpected policy shift by the SNB pushed Swiss franc valuations in the opposite direction to consensus expectations which led to an almighty rush for the exit by traders – colloquially known as the “Black Swan ” to be forever singed into the memories of currency traders.

Decrypting Bitcoin Valuations

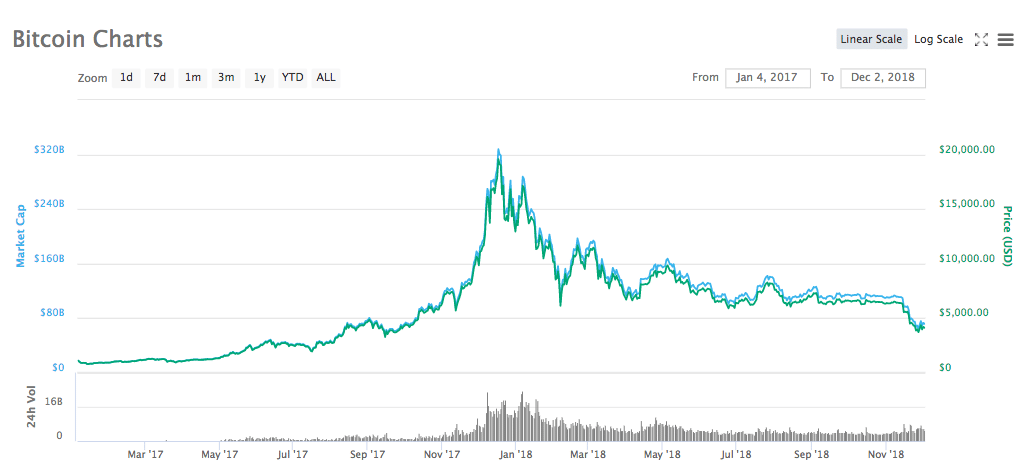

The price of Bitcoin was rather flat for more than four years, somewhere around $500 per Bitcoin. In 2016, as media coverage intensified, both professional and amateur investors began to dip their toes into cryptocurrencies which helped the price to increase – and thereby attracting more investors in a snowball effect. The price sailed past the $1,000 barrier in early 2017 and reached the all-time high of almost $20,000 within 12 months on the famous Sunday, the 17th of December 2017.

The sharp increase led to claims that the cryptocurrency was experiencing a classic bubble.

Bitcoin price 2017-2018. Source: coinmarketcap.com

Throughout 2018, the price has trended lower, down to around $3,800 per Bitcoin today, potentially because of profit-taking and a realization that Bitcoin prices were a tad overvalued.

However, the so-called bubble did not burst, and there was no perceivable rush to sell. In fact, the crypto market (which by the way includes other currencies, not just Bitcoins) continues to thrive with several countries drafting knee-jerk legislation to thwart initial coin offerings (ICO’s) under the guise of protecting investors.

Putting Faith in Bitcoin

Bitcoins may well be worth the investment, but two things become abundantly clear if taking history into account.

For one, adequate knowledge of the crypto market is required in order to allow investors to make informed choices that reduce the impact of irrational expectations.

Secondly, investors must understand that given the risks facing any asset class (and the propensity for market participants to rush for the exits all at once, while entering single file when entering) – investing more than you can afford to lose, in other words, excessive risk-taking, is ill-advised.

It is a widely accepted axiom that the inter-relationship between risk and return fundamentally governs the behaviour of financial markets. So as Bitcoin prices continue to oscillate, falling prey to buying sprees and sharp sell-offs, investors may want to either take a long-term view and hold for a considerable time, or, to accept the risk of sharp valuation changes in the short-term given the propensity for sharp volatility.

Bitcoin's weekend bloodbath is not a good sign for U.S. stocks on Monday. It's not just the crypto bubble that is popping. #Bitcoin is just leading the way down for speculative assets, as it's the most speculative asset of them all!

— Peter Schiff (@PeterSchiff) November 24, 2018

To buy, or not buy Bitcoin – is the question many investors are asking. The answer is a rather subjective one that is more rooted in personal investment psychology rather than an objective one rooted in market analysis.

Tin hats on.

Dr. Demetrios Zamboglou is a Fintech Expert and has been analyzing data from the retail trading industry for over ten years.