Jihan Wu, the founder of Bitmain, the Chinese cryptocurrency mining giant, wants to get rid of his new 'Bitcoin Cash Satoshi Vision' coins.

I am wondering when I can deposit my BSV token into exchange to sell.

— Jihan Wu (@JihanWu) November 17, 2018

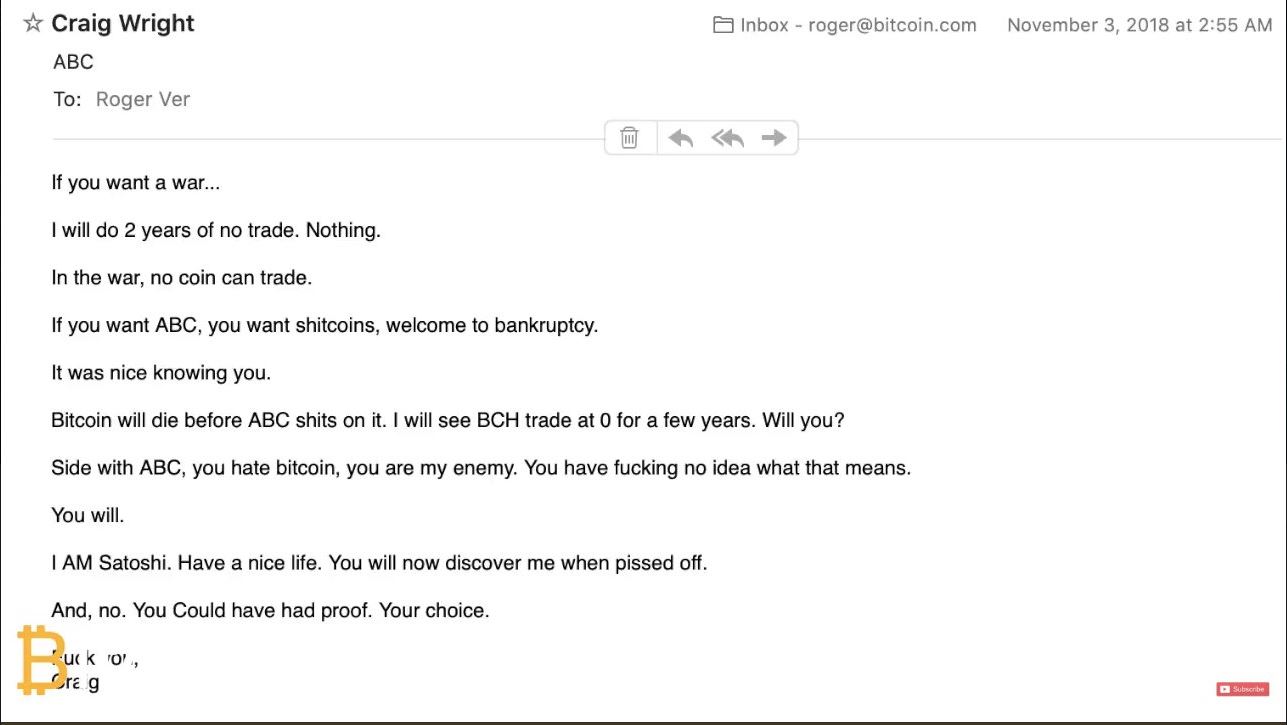

This is the new cryptocurrency created by splitting from Bitcoin Cash, which itself is a spin-off of Bitcoin. The people behind Bitcoin Cash Satoshi Vision (BCHSV) are passionate about their new coin being the real Bitcoin (just as the people behind Bitcoin Cash are passionate about their coin being the real Bitcoin). This has led to an amusing nerd-war:

Source: bitcoin.com

This was an email written by Craig Wright, an Australian computer programmer who spearheaded the creation of the BCHSV movement. Wright claims to be Satoshi Nakamoto, inventor of Bitcoin, although he provided only incomplete proof at the time of his claim and then declined to provide more.

Against him stands Wu, Roger Ver (CEO of Bitcoin.com and the man to whom the above dispatch is addressed), and John McAfee, anti-virus mogul and publicity-loving cryptocurrency enthusiast.

Craig Wright claims to be the real Satoshi. He says this believing that no-one knows the truth. He is wrong. I tell you now - the real Satoshi is not Craig Wright.

— John McAfee (@officialmcafee) November 16, 2018

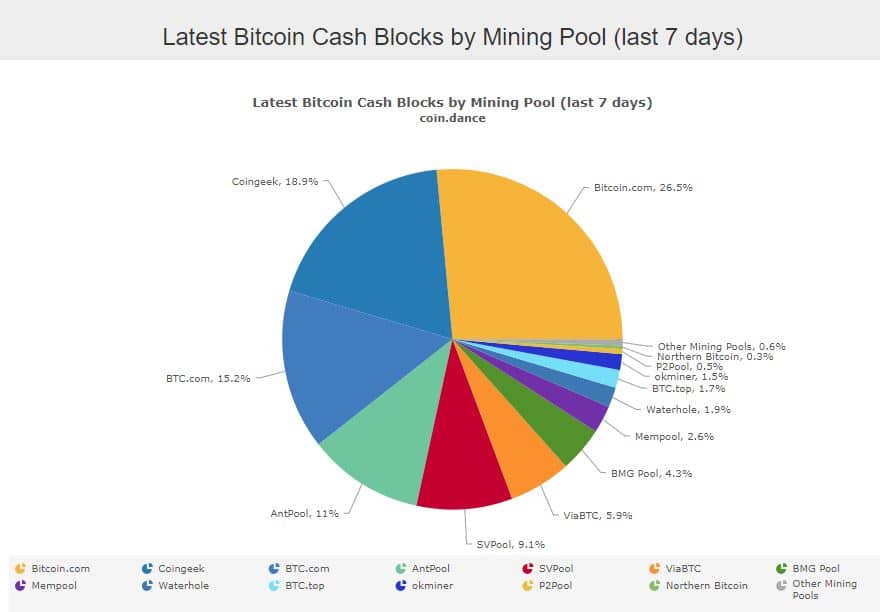

With Wright stands Calvin Ayre, a Canadian entrepreneur who lives on a Caribbean island and runs a Bitcoin Cash mining pool called Coingeek.com, which is one of the bigger contributors to the Bitcoin Cash system.

The hash war is not about personalities...this is about clear technical choices. Stable base protocol that scales to enterprise levels or once again going down the side chain route that failed BTC. SV is the only true Bitcoin and it will survive this and be stronger than ever.

— Calvin Ayre (@CalvinAyre) November 18, 2018

Why does any of this matter, really

Wu's post is significant because he holds a lot of BCHSV.

When a cryptocurrency's Blockchain forks, it becomes two coins where once it was one. Holders of coin number one will suddenly hold an equal number of coin number two.

Accounts holding Bitcoin Cash (BCH) prior to the Nov 15th fork have been credited with Bitcoin SV (BSV). Trading is now open. Funding is still being evaluated and may come later this week. https://t.co/l2orqED6gO

— Kraken Exchange (@krakenfx) November 18, 2018

On the 15th of November, Bitcoin Cash holders suddenly had the same amount of BCHSV. Wu, being as he is at the head of a company which values itself at $18 billion, has a lot of both. In fact, in August 2018 Bitmain reported holdings of around five percent of the Bitcoin Cash circulation.

Whales, as such people are called amongst cryptocurrency fans, offloading large amounts of money onto the market can cause the price of a coin to crash. For example, this happened when Bitcoin Cash was created. Many people sold off their new BCH tokens, causing its price to drop. So this could be damaging to the BCHSV network.

Noted, & in theory that makes some sense on a small scale, however Jihan Wu held a massive amount of BCH, so if he sells all of his BSV tokens, there would not be enough buyers and the BSV price would plummet to near zero. That would not support BSV.

— Scott Hall (@scottphall44) November 17, 2018

Who is winning?

This is hard to say.

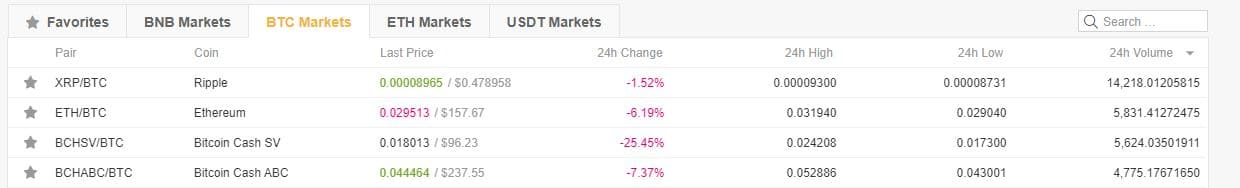

As you can see from the Binance cryptocurrency exchange, BCHSV appears to be in the midst of such a selloff; trading volumes are high, while the price is low and dropping fast.

Source: binance.com

According to Coin Dance, BCHSV is commanding more of the world's Hash Rate - meaning that more computers are focusing on it. However, this hash power is concentrated in a few entities, while Bitcoin Cash nodes are more widespread and more numerous (BCHSV nodes are Coingeek, SVPool, BMG Pool and Mempool):

Source: ash.coin.dance

Exchanges as a whole seem most concerned about this silly feud harming business.

I still prefer chopsticks, they coexist in parallel, and compliments each other.

— CZ Binance (@cz_binance) November 15, 2018

One question that has been raised by this soap opera is whether Bitcoin Cash is truly as decentralised as its proponents claim it to be. In October 2018, economist Nouriel Roubini said that currency decentralisation is a myth created by “a bunch of self-serving greedy white men” to "enrich themselves".

Those who stand against Jihan Wu are a idiots who don't see the realities of the playing field. Please, get real. I will not let my ego destroy me by making me think I could challenge the only real power in this space. My email to him should make it clear to anyone where I stand. pic.twitter.com/WJBJyzaEAy

— John McAfee (@officialmcafee) November 15, 2018

Corporate reshuffle

A few days ago, a Chinese news site reported that Wu had lost his voting rights at the company. Bitmain denied this; there had been a corporate shuffle, in which Wu changed position from board director to board supervisor. The changes were made because the company plans to go public soon.

It aims to raise around $3 billion and values itself at $18 billion. However, some have expressed concern because that valuation seems to have an unstable basis, extrapolated as it is from the dramatic profits realised in the cryptocurrency hype of last year and Bitmain's subsequent monopoly. Cryptocurrency mining is becoming an increasingly less profitable endeavour.